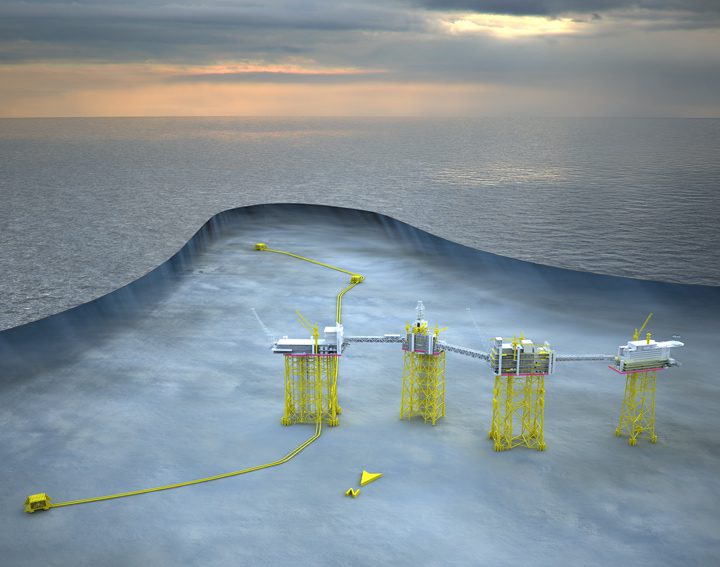

Johan Sverdrup Development rendering courtesy Statoil

By Saleha Mohsin and Mikael Holter

(Bloomberg) — Det Norske Oljeselskap ASA, which complained its share of the giant Johan Sverdrup oil field was insufficient, got an even smaller stake after Norway’s government was called in to resolve the dispute.

Det Norske fell the most in more than four months in Oslo trading after the government redistributed the stakes on Thursday, cutting the company’s portion to 11.5733 percent from 11.8933 percent announced in February. Statoil ASA’s share was unchanged, while those of Lundin Petroleum AB and A.P. Moeller- Maersk A/S’s were increased. Petoro AS’s stake was cut.

Det Norske, controlled by billionaire Kjell Inge Roekke, was the only owner to oppose the proposed split in the development plan submitted in February, saying it didn’t fully reflect that barrels on its side of the field are more valuable. The four other companies left the decision, complicated by a field that stretches over three licenses with different owner distributions, to the petroleum ministry.

“Det Norske is probably very surprised — in a negative way,” Kristoffer Dahlberg, an analyst at SpareBank 1 Markets AS, said in a phone interview. “They’ve been very clear that they wanted a higher share. After they got a lower one, I’d be surprised if they don’t take this to court.”

Det Norske fell as much as 6.3 percent, the most since Feb. 19, and traded 5.8 percent lower at 53.60 kroner a share as of 11:18 a.m.

Studying Decision

“We will now study the decision thoroughly before we decide how to proceed,” Karl Johnny Hersvik, chief executive officer of Det Norske, said in a statement. The company may take legal steps if it decides it can’t accept the outcome, spokesman Rolf Jarle Broeske said by phone.

Statoil’s share was maintained at 40.0267 percent while Lundin was handed 22.6 percent compared with 22.12 percent earlier. A.P. Moeller-Maersk’s stake rose to 8.44 percent from 8.12 percent and state-run Petoro saw its share fall to 17.36 percent from 17.84 percent.

Dahlberg, who has a neutral recommendation on Det Norske, had expected the split to remain unchanged, as had Lundin’s CEO Ashley Heppenstall.

The ministry, which based its decision on information from the companies and a review by the Norwegian Petroleum Directorate, set a three-week deadline for appeals. If the field partners don’t submit the so-called unitization agreement by Aug. 15, it will be determined by the government, the ministry said.

Biggest Discovery

“The decision means that all companies will now have a vested interest in developing and operating the field in the coming decades, so that we achieve good resource and highest possible value from the field,” Petroleum and Energy Minister Tord Lien said in a statement.

The Sverdrup field, which could hold as much as 3 billion barrels of oil, is the biggest discovery and largest offshore development in Norway in decades, with planned first-phase investments of 117 billion kroner ($14.8 billion). The field is scheduled to start production at the end of 2019 and will account for about a quarter of Norway’s total petroleum production by the middle of the next decade.

Roekke, whose Aker ASA investment company owns 50 percent of Det Norske, said in an April 16 letter to shareholders that the difference between the proposed Sverdrup split and what he considered a fair distribution represented about 4 billion kroner. Brent crude traded at about $60 a barrel at the time.

©2015 Bloomberg News

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club