Image courtesy Noble Energy

JERUSALEM–The partners in Israel’s large offshore Leviathan natural gas reserve confirmed Monday that they have approached Australia’s Woodside Petroleum Ltd. (WPL.AU) about acquiring a share in Leviathan but didn’t give details.

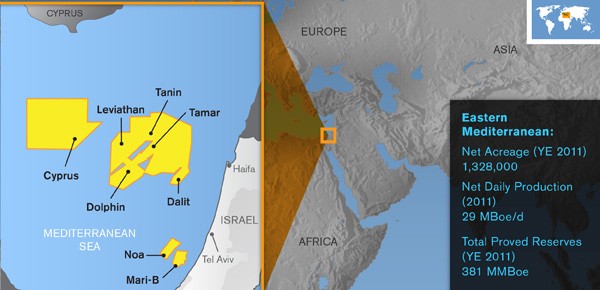

The Leviathan partners, which include Israeli energy exploration companies and Houston-based Noble Energy Inc. (NBL), have since last year been looking for a strategic partner to help develop the Leviathan field, which is estimated to contain up to 16 trillion cubic feet of gas deep under the Mediterranean Sea.

There have been local and international media reports that the Leviathan partners have also offered the stake to Russia’s Gazprom and Korea Gas Corp. The Arab League‘s continuing boycott of Israel and other political factors will, however, likely prevent most international petroleum giants from working on Leviathan due to their connections with the large oil-producing countries of the Middle East and Persian Gulf, according to sector analysts.

Woodside specializes in deep water drilling, mainly in Australia, and sells its petroleum products in Australia and several East Asian countries. Leviathan, located off the coast of northern Israel, isn’t scheduled to begin production for several years, but when it does, experts say, it will allow Israel energy independence in addition to making it a net exporter of natural gas. Another nearby reserve, Tamar, is scheduled to being producing next year, and contains up to 9 trillion cubic feet of natural gas.

Israel currently faces a natural gas shortage as its supply deal with Egypt has broken down over the last two years, forcing local energy producers to rely on more expensive sources of fuel and pushing up electricity prices.

Noble holds 39.66% of Leviathan; Delek Group Ltd. (DLEKG.TV) subsidiaries Delek Drilling Ltd. Partnership (DLEKG.TV) and Avner Oil Exploration Ltd. Partnership (AVNR.L.TV) each hold 22.67%; and Ratio Oil Exploration Ltd. Partnership (RRATI.L.TV) holds 15%.

At 1028 GMT, shares of Delek Drilling were up 0.43 shekels. or 3.38%, at ILS13.14; shares of Avner were up ILS0.026, or 2.95%, at ILS2.30; and shares of Ratio were up ILS0.026, or 8.15%, at ILS0.345, in a higher Tel Aviv market.

– Sara Toth Stub, (c) 2012 Dow Jones & Company

Updated: December 6, 2023 (Originally published October 22, 2012)

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club