Hung Cao – A Navy Diver In The Pentagon Briefing Room

Hung Cao and the Fight to Rebuild America’s Maritime Power Before the Next War Arrives by Captain John Konrad (gCaptain) The first thing you notice about the US Navy’s Undersecretary...

Nancy Pelosi departed Taiwan this morning after reiterating her support for the island. This resulted in Chinese anger, as Beijing threatens trade and naval retaliation. Here’s everything you need to know about China’s response in regard to shipping, naval posturing, and trade.

(Bloomberg) China’s announcement of military drills around Taiwan as US House Speaker Nancy Pelosi visits the island is creating ripple effects across global supply chains, prompting detours and delaying energy shipments.

Gas suppliers are rerouting or reducing speed on some liquefied natural gas vessels currently en route to North Asia, according to people familiar with the matter. Shipments to Taiwan and Japan this weekend will be affected said the people, who requested anonymity as the information isn’t public.

Shipping companies are assessing their options after China’s response to the visit of the highest-ranking US official to the island in 25 years. The actions threaten to disrupt one of the world’s busiest waterways.

China, which regards Taiwan as part of its territory, condemned Pelosi’s visit and said its military exercises would include “long-range live firing” near Taiwan starting as soon as Tuesday evening, as well as more drills encircling the island from Aug. 4. Early Wednesday, state broadcaster CCTV said China had begun joint Navy and Air Force maneuvers in the region.

Local branches of China’s maritime safety administration have issued multiple warnings for ships to avoid certain territories, citing the military exercises. A notice from the regulator in Fujian, the province along the Taiwan Strait, said ships were banned from sailing into the areas where exercises will be conducted from Thursday to Sunday.

Taiwan’s Maritime and Port Bureau warned ships to find alternative routes to access and depart from seven major ports on the island during China’s drills, according to the Apple Daily.

Ship managers and shipowners said traffic overall through the Taiwan Strait was normal on Wednesday, and consulting firms reported little impact for oil tankers in the region.

But as China ramps up military activity and bans take effect, shippers may need to reroute vessels around the eastern side of the island, rather than through the busy waterway between mainland China and Taiwan. That will create delays of about three days, according to shipbrokers.

“If there is live firing in the part of the straits that are used for navigation, then tanker traffic is likely to divert,” said Anoop Singh, head of tanker research at Braemar. He added, however, that “it is likely counterproductive economically for China to close navigations through the straits.”

Also Read: US Navy Carrier Enters South China Sea Amid Taiwan Tensions

While the disruptions could exacerbate a shortage of LNG amid an energy crunch, delays of a few days aren’t uncommon. Shippers often face typhoons at this time of year that create similar disruptions.

The Taiwan Strait is a key route for supply chains, with almost half of the global container fleet passing through the waterway this year, according to data compiled by Bloomberg. However, only about 14% of China’s oil and gas vessels have transited the strait this year, according to analytics firm Vortexa. Smaller vessels or those with shorter voyages are more likely to take that route, while bigger oil tankers sail east of Taiwan.

The military exercises are scheduled to end by next week, and shippers and analysts will be watching to see if it blows over quickly.

“We might be concerned if the drills become longer and more intense to impact supply chains, but there is no sign of that happening now,” says Huang Huiming, a fund manager at Nanjing Jing Heng Investment Management Co.

The standoff between the US and China over Taiwan has thrown a spotlight on growing risks to one of the world’s busiest shipping lanes — even a minor disruption could ripple through supply chains.

The Taiwan Strait is the primary route for ships passing from China, Japan, South Korea and Taiwan to points west, carrying goods from Asian factory hubs to markets in Europe, the US and all points in between. Almost half of the global container fleet and a whopping 88% of the world’s largest ships by tonnage passed through the waterway this year, according to data compiled by Bloomberg.

Any actions over Taiwan that affect the strait would be another blow to global shipping. Supply chains, which have been reeling since the start of the pandemic, have been struggling to recover this year from lockdowns in China’s cities and Russia’s invasion of Ukraine.

The Taiwan Taiex Shipping and Transportation Index slumped as much as 3.2% on Tuesday, among the worst-performing sub-indexes in Taiwan’s benchmark stock index. Taiwanese carrier Evergreen Marine Corp. dropped as much as 3.7%.

Taiwan has long been a flash point between the US and China, and tensions have been exacerbated by US House Speaker Nancy Pelosi’s expected visit on Tuesday. China regards Taiwan as part of its territory and has promised “grave consequences” in response to a visit by the No. 3 US official.

US National Security Council spokesman John Kirby on Monday detailed possible actions the US expects China could take in response to Pelosi’s trip, including firing missiles into the Taiwan Strait, making “spurious” legal claims about the strait and launching new military operations. During the last major Taiwan crisis in 1995-96, China lobbed missiles into the sea near Taiwanese ports, disrupting shipping traffic, and then-President Bill Clinton sent two aircraft carrier battle groups to the area.

Even if the US and China manage to avoid another repeat of that crisis, Russia’s invasion of Ukraine has undermined confidence that the international community could prevent Beijing from attempting similarly disruptive military action across the Taiwan Strait in the coming years. The US’s top uniformed officer, General Mark Milley, has told Congress that Chinese President Xi Jinping is seeking the capability to take Taiwan by 2027.

The US and key allies say much of the Taiwan Strait constitutes international waters, and they routinely send naval vessels through the waterway as part of freedom-of-navigation exercises. But Chinese officials have in recent months repeatedly asserted that the strait isn’t international waters in meetings with US counterparts, Bloomberg News reported in June.

China, as the world’s largest exporting nation, would have much to lose by taking any military action that disrupts its own commercial links to the world. The Foreign Ministry has rejected American concerns that Beijing might use its growing naval power to restrict global trade routes, saying in a fact sheet in June that the country “actively safeguards the security of and unimpeded passage through?international shipping lanes.”

“Blocking the entire strait would be very difficult and risk a confrontation that ultimately may work to China’s disadvantage,” said Carl Schuster, a former operations director at the US Pacific Command’s Joint Intelligence Center. “Doing it once would make a very important and symbolic political-military point, but I don’t think Xi is that confident this administration would do nothing.”

Still, one lesson from Russia’s blockade of Ukraine’s Black Sea ports has been the capacity of a conflict in one region to ripple across the globe, crimping commodities markets and driving up prices. Considering the number of vessels traversing the Taiwan Strait, even a minor disruption could have an impact on world trade during the peak season for shipping goods to the US for the Christmas season.

About 48% of the world’s 5,400 operational container ships passed through the Taiwan Strait in the first seven months of this year, providing a steady supply of clothing, appliances, mobile phones and semiconductors. If only the largest 10th of the fleet is considered, the waterway accounts for 88% of traffic, with many of those vessels servicing transcontinental routes to Europe.

While ships can divert around the eastern coast of Taiwan through the Philippine Sea, which would add only a few extra days to the journey, alternative routes pose difficulties. The Luzon Strait between the Philippines and Taiwan offers a possible north-south path, but the typhoon season in South China Sea makes it risky to travel.

More tropical cyclones enter the region surrounding the Philippines than anywhere else in the world, with an average of 20 per year, according to the Philippine Atmospheric, Geophysical and Astronomical Services Administration. Three typhoons made it far enough west to scatter ships out of ports in Hong Kong and Shanghai in 2021, causing major supply-chain disruptions.

China halted some trade with Taiwan in retaliation to the high-profile visit of US House Speaker Nancy Pelosi to the island, with more disruptions likely as political tensions intensify.

China suspended some fish and fruit imports from Taiwan, citing excessive pesticide residue detected on products since last year and some frozen fish packages that tested positive for coronavirus in June. Exports of natural sand, used in construction, were also banned.

With Taiwan’s agricultural exports accounting for only 0.6% of total exports last year, according to DBS Group Holdings Ltd., and China’s sand exports to the island amounting to just over $1 million last year, the trade bans imposed so far are likely to have only a marginal impact on Taiwan’s economy. However, the bigger risk is if Beijing widens the restrictions or shipments are disrupted as China conducts military exercises around the island.

“What needs to be watched is whether Beijing will broaden the trade bans into the manufacturing sector, particularly semiconductors/electronics going forward,” said Ma Tieying, senior economist at DBS.

Chinese customs data show Beijing has also blocked the imports of over 2,000 food items from Taiwan out of about 3,200, spanning products from tea to biscuits to fish. It’s unclear when the imports were suspended though. On Monday, Taiwan media reported that China banned food imports from more than 100 of the island’s suppliers.

Beijing has often targeted Taiwan’s agricultural industry for punishment over political issues. Many of southern Taiwan’s fruit-producing regions are typically bastions of political support for President Tsai Ing-wen’s Democratic Progressive Party, which advocates for Taiwan’s formal independence.

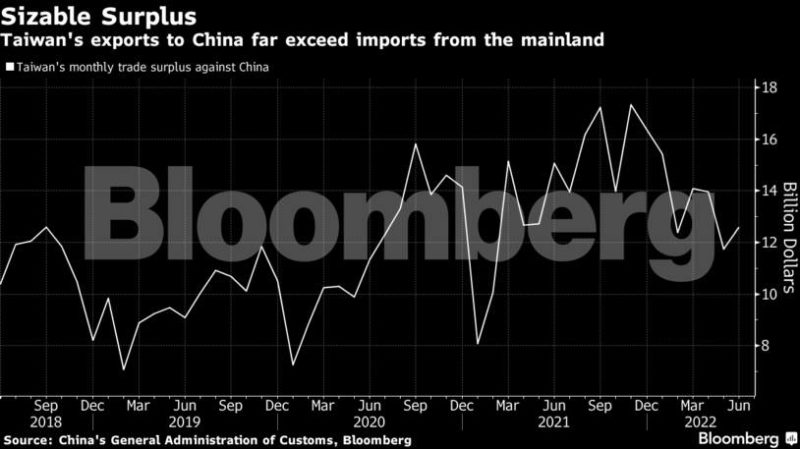

China is Taiwan’s largest trading partner, with bilateral trade rising 26% on year to $328.3 billion last year. Taiwan held a sizable surplus against China, with exports from the island exceeding imports by $172 billion, according to Chinese customs data. While Beijing could leverage that advantage by sanctioning exporters, China also relies on Taiwan for semiconductor supplies.

About a fifth of Taiwan’s total agricultural exports, or $1.12 billion, was shipped to China last year.

Even Pay, an analyst at consultancy Trivium China in Beijing, said more trade disruptions can be expected between China and Taiwan while tensions remain high. She said it was “common practice” for Beijing to identify minor compliance issues and enforce rules very strictly with trade partners, citing the example of Canadian canola after Meng Wanzhou, chief financial officer of Huawei Technologies Co., was detained.

“It looks like stepped-up military exercises announced Tuesday night may disrupt shipping in the region through Sunday at least, particularly into ports in Taiwan and Fujian, but also for any cargoes that might typically pass through the area around Taiwan,” said Pay.

The disruptions, especially on the western coast of Taiwan facing the straits, however, may deal a heavy blow to the island’s commodity imports. Taiwan accounts for 5% of global coal imports, 5% of global LNG imports, 2% of global crude oil imports, 2% of global clean oil products, and 1% of global LPG imports, according to Banchero Costa & Co.

“For energy, Taiwan is almost entirely reliant on imports, hence a potential blockade on imports would be a disaster for the Taiwanese economy,” said Ralph Leszczynski, head of research at the shipbroker.

China caught Taiwan off guard last year when it suddenly blocked pineapple imports from there. Beijing later halted imports of wax and sugar apples last September. While most fruit produced in Taiwan is consumed domestically, the vast majority of exports go to China.

Taiwan downplayed the sand export ban on Wednesday, with the Ministry of Economic Affairs saying in a statement that the impact will be “limited.”

With grains about 5 millimeters wide or less, natural sand is typically used to produce things like concrete and asphalt. Sands used in Taiwan’s construction industry, though, are mostly from the island, its Finance Minister Su Jain-rong said. Taiwan imported about 20,000 metric tons of natural sand from China in the first half of this year, according to the economic affairs ministry.

China previously halted natural sand exports to Taiwan in March 2007, citing environmental concerns, and lifted the ban about one year later. Taiwan activated a contingency plan at the time, including importing materials from the Philippines and using local river sand to close the gap.

Taiwan imported 5.67 million metric tons of sand and gravel in 2020, with natural sand constituting about 8% of total, according to a report from Taiwan’s Ministry of Economic Affairs. More than 90% of Taiwan’s imported sand and gravel is from China, due to much higher transportation costs from other countries like Vietnam, the report said.

China warned airlines operating in Asia to avoid flying in areas around Taiwan where it is conducting military exercises in response to US House Speaker Nancy Pelosi’s visit to the island.

An official notice sent late on Tuesday Hong Kong time designated six areas of airspace as “danger zones,” according to carriers who received the message and Jang Chang Seog, a Korean transport ministry official. Flights will be restricted from 12 p.m. Aug. 4, to 12 p.m. Aug. 7.

China’s Xiamen Airlines Co. announced adjustments to several flights, citing “flow control” in Fujian, just across the Taiwan Strait from the island. Cathay Pacific Airways Ltd. pilots were advised to carry 30 minutes worth of extra fuel for possible rerouting in Taiwan.

“Our flights currently avoid going through the designated airspace zones around the Taiwan region,” a Cathay spokesperson said. “This may potentially lead to more flying time for some flights and we appreciate our customers’ understanding.”

Calls and messages to China’s civil aviation authority weren’t immediately returned. Read full story…

With House Speaker Nancy Pelosi poised to land in Taiwan later on Tuesday, the world is now bracing for China’s response.

President Xi Jinping told US leader Joe Biden during a phone call last week that “whoever plays with fire will get burnt” in reference to Taiwan, which China regards as its territory. Foreign Ministry spokesman Zhao Lijian then said Monday the People’s Liberation Army “won’t sit idly by” if Pelosi becomes the highest-ranking American official to visit Taiwan in 25 years.

Neither Xi nor Biden have an interest in triggering a conflict that could do even more economic damage at home, and the call last week indicated they were preparing for their first face-to-face meeting as leaders in the coming months.

But the bellicose rhetoric and growing animosity in both countries adds to pressure on Xi to take a strong response, particularly as he prepares for a twice-a-decade party meeting later this year at which he’s expected to secure a third term in office.

While the US scrapped its mutual defense treaty with Taiwan in 1979, China must weigh the possibility America’s military would get drawn in. Biden said in May that Washington would defend Taiwan in any attack from China, although the White House clarified he meant the US would provide military weapons in line with existing agreements.

“The big constraint on both sides is still the risk of a war that would just be too costly from either side’s perspective,” Andrew Gilholm, director of analysis for China and North Asia at Control Risks, said on Bloomberg TV. Still, he added, “the concern is that risks will be taken because of domestic drivers.”

Here are options for actions China could take:

With daily incursions into the island’s air defense identification zone already the norm, the People’s Liberation Army would need to send in either a particularly large or unusual series of flights. The daily record is 56 PLA planes on Oct. 4, which coincided with nearby US-led military exercises. Some 15 planes flew around the east side of Taiwan, rather than the usual southwestern routes, after a US congressional delegation visit in November, for example.

China could keep this level of aggression up for days, or weeks, depleting the resources of Taiwan’s already stretched Air Force as it seeks to drive away the planes.

China will have to respond militarily “in a way that’s a clear escalation from previous shows of force,” said Amanda Hsiao, a senior analyst at Crisis Group based in Taiwan.

The Communist Party’s Global Times newspaper has suggested China should conduct a military flight directly over Taiwan, forcing President Tsai Ing-wen’s government to decide whether to shoot it down. Last year, Taiwanese Defense Minister Chiu Kuo-cheng warned: “The closer they get to the island, the stronger we will hit back.”

Alternatively, sending a deep or extended sortie across Taiwan Strait’s median line, a buffer zonethe US established in 1954 that Beijing doesn’t recognize, would put pressure on Taiwan’s military by requiring its planes to stay in the air. PLA aircraft repeatedly breached the line in September 2020, when then-US Undersecretary of State Keith Krach traveled to the island.

Hu Xijin, former editor-in-chief of the Global Times, said in a now-deleted Tweet that PLA warplanes could “forcibly dispel Pelosi’s plane.” He even suggested that Chinese warplanes “accompany” Pelosi on any attempted flight into Taiwan, a move that could easily lead to a miscalculation on either side.

The summer of 1995 saw one of China’s most provocative responses to an exchange between Washington and Taipei, when Beijing test-fired missiles into the sea near the island. The move was part of China’s protests against President Bill Clinton’s decision to let Taiwan’s first democratically elected president, Lee Teng-hui, visit the US.

China declared exclusion zones around target areas during the tests, disrupting shipping and air traffic. More recently, the PLA launched “carrier-killer” ballistic missiles into the South China Sea in August 2020, in what was seen as a response to US naval exercises.

Related Book: Carrier Killer: China’s Anti-Ship Ballistic Missiles by Gerry Doyle and Blake Herzinger

China is Taiwan’s largest trading partner. Beijing could leverage that advantage by sanctioning exporters, slapping a boycott on some Taiwanese goods or restricting two-way trade. On Monday, China banned food imports from more than 100 Taiwanese suppliers, according to local outlet United Daily News. However, China must tread carefully as it needs Taiwan for semiconductors.

Beijing has already hit various Taiwanese leaders with sanctions, including bans on traveling to the mainland. More officials could face similar actions, but they’d have little impact as Taiwanese politicians are unlikely to travel to the mainland or do business there.

China could also disrupt shipping in the Taiwan Strait, a key global trade route. Chinese military officials in recent months have repeatedly told US counterparts that the strait isn’t international waters. Still, any moves that hinder commercial shipping would only hurt China’s economy.

The Global Times warned Tuesday that the Biden administration would face a “serious” setback in China-US relations for Pelosi’s trip. That could mean recalling China’s US Ambassador Qin Gang, who took up his post last year. In 1995, Beijing withdrew its then-US Ambassador Li Daoyu after Washington allowed Taiwan’s then-President Lee to visit the US. However, that spat occurred at a higher diplomatic level to Pelosi, who is second in line to the presidency.

Last year, China recalled its ambassador to Lithuania after the Baltic nation allowed Taiwan to open an office in its capital under its own name, rather than Chinese Taipei — a term Beijing considers more neutral.

Beijing has military options other than mounting a risky invasion across the 130-kilometer (80-mile) Taiwan Strait — such as seizing one of the smaller outlying islands held by the government in Taipei, although though this form of provocation is highly unlikely.

During the early days of the Cold War, the PLA’s military bombardment of Taiwan’s Kinmen Islands, located just off southeastern China’s coastline, drew major US military support. Taiwan repelled the Chinese advance, but not before hundreds of its soldiers were killed. The Taipei-controled Pratas Island, 400 kilometers (250 miles) from Taiwan’s coastline, is another vulnerable point.

China in 2012 occupied the Scarborough Shoal, a coral reef roughly the size of Manhattan Island, which the Philippines claimed as its own, in a territorial dispute in the South China Sea. The US would view any such seizure of Taiwanese territory as a major escalation that could test the limits of Biden’s military commitment to the island democracy.

Still, such action also carries diplomatic risks for Beijing. Seizing an island under Taiwan’s control could trigger the US to add more sanctions on China and alarm neighboring countries in Asia, many of which also have territorial disputes with Beijing.

By Stephen Stapczynski, Ann Koh, Kevin Varley, Rebecca Choong Wilkins, Colum Murphy and Sharon Cho, With assistance from Serene Cheong, Charlotte Yang, April Ma, Claire Che, Kevin Varley, Philip J. Heijmans, Adrian Leung and Debby Wu. © 2022 Bloomberg L.P.

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up