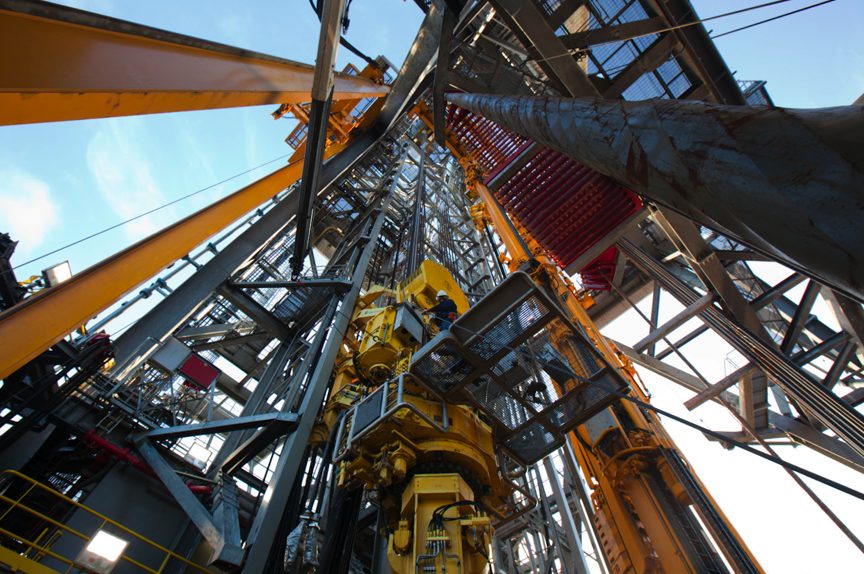

(Bloomberg) — Petroleo Brasileiro SA, the world’s largest deep-water oil driller, is becoming less profitable as costs rise faster than sales because of equipment shortages and falling output.

For every $100 of revenue in the third quarter, Petrobras had a gross profit of $25, down from $32 a year earlier and $40 in the same period of 2009, according to data compiled by Bloomberg. Gross margins have fallen on a year-over-year basis for 11 straight quarters. Petrobras’s shares plunged by the most in almost three months after the company posted an unexpected drop in net income on Oct. 26.

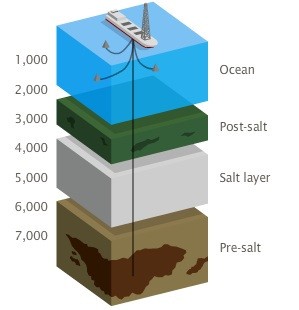

The producer, which is investing $236.5 billion as it develops the Americas’ largest oil finds in more than three decades, is struggling to contain surging labor and equipment costs as inflation accelerates after Brazil’s central bank cut interest rates to a record low. Petrobras has also faced delays of more than a year in getting the drilling rigs it needs to tap deposits trapped under as much as 3,000 meters (9,800 feet) of salt and rocks below the Atlantic seabed.

The producer, which is investing $236.5 billion as it develops the Americas’ largest oil finds in more than three decades, is struggling to contain surging labor and equipment costs as inflation accelerates after Brazil’s central bank cut interest rates to a record low. Petrobras has also faced delays of more than a year in getting the drilling rigs it needs to tap deposits trapped under as much as 3,000 meters (9,800 feet) of salt and rocks below the Atlantic seabed.

“As long as Petrobras is increasing production offshore in deeper areas, of course that has associated cost increases,” Ana Paula Ares, an analyst at Fitch Ratings who covers Latin American oil producers, said in a telephone interview from Buenos Aires. “Lifting costs at Pemex are almost half that of Petrobras, because Pemex is on shore and in shallow waters, while Petrobras is in deep waters.”

Lifting Costs

Rio de Janeiro-based Petrobras reported lifting costs, the average expense to produce one barrel of oil equivalent, of $15.42 in the third quarter compared with $13.37 a year earlier. Mexico’s state-run oil company Petroleos Mexicanos, known as Pemex, had lifting cost of $6.12 in 2011, according to the company’s website.

Petrobras reported in an Oct. 26 regulatory filing that net income unexpectedly fell 12 percent to 5.57 billion reais ($2.7 billion), or 43 centavos a share, from 6.34 billion, or 49 centavos, a year earlier. The company was expected to report adjusted profit of 58 centavos a share, the average estimate of seven analysts in a Bloomberg survey.

The stock fell as much as 3.9 percent to 21.25 reais as of 10:08 a.m. in Sao Paulo trading, the most since Aug. 6.

“We continue working with a determined focus to recover the profitability of the company,” Chief Executive Officer Maria das Gracas Foster said in the earnings release. “We’re directing our best efforts at developing production.”

Shares Drop

Shares have lost 3.1 percent for investors this year before today in U.S. dollar terms, the fourth worst performance by a global oil company with a market value of more than $50 billion, according to data compiled by Bloomberg. Colombia’s Ecopetrol SA returned 54 percent, while Cnooc Ltd. registered a 22 percent return, the data show.

Operators of drilling rigs are charging higher rates as demand for new deep-water equipment increases and the labor market tightens, said Bloomberg Industries analyst Christian O’Neill. Costs are also rising as Brazilian inflation accelerated for a third month to 5.28 percent in September.

“Given the shortage of labor and materials, and the specialization that’s required, naturally you’re going to put upward pressure on costs,” O’Neill said in a telephone interview from New Jersey. “That’s an industry-wide phenomenon when you go into specialized deep-water offshore type of projects.”

Petrobras, which operates the largest fleet of production platforms of any oil company, plans to triple its drilling vessels by 2020. The producer had an average delivery delay of 542 days for 10 rigs built outside of Brazil and delivered in 2011, according to the 2012-2016 business plan it released June 14.

‘Technical Breakthroughs’

Diamond Offshore Drilling Inc. Senior Vice President Gary Krenek said on an Oct. 18 conference call that the Houston-based drilling contractor will save $40,000 a day in operating costs by moving a rig out of Brazil. Noble Corp. Chief Executive Officer David Williams said on another call that same day that the Swiss driller “happily” doesn’t have any big new projects in Brazil lined up.

As Petrobras gains knowledge of the conditions in the so- called pre-salt region in coming years, it will improve technology and become more efficient to reduce the costs of these projects, said Cleveland Jones, an oil specialist and geology professor at Rio de Janeiro State University.

“There are a lot of technical breakthroughs that will make these original project estimates conservative,” Jones said by telephone from Rio de Janeiro. “I don’t think it’s fully being accounted for.”

Local-Content

While the bulk of the rigs in Brazil are built and operated by foreign companies such as Noble and Diamond, the Brazilian government is pushing to increase the amount of locally manufactured rigs. Petrobras needs to purchase as much as 70 percent of its equipment from domestic suppliers to meet mandates set by former President Luiz Inacio Lula da Silva.

OSX Brasil SA, the shipbuilder controlled by billionaire Eike Batista, built its first platform outside of Brazil and has plans to construct the second and third vessels at sites abroad after its shipyard in the state of Rio de Janeiro was delayed.

Petrobras has missed output goals for at least the past eight years as production from its deep-water discoveries failed to compensate for faster-than-expected declines at older fields in Brazil’s offshore Campos Basin. The company, which forecasts its output to remain little changed through the end of 2013, has a track record of missing project deadlines as requirements to purchase goods and services from local suppliers contribute to delays, its CEO said on June 25 when presenting the company’s five-year investment plan to investors and analysts.

“You’re spending the capital up front but don’t really have the production to show for it yet,” Bloomberg Industries’ O’Neill said. “That’s going to put pressure on the operating metrics of the company.”

– Peter Millard and Rodrigo Orihuela, Copyright 2012 Bloomberg.

Join The Club

Join The Club