By Brian K. Sullivan and Laura Blewitt (Bloomberg) — Harvey, which could strengthen into the first hurricane to strike Texas since 2008 this week, has already spurred one refiner to start shutting down a plant, forced workers to be evacuated from Gulf of Mexico platforms, and sent cotton rallying.

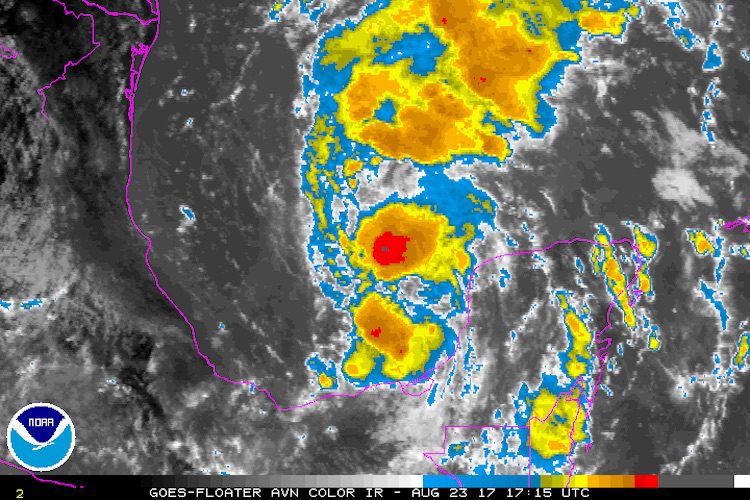

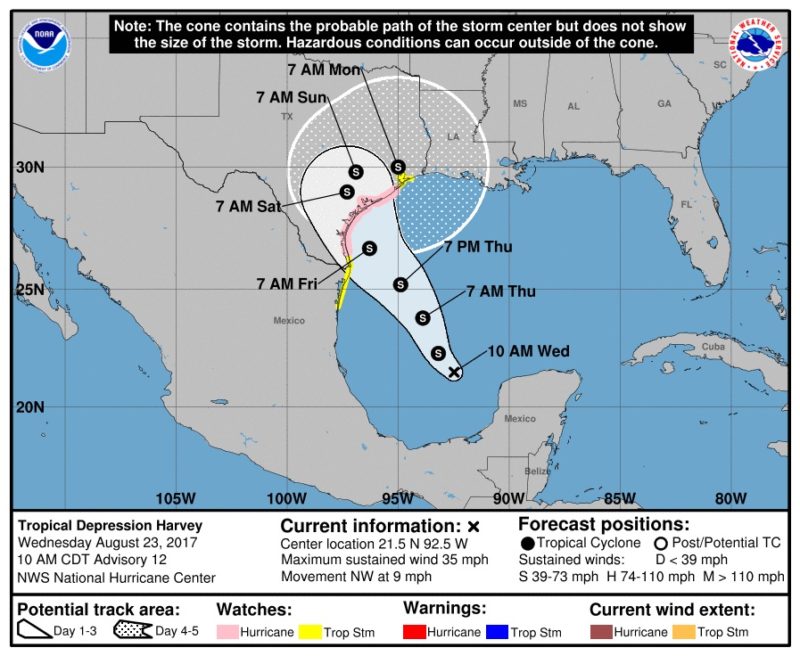

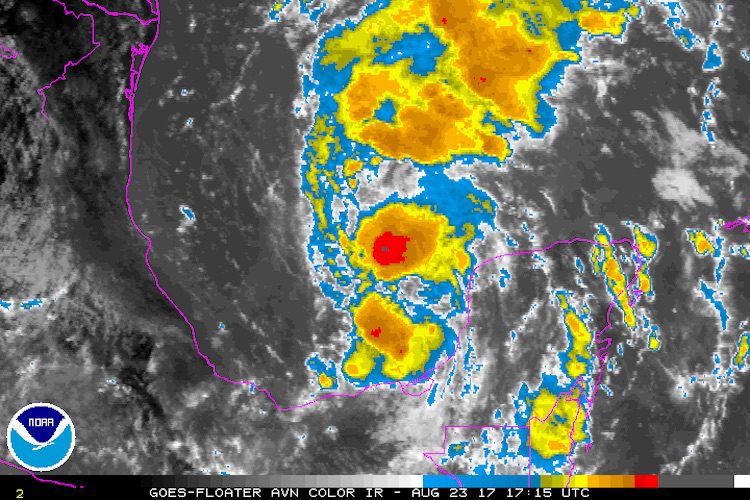

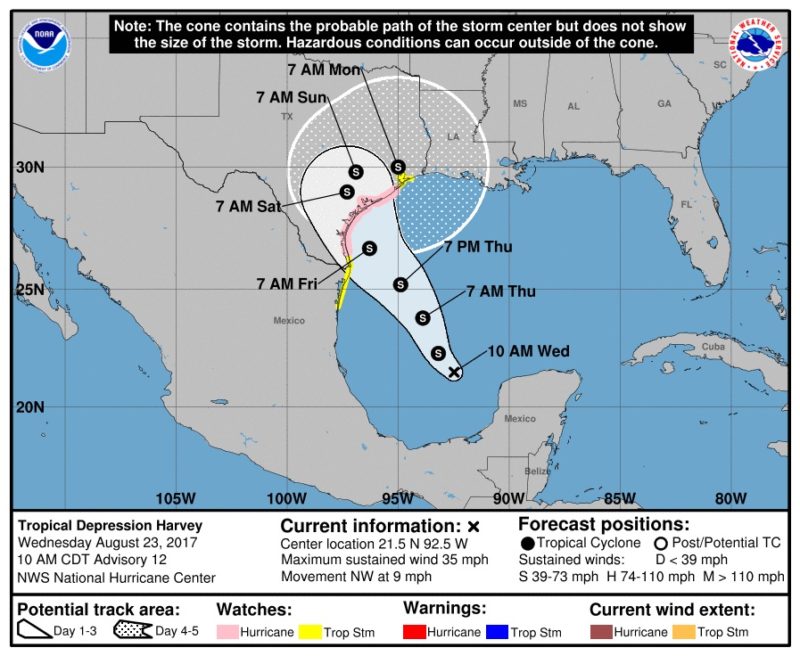

Currently a tropical depression, Harvey was 470 miles (756 kilometers) southeast of Port Mansfield, Texas, with top winds of 35 miles per hour, the U.S. National Hurricane Center said in an advisory at 11 a.m. New York time. It could develop into a hurricane just before landfall.

“It could intensify right up to landfall on Friday,” said Jeff Masters, co-founder of Weather Underground in Ann Arbor, Michigan. “I expect a Category 1 hurricane at landfall, but I cannot rule out a Category 2.”

The Gulf Coast from Corpus Christi, Texas, to Lake Charles, Louisiana, is home to nearly 30 refineries — making up about 7 million barrels a day of refining capacity — and is in the path of heavy rainfall expected to start as early as Friday. Flooding poses risks to operations, while torrential rains can shut units and cause supply disruptions.

Phillips 66 began a plantwide shutdown of its Lake Charles, Louisiana refinery late Tuesday after its power supplier warned of a high potential for electrical failure, according to a company statement.

“Biggest impact of this storm will be a significant reduction of crude oil imports into the Texas Gulf Coast, resulting in refineries cutting crude rates,” Andy Lipow, president of Lipow Oil Associates in Houston, said by email. “There will also be a significant impact on petroleum product exports impacting supplies into Mexico.”

Ike in 2008 was the last hurricane to hit Texas, said Dennis Feltgen, spokesman for the National Hurricane Center. Ike struck as a Category 2 storm on the five-step Saffir Simpson scale.

Heavy Rains

Along the coastline, seas could rise 4 to 6 feet above ground level and from 10 to 15 inches of rain will probably fall across parts of Texas into Louisiana, the hurricane center said. Some areas could get as much as 20 inches of rain.

“It is going to be a wet one,” Masters said. “It is not going to move fast after landfall and that is going to cause big trouble” from flooding rains.

The current track calls for the storm to land in southeastern Texas and then turn toward Houston. Masters said at least one computer-forecast model shows the storm heading back into the Gulf of Mexico early next week before coming ashore in Texas again.

Anadarko Petroleum Corp. said Tuesday it removed nonessential staff from some oil and gas production platforms in the Gulf of Mexico in response to weather conditions.

Cotton rallied on speculation the storm will threaten U.S. crops. On ICE Futures U.S. in New York, cotton for December delivery climbed 1.8 percent to 69.03 cents a pound after earlier reaching the highest since Aug. 10.

“Some concern is developing” regarding the storm impact and the heavy rains expected in Texas, Louis Rose, director of research and analytics at Rose Commodity Group in Memphis, Tennessee, says by email.

Wholesale gasoline prices continued to climb in Houston on Wednesday as suppliers stocked up in anticipation of potential outages at fuel distribution centers.

Mansfield Oil Co., a Georgia-based fuel distributor, said it raised its storm conditions to a red alert. “Heavy rainfall is expected in this region, which could impact refinery operations and trucking logistics in the region,” the company said by email.

Harvey’s path will skirt offshore oil rigs and gas platforms owned by state-run Petroleos Mexicanos in the Bay of Campeche. The company said it has no plans to evacuate workers.

© 2017 Bloomberg L.P

Join The Club

Join The Club