Trump Trade Wars: A Look At Winners And Losers Since 2016

by Tom Orlik (Bloomberg) Who Loses in Trump’s Endless Trade War? In 2016, Donald Trump campaigned for the US presidency on a promise to beat China. Once in office, he unleashed a...

Tired of staid common shares? Looking to spice up your day-trading life? How about some Series-B Cumulative Redeemable Perpetual Preferred Shares? (I cannot wait for the Series-A version). This is what happens when capital-hungry ship owners meet with Wall Street ingenuity. During the past few weeks, two of Greece’s most respectable shipping companies, namely Tsakos Energy Navigation (TNP) and Safe Bulkers (SB), have decided to issue this kind of hybrid security, to fortify their equity capital and better deal with capital expenditure requirements and debt-covenant compliance.

Tsakos Energy Navigation was the first to take the plunge, issuing 2,000,000 shares of preferred shares at $25 per share, for total gross proceeds of $50 million. The preferred shares pay an annual dividend of 8.0%. Last Monday, Safe Bulkers made an announcement for an IPO of similar type securities. I expect Safe Bulkers to successfully price the new shares later this week.

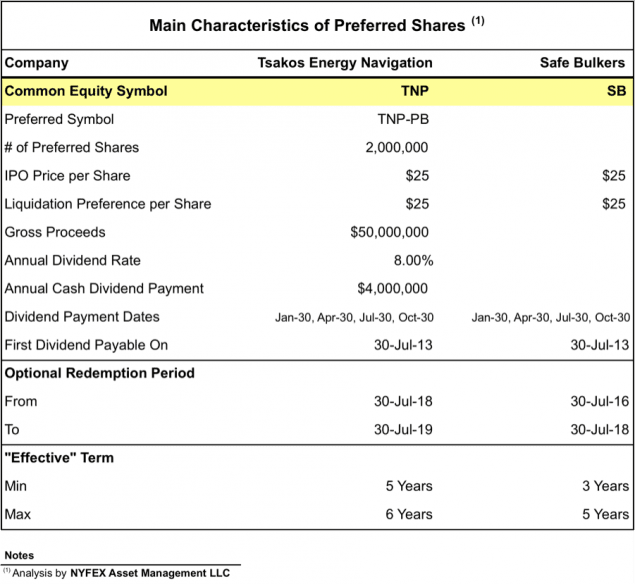

In the table below I have outlined the main characteristics of the preferred shares. In this article I will provide a layman’s guide to the securities and analyze whether they represent an investment opportunity.

These securities are preferred because in case of liquidation, they have a senior claim to all outstanding common shares. For both companies, the liquidation preference is $25 per share, which means that if you purchase these shares at par, you stand to collect your investment back before common shareholders get a dime. They are cumulative, because preferred shareholders have a claim on any unpaid dividend.

Now here comes the tricky part. Why are they both redeemable and perpetual?

Let’s start with perpetuity. In theory, these shares never expire. In practice there is nothing perpetual about them. Each security issue comes with an optional redemption period. In the case of TNP the optional redemption period starts 5 years after the payment of the first dividend. In the case of SB it starts sooner, only three years after the payment of the first dividend.

Unless the companies redeem the preferred shares during the optional redemption period, the dividend rate starts going up, potentially rising up to 30% per annum, assuming there is any money left. Because of the stiff dividend escalation clause, I believe the plan is for either company to redeem the shares as soon as possible & legally permissible.

Nobody knows what the exact motive behind the issuance of these shares might be, but I believe it is a savvy move to increase equity reserves in the medium term without diluting existing shareholders. In the case of Safe Bulkers for example, the preferred shares will provide a 3-year stopgap, without increasing the number of common shares outstanding. I also like the fact that CEO of SB Polys Hajioannou intends to participate in the offering.

Will they be a good investment opportunity? Preferred shares are a funny species of hybrid security, sharing characteristics with both debt and equity. They look like equity, because their principal is not guaranteed. But they behave like debt, because their holders stand to collect a fixed annual dividend. Since they are considered riskier that debt, the dividend yield is higher that debt interest. Tsakos Energy Navigation will pay an 8.0% annual dividend. Safe Bulkers has not priced its securities yet, and it would be interesting to see if their annual dividend will be higher or lower than 8.0%, especially since their optional redemption period kicks in two years earlier.

Investor will be able to purchase and/or trade these securities in the market. The TNP preferred shares are already publicly traded on NYSE (Yahoo Symbol: TNP-PB). I expect the same will be true for the SB preferred shares when they are issued.

If you believe that these companies will be around for a while, and are looking for a higher dividend yield over the next three to five years, you might want to consider allocating some of your investment capital in two of Greece’s bluest shipping chips.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up