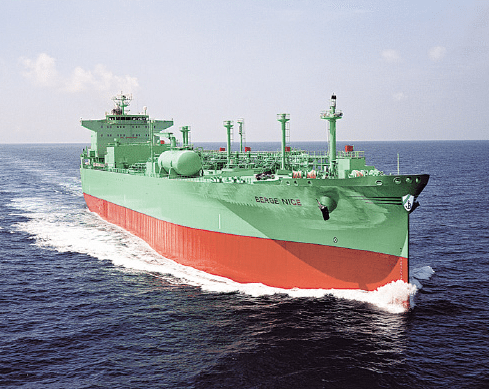

Berge Nice, a 59,200m3, Multi-purpose LPG Carrier. Image: Kawasaki Heavy Industries

Feb. 6 (Bloomberg) — Delays to the $5.25 billion Panama Canal expansion may prolong a surge in rates for ships hauling liquefied petroleum gas between the U.S. and Asia, according to Arctic Securities ASA.

Work on the expansion was suspended yesterday after negotiations broke down between the Panama Canal Authority and a group of construction firms undertaking the enlargement, according to the head of the authority. A spokeswoman for Sacyr SA, which is leading the works, said they were slowed. Freight rates for very large gas carriers will fall once the enlargement is complete because it will cut voyage durations for the ships, Arctic analyst Erik Nikolai Stavseth said.

“As long as the Panama Canal remains unfit for taking VLGCs, that’s going to have a positive impact on the freight market,” Stavseth, who anticipates delays until 2016, said by phone today. “Assuming exports continue as normal, volumes will continue to be shipped.”

Rates for the largest ships hauling LPG, used for cooking and heating, are surging as the U.S. boosts exports. The U.S. has among the world’s cheapest supplies of the fuel, which is a byproduct of refining crude and drilling for oil and gas in shale formations.

Arctic Securities forecasts rates will rise to $45,000 a day in 2015 from $30,400 in 2012 and then drop to $37,500 after the completion of the Panama Canal expansion.

“The volumes will continue to move, it’s just that they will move longer-haul, rather than through Panama,” said Nicola Williams, an analyst at Clarkson Plc, the world’s biggest shipbroker. “We see a continuation of longer-haul movements for a longer time than we’d originally anticipated.”

– Natasha Doff, Copyright 2014 Bloomberg.

Join The Club

Join The Club