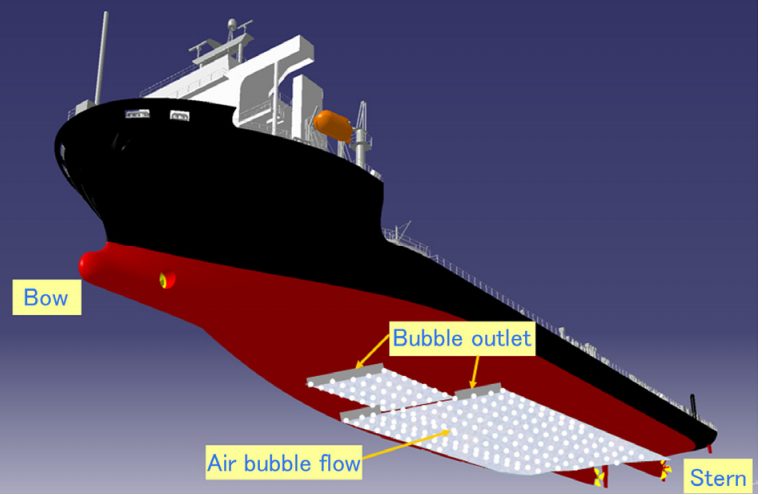

Mitsubishi’s Air Lubrication System (MALS) blows air through the ships hull to reduce the frictional resistance as the ship moves through the water

By Brenda Goh

By Brenda Goh

CHONGQING, China, Nov 7 (Reuters) – Paint inspired by the skin of a tuna fish and automated drone ships that don’t need crews: such ideas could revolutionise the next generation of ocean vessels as the shipping sector looks to cut costs and tackle pollution.

Faced with new environmental rules and the need to cap operating costs as profits slide, shippers are renewing their fleets to make them more eco-friendly and fuel-efficient, participants at a shipping conference in China said this week.

Other ideas, such as powering ships with liquefied natural gas (LNG) to reduce emissions and using 3D printing to make parts, are gaining traction, as these forces drive a fundamental rethink of shipping technology.

“The new ships now have to be energy-efficient. It’s all about being economical, about ‘green’ shipping,” said Li Zhen, chairman of Sinotrans Shipping, which is ordering ships at least 20 percent larger than its older vessels to improve efficiency.

It is also considering LNG-fuelled ships for its inland fleet that sails China’s Yangtze river.

Among the more inventive ideas is a low-friction paint inspired by tuna skin, the membrane of which attracts water into its microscopic indents, making it extremely slippery.

That is being developed by ClassNK, a Japanese classification society, which sets guidelines for ship construction and monitors the seaworthiness of vessels, in collaboration with Nippon Paint Holdings Co.

Infused with hydro-gel, the paint can reduce a ship’s fuel consumption by 6-7 percent, ClassNK Chairman Noboru Ueda said.

Another classification society, Britain’s Lloyd’s Register, is working on a project to fit a ship’s hull with fans that blow a layer of bubbles to the vessel’s bottom, helping it glide more easily through the water, thereby burning less fuel.

Japanese shipper Nippon Yusen Kaisha already operates vessels that have a similar air-lubrication system, which it says could reduce carbon dioxide emissions by 10 percent.

“There is huge competition going on between designers as to who has the most fuel-efficient designs because that’s the selling point nowadays. You don’t get any vessels sold unless they’re environmentally friendly,” said Riku-Pekka Hagg, vice president of ship design at Finland’s Wartsila.

3D printers to make parts could cut the use of raw materials and allow cheaper localised manufacturing. Danish shipper Maersk Line is investing in one such project.

The rising cost of employing people willing to spend months at sea and a desire to reduce the number of shipping fatalities are driving the likes of Rolls-Royce Holdings and the European Union to research crew-less, drone-like ships, although international laws may need to be changed before they take to the seas.

SLUMP SPURS INNOVATION

The shipping business may be in a depression, but that is itself a catalyst for change.

The industry is suffering from an oversupply of ships ordered before the 2008/09 financial crisis, which has pushed down freight rates and thus profits, forcing firms to focus on lowering their costs to remain competitive.

In China, the world’s largest shipbuilder, the government is offering firms subsidies to scrap ships and calling for a more environmentally friendly fleet.

State-owned China Shipbuilding Industry Corporation says prices for vessels are 30 percent lower than before the crisis. As a result shippers in China and elsewhere are retiring old vessels and buying newer, more efficient models.

China’s shipyards received orders for vessels totalling 52.49 million deadweight tonnes from January to September, 38 percent higher than in the same period in 2013, according to the China Association of the National Shipbuilding Industry.

Out of the 348 ships delivered to Chinese owners in 2013/14, about 30 percent contained fuel-efficient engines, data from maritime intelligence provider VesselsValue.com showed. That compares with just two out of 570 ships delivered in 2009/10.

The more revolutionary ideas will take time to come through and some will inevitably fall by the wayside.

“The problem for the shipping industry is that they’ve been offered so many solutions which have turned out to be not as good as they thought,” said Lloyd’s Register’s marine director, Tom Boardley.

But he acknowledged the potential. “We’re testing all sorts of different technology, and a lot of small venture capital companies are coming up with new ideas, because everyone knows that the marine industry spends a lot of money.” (Additional reporting by Keith Wallis; Editing by Alan Raybould)

(c) 2014 Thomson Reuters, All Rights Reserved

Join The Club

Join The Club