Greece To Supply Ukraine With US Natural Gas For Winter

By Sotiris Nikas Nov 16, 2025 (Bloomberg) –Ukraine said it’s reached an agreement with Greece that will help secure the supply of natural gas for the coming winter heating season. Following...

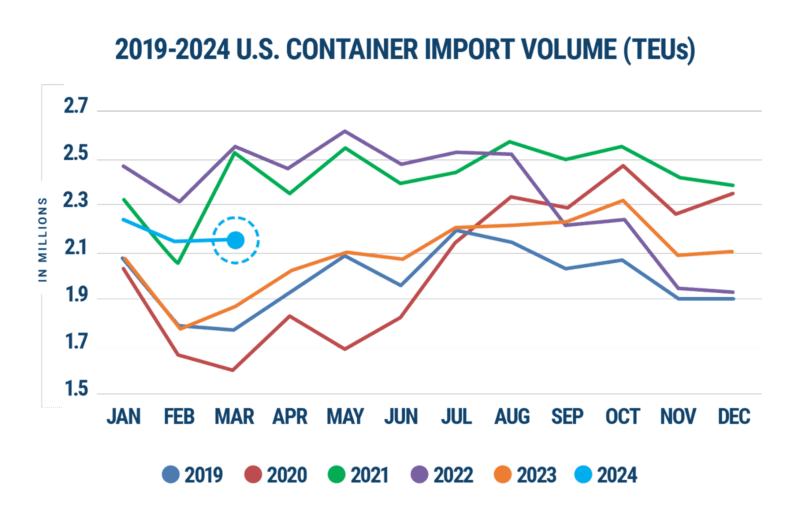

Despite pervasive supply chain disruptions, U.S. container imports jumped nearly 16% in March, underscoring the strong trajectory of U.S. container imports, according to the latest Global Shipping Report from Descartes.

Although there was only a slight increase of 0.4% in container import volumes from February 2024, the year-over-year comparison paints a more robust picture for inbound container volumes with a 15.7% increase compared to March 2023, and a remarkable 20.6% increase from pre-pandemic levels in March 2019.

Additionally, the Chinese Lunar New Year’s impact may have obscured even more significant growth. The week-long holiday did not impact U.S. imports until the latter half of March 2024. By comparing the first 15 days of March 2024 to the same period in 2023, a timeframe unaffected by the Lunar New Year, Descartes observed U.S. container import growth as high as 22.7%.

The growth also comes as imports from China dipped in March, falling by 13.8% from February 2024 due to the Lunar New Year effect, which led to significant volume losses at the Port of Los Angeles. Adding to the disruption was the collapse of the Francis Scott Key Bridge at the Port of Baltimore on March 26, resulting in Baltimore experiencing the largest decrease in container volume among the top 10 U.S. ports.

Despite these challenges, port transit delays have been improving across all major ports. The Port of Oakland saw the biggest improvement with wait times falling 2.8 days compared to February, followed by Long Beach with a reduction of 1.1 days.

The first quarter of 2024 has proven to be a strong start for U.S. container imports according to Descartes’ metrics. Nevertheless, concerns around global supply chain performance persist due to ongoing conditions at the Panama and Suez Canals, upcoming labor negotiations at U.S. South Atlantic and Gulf Coast ports, Middle East conflict, and the yet-to-be-fully-realized impact of the Baltimore Bridge collapse.

“Considering declining import volumes from China, March 2024 was a strong month and continues the robust performance that began in January 2024,” said Chris Jones, EVP Industry, Descartes. “Despite the combined effect of the Panama drought and the conflict in the Middle East, port transit delays showed continued improvement across nearly all the top ports, as March volumes at East and Gulf Coast ports remained stable.”

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up