Firms in Fed’s Beige Book Fret Over Any Lengthy Baltimore Port Closure

(Bloomberg) — The closure of one of the East Coast’s busiest ports after the collapse of Baltimore’s Francis Scott Key Bridge has so far not led to broad price increases,...

In 2013, the dry bulk fleet grew larger, the order book is increased, the age profile of the fleet is getting younger and shipowners slowed scrapping of vessels. On the demand side, GDP growth in Asia is slowing, mine development is less than expected and absorbs newbuildings for years. There are also signs that the U.S. Federal Reserve may begin to taper the buying of debt, Quantitative Easing (“QE”), in coming months. Yet, investors, particularly private equity investors, are piling into shipping with rampant disregard in spite of each of these troubling signs. This is worse than being a character in ”Alice in Wonderland” or caught in the “Twilight Zone”.

Shipowners (and others who have caught the bug) love to own and buy ships.

Shipyards are not capitalist entities, but socio-economic entities.

The dry bulk fleet end December 31, 2012 at 672.8 million deadweight (“dwt.”) tons. The fleet as of October 31st reach a total of 705.6 million dwt., a net increase of 32.8 million dwt. or a 4.9% increase in tonnage. The dry bulk fleet experienced an increase deadweight tonnage in each of the following classes of ship Capesize, Panamax and Handymax. Handysize fleet was effectively near breakeven in deadweight tonnage as compared to the end of 2012. At the end of 2013 it is estimated that the dry bulk fleet employment rate will be 80.6%.

With nearly 16+% of the world dry bulk fleet due in the next 2 1/4 years, there will not be enough demand to support total capacity of the world dry bulk fleet. Between 2013 and 2016, dry bulk fleet supply is forecasted to grow from approximately 90+ million deadweight tons (“dwt.”) to 790+ million dwt. In addition, slow-steaming represents a material “shadow supply” of dry bulk tonnage. It has been estimated represents 16% of excess fleet capacity.

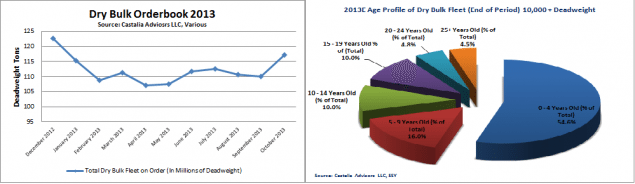

The orderbook which was projected by analysts to be lower by year-end is rising and by ear-end may exceed the level of December 31, 2012. As of October 31st, each class of dry bulk vessel has seen an increase in the number of vessels ordered since the end of 2012. In terms of deadweight tonnage, Capesize, Panamax and Handymax vessels have seen an increase.

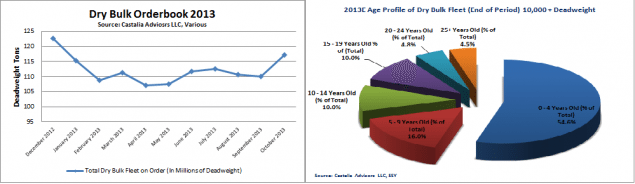

The age profile of the dry bulk fleet is awful. In the early to mid-1990s investors were looking at a fleet that was essentially older than 15years old. It is expected that 70.6% of the fleet will be between 0 and 9 years old by the end of 2013. This is a fleet that is not disappearing any time soon. To make matters worse, over the next two years it will even get younger.

At what point will shipowners and investors “Just Say NO” to ordering more ships?

It is almost as though shipowners and investors are on drugs or in the “Twilight Zone”. However, do not expect shipyards to say “no” to more ship orders. The impact of the current orderbook and the size of the fleet is going to impact the dry bulk market years to come. We expect the market will sub-optimize returns beyond 2018. We also expect the “zombie” companies that exist currently will be joined by others in need of restructuring in 2 1/2 to five years. It will take a massive cleansing of the dry bulk market and its financing system to reinvigorate growth to the market. In the meantime, investors should own the cargo instead of the ship.

In any event, what investors are doing now is suicidal.

Jay Goodgal can be reached via email at [email protected]

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,933 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,933 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up