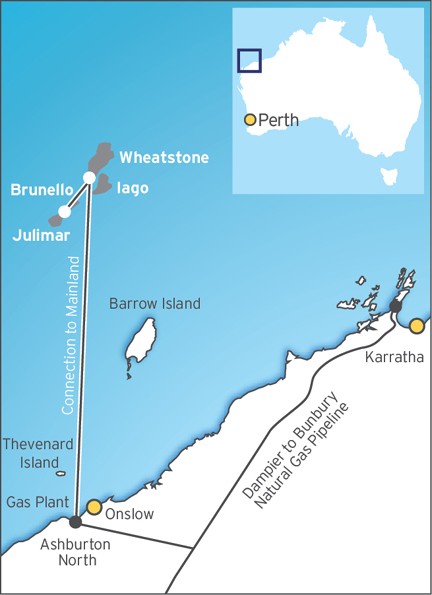

Map of the Wheatstone LNG development via Chevron, click for larger

TOKYO–Japan Bank For International Cooperation has signed a contract to lend up to $1.927 billion dollars to a Japanese consortium that owns a minor stake in the Wheatstone liquefied natural gas project in Western Australia, the bank said in a statement Tuesday.

“LNG supply from Australia, where there are rich gas reserves and very small political risks, has been more and more important,” the state-owned bank said.

The consortium, PE Wheatstone Pty, has a 10% stake in Wheatstone’s feedstock gas field and an 8% stake in LNG production facilities.

JBIC also said it will underwrite $273 million dollar equivalent of preferred stocks of Pan-Pacific Energy, the major stakeholder of PE Wheatstone.

This money will be used to pay for the stakes and development work.

Mitsubishi Corp. (8058.TO), Nippon Yusen KK (9101.TO), Tokyo Electric Power Co. (9501.TO) and government-funded Japan Oil, Gas and Metals National Corp. own PE Wheatstone through Pan-Pacific Energy.

The project is scheduled to start shipments in early 2017 with an annual capacity of 8.9 million metric tons of LNG. Of the 8.9 million tons, roughly 7 million tons is committed by Japanese companies, including Tokyo Electric.

– Mari Iwata, (c) 2012 Dow Jones Newswires

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club