A container ship arrives at a loading terminal during a media tour at the annual news conference of the Hamburg harbour in Hamburg, Germany February 15, 2017. REUTERS/Fabian Bimmer

By Mark Gilbert

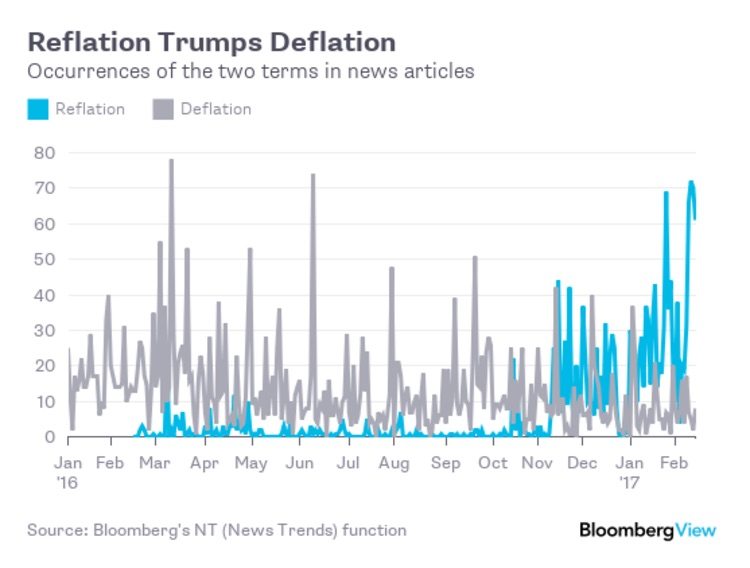

(Bloomberg View) — About a year ago, I wrote a couple of columns examining the data available in the industries responsible for moving goods from A to B. “Shipping News Says World Economy Is Toast,” was my dour conclusion. Today, however, many of those indicators are pointing to a much brighter outlook for the global economy, suggesting that reflation has indeed replaced deflation as the next economic trend.

That shift in expectations is reinforced by a rebound in shipping data. The cost of shipping containers from China’s ports, for example, had dropped by more than 40 percent by the start of last year from its peak in mid-2012. Indexes of container costs from both Shanghai and the rest of China, covering shipments to the rest of the world, have been marching higher for the past year:

On the railroads of North America, the picture a year ago was relentlessly bleak. Train transport of coal, chemicals, metals, agricultural goods, autos and other goods declined in every week bar one from March 2015 until the end of October 2016. Since then, however, the data from the Association of American Railroads has started to turn positive:

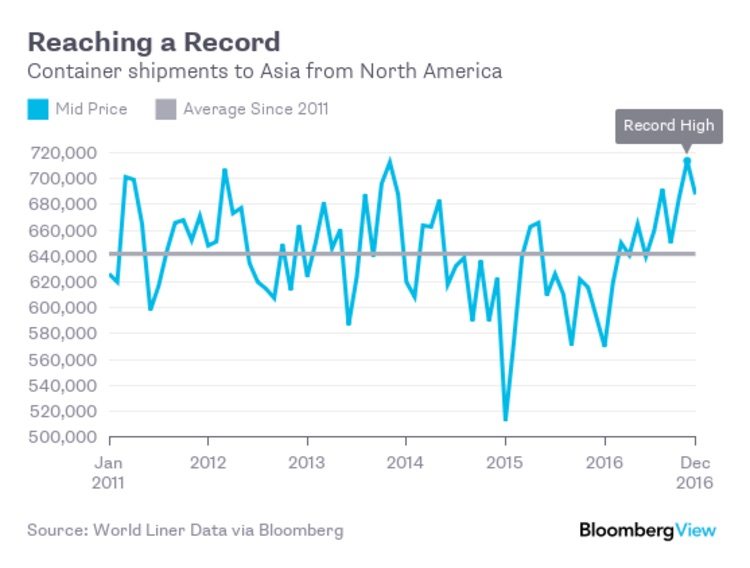

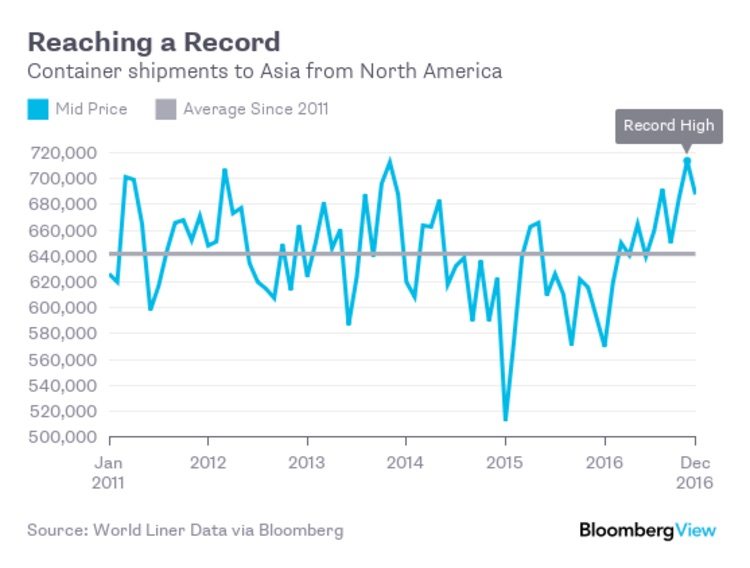

Activity between the U.S. and Asia has also picked up in recent months. The volume of containers (called “Twenty-Foot Equivalent Units” or TEUs in the jargon of logistics) shipped from North America to Asia was below average for most of 2015 and the first quarter of 2016. The most recent figures from World Line data, however, suggest volume has rebounded, and posted a record at the end of November:

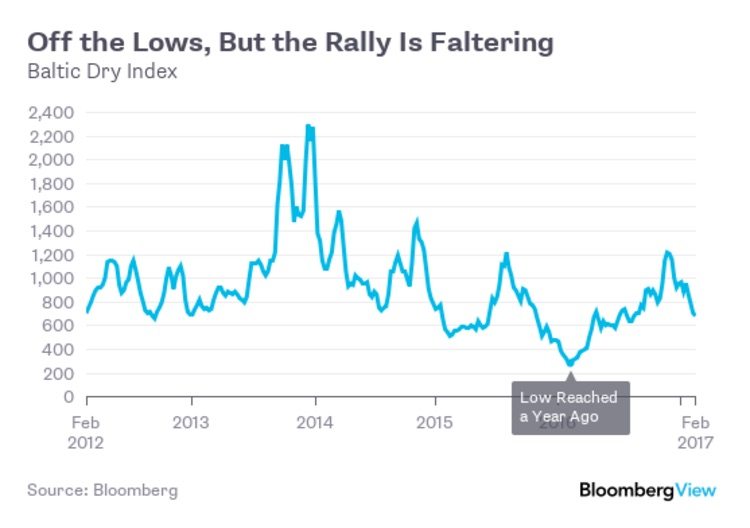

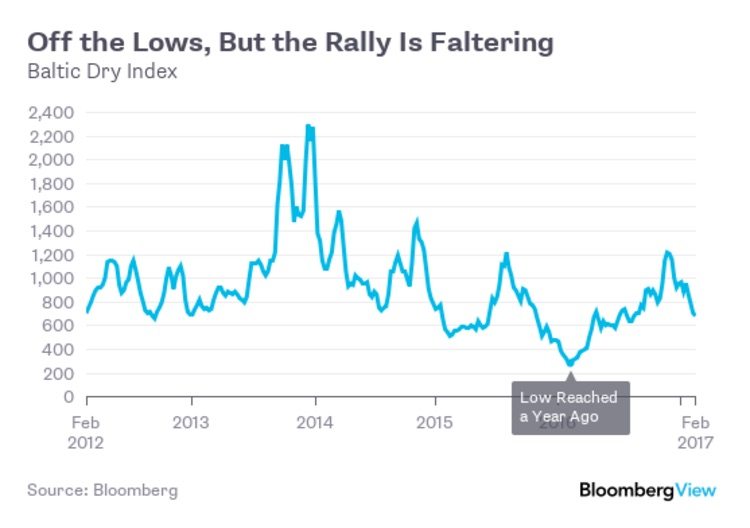

The shipping news isn’t all good. A similar set of data for volumes of TEUs to Europe from North America posted a two-year high in March 2016, but has since slipped back below its average since 2011. Similarly, the traditional global shipping measure known as the Baltic Dry Index declined to a multi-year low at the start of 2016; a rally in the index has faltered after peaking in mid-November. Values, though, remain more than double the low seen a year ago, even though the number of massive carriers, called capesize vessels, capable of carrying tonnage of 150,000 or more has surged to a record after faltering last year:

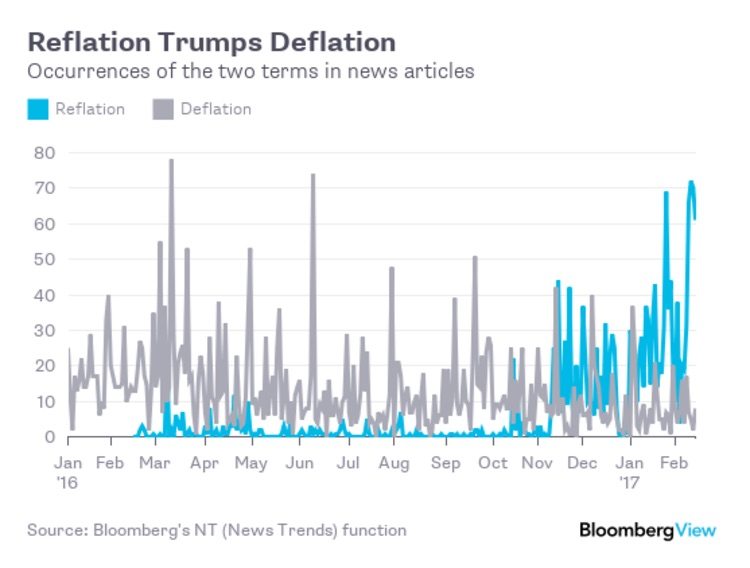

For the past few years, central banks have been working to stave off deflation amid concern that a sustained period of falling consumer prices would kill the economy. Finally, they seem to be winning that battle; January U.S. consumer prices posted their biggest increase since 2013, with economists also predicting faster inflation in the U.K. and the euro region. Expectations that President Donald Trump will boost infrastructure spending in the world’s largest economy have helped turn sentiment around:

The fundamental improvement in the shipping data helps confirm that out in the real world, the shift toward reflation from deflation is gaining traction.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Mark Gilbert is a Bloomberg View columnist and writes editorials on economics, finance and politics. He was London bureau chief for Bloomberg News and is the author of “Complicit: How Greed and Collusion Made the Credit Crisis Unstoppable.”

© 2017 Bloomberg L.P

Join The Club

Join The Club