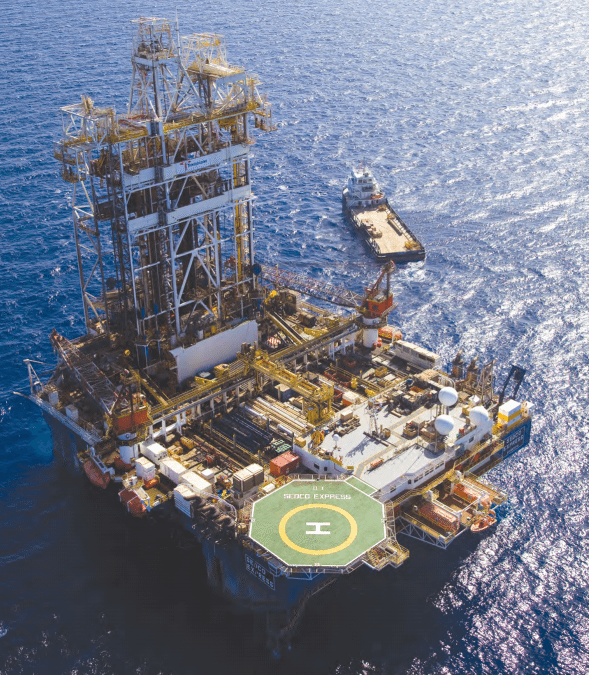

Sedco Express, image: Noble Energy Inc.

Dec. 30 (Bloomberg) — Israel’s sputtering preparations for exporting offshore natural gas have postponed drilling and threaten a $2.3 billion investment from Australia’s Woodside Petroleum Ltd.

Perth-based Woodside said it’s examining other options in case details of drilling at Israel’s Leviathan gas field aren’t settled in the first half of 2014. After taking two years to decide how much gas to export, the Israeli government hasn’t signed off on details such as where to build refineries. Partners are still discussing how to transport the fuel.

“It needs to be a compelling value case, given the amount of investment that would be involved and the significance of the decision,” Woodside’s Chief Executive Officer Peter Coleman told analysts and reporters on a Dec. 10 call. Shares in the drilling partners sank in response.

The discovery in 2010 of Leviathan, then the biggest offshore find in a decade, was a bonanza for Israel, which had envied the fuel riches of its Persian Gulf neighbors. Leviathan and the neighboring Tamar field are forecast to meet Israel’s domestic needs for 25 years. The government has concluded there’s enough gas to allow exports as well, which enticed companies such as Woodside to take interest.

Woodside isn’t the only company left hanging by delays. Russia’s state-run OAO Gazprom, the world’s biggest natural gas producer, said in an e-mail it remains “very much interested” in closing a 20-year deal to export liquefied natural gas from Tamar. It signed an initial agreement 10 months ago.

Russia Collaboration

During Prime Minister Benjamin Netanyahu’s trip last month to Moscow, President Vladimir Putin said the two governments were “actively working on cooperation in the energy sector.”

The delays on Leviathan have contributed to an 11 percent drop in the shares of Delek Group Ltd., the project’s biggest Israeli partner, from a Dec. 3 peak. It also prompted a downgrade by Barclays Plc.

Houston-based Noble Energy Ltd., the lead developer, has lost 1.9 percent in New York, and another Israeli partner, Avner Oil Exploration LLP, has dropped 9.3 percent. The yield on Israel’s benchmark 10-year bond has fallen 27 basis points since late March, when production at Tamar began.

Putting off Israel’s gas exports may also chip away at the $1 billion a month that Energy Minister Silvan Shalom estimates the country will save from the discoveries.

“These are domestic issues that should have been settled by now, like antitrust challenges and where you locate the production facilities,” said Noam Pincu, an energy analyst at Psagot Investment House Ltd. in Tel Aviv. “It’s all solvable, but it’s still going to take at least a few months.”

Exports Pared

In June, the cabinet approved exporting 40 percent of the gas finds, down from the 50 percent a government-appointed committee recommended in 2011. The Supreme Court in October rejected a challenge to the exports by opposition lawmakers and environmentalists.

The delays led Noble to postpone its start-date for production at Leviathan by a year to the end of 2017, according to a Dec. 17 company presentation in Houston.

“I just could not believe they can take that long,” Chief Executive Charles Davidson said at the conference. The company won’t go ahead with “moving a rig over there to drill a quarter-billion dollar well” until it gets “a really sustained drilling program ready to go in Israel,” he said.

Barclays’s investment-banking unit in Tel Aviv cut its rating for Israeli energy exploration companies the following day to neutral from positive, citing Woodside’s reconsideration of Leviathan, postponed drilling schedules and delays in deciding how to transport the gas.

No ‘Major Catalysts’

“We do not see any major catalysts for Leviathan in 2014,” Barclays analyst David Kaplan wrote in a note to investors.

New gas production helped to power the shekel’s 7.1 percent surge against the dollar this year, the most among 31 major currencies Bloomberg tracks. The Bank of Israel said in October it will purchase $5.6 billion in 2013 and 2014 to offset the effect of the gas on the exchange rate.

Gas production is already strengthening the nation’s current-account balance by as much as $3 billion this year, according to the Bank of Israel.

Noble is looking for a partner to develop an LNG project that may cost $5 billion. It also plans a deeper well in the Mediterranean Sea next year to search for Israel’s first offshore crude finds, Davidson said on a July 26 call with investors.

Alternatives Considered

Proposals to export Leviathan’s gas include building a pipeline to Greece or combining the gas from discoveries off Cyprus and Israel at a joint LNG plant as soon as 2018.

Woodside’s Coleman expressed irritation that Leviathan partners were discussing options outside his company’s LNG plan.

“There’s still an opportunity for Woodside to create significant value within the joint venture,” he said on the Dec. 10 conference call. “But I can assure shareholders we are focused on ensuring we have a commercial outcome that delivers value.”

– Jonathan Ferziger, Copyright 2013 Bloomberg.

Join The Club

Join The Club