Will Red Sea Tensions Fuel Inflation?

By Vince Golle (Bloomberg) Shipping costs are rising as hundreds of container ships that typically transit the key maritime artery of the Red Sea and Suez Canal are rerouting after a...

Dr. Martin Stopford, image (c) Marine Money

Dr. Martin Stopford of Clarkson Research Services, economist and author of the renowned textbook Maritime Economics, compares shipping to a game of 3D poker. “Like poker,” he claims, “the shipping market has simple rules, but in practice is endlessly complex.”

At Marine Money Week 2012 in New York City, Stopford guided investors through the past few decades of shipping markets, highlighting their volatile and cyclic nature, and presenting his insights into current market trends.

Stopford traces boom and bust cycles back to 1967. In 1972, Stopford, among other analysts, predicted tanker markets would be dead for the next 3 years. Instead, 1973 became a “super boom,” lasting 6 months until shipowners ordered 120 million deadweight of tankers against an existing fleet capacity of 197 million deadweight, hence busting the market with vessel oversupply.

Another 8 to 10 years passed before the tanker market recovered from its self-inflicted ordering fiasco. In the 1980’s, distressed markets resulted in the best vessel deals. During that time, Stopford witnessed a newbuild Panamax bulk carrier that cost $30 million to the owner sell two weeks later to the bank for $8 million.

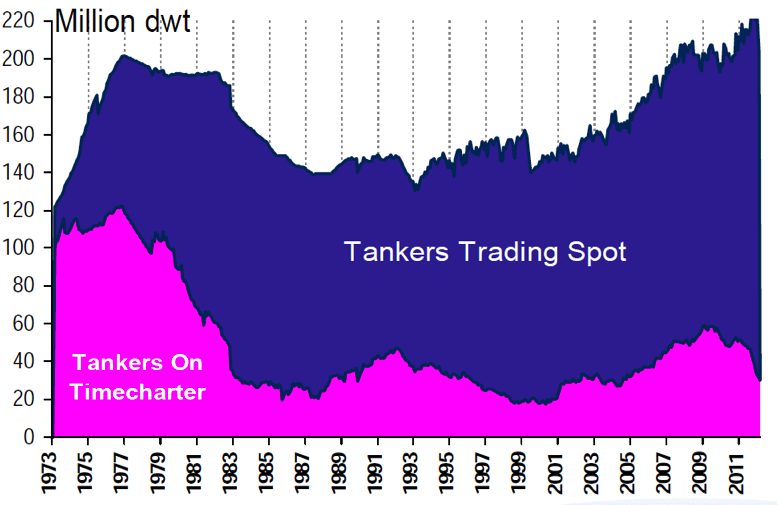

The 1990’s presented a disappointing period of weak returns followed by the super boom of the 2000’s. As was the case in previous cycles, high charter rates in the 2000’s led to a fat order book, which brings us to the current shipbuilding investment bubble. Tanker supply is more stable than bulker supply, Stopford notes, but whereas the market delivered about 30 million tonnes per year consistently in the boom when single-hulled tankers were being replaced, 40 million tonnes were delivered last year.

Stopford draws comparisons between post-Lehman tanker earnings and 1990’s markets but warns investors of two notable differences between the decades – the LIBOR interest rate has fallen dramatically and fewer tankers are on time charter contracts, implying that the majority of the global tanker fleet responds quickly to cash pressures.

Further exacerbating the predicament of shipowners today is persistently rising fuel costs. In the past eight months, vessel costs have exceeded earnings, tightening the cash squeeze for owners and fundamentally altering the balance of maritime economics.

Anticipating that shipowners may struggle to survive in the weak decade ahead, Stopford’s advice is to invest for the environment by anticipating impending regulations and invest for the economy by conforming to the “bunker regime” and slow steaming.

Or, as World Poker Champion Amarillo Slim put it, “play fast in a slow game and slow in a fast game.”

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up