VladSV / Shutterstock.com

By Firat Kayakiran (Bloomberg) — A Greek shipowner is predicting new rules for marine fuel will put thousands of the world’s merchant vessels out of business in the next two years, roiling global trade. In fact, he’s wagering $1.1 billion on it.

Evangelos Marinakis, chairman of Capital Maritime & Trading Corp., based near Athens, says his company has invested that much in the last 18 months to upgrade its 71 ships spanning from oil tankers to container carriers. The rules, designed to clean up vessel emissions, will benefit more modern vessels and contribute to sending many older ones to the scrapyard, Marinakis said.

“As much as a quarter of the current fleet could be scrapped,” Marinakis said in an interview in London, where he also has an office. More than 20 percent of the 95,000-ship global fleet is over 15 years old, too old for additional investments. “This could have an adverse impact on world trade,” added Marinakis, who founded his first shipping company in 1991 at the age of 24.

It’s a bold prediction — one critics say is overblown — but something is clear: the changes are creating expensive complications for owners. As of Jan. 1, 2020, the entire fleet, handling about 90 percent of global trade, must reduce the amount of sulfur vessels belch into the atmosphere, under rules adopted last year by the International Maritime Organization, a United Nations agency.

The goal is to curb a pollutant, sulfur, that’s been linked to asthma and acid rain, and which is a component of so-called bunkering fuel for vessels. The rules have been nearly a decade in the making.

The shipping industry sees challenges on several fronts, noting that few vessels have been equipped with the scrubbers needed to reduce sulfur pollution and too few refineries churn out enough of the cleaner fuel needed to meet demand.

Teething Issues

“We expect full implementation in 2020 but there may be some teething issues about the availability of the fuel at the port,” Simon Bennett, director of policy and external relations at the International Chamber of Shipping, said in a phone interview. The London-based group represents shipowners and operators controlling thousands of vessels.

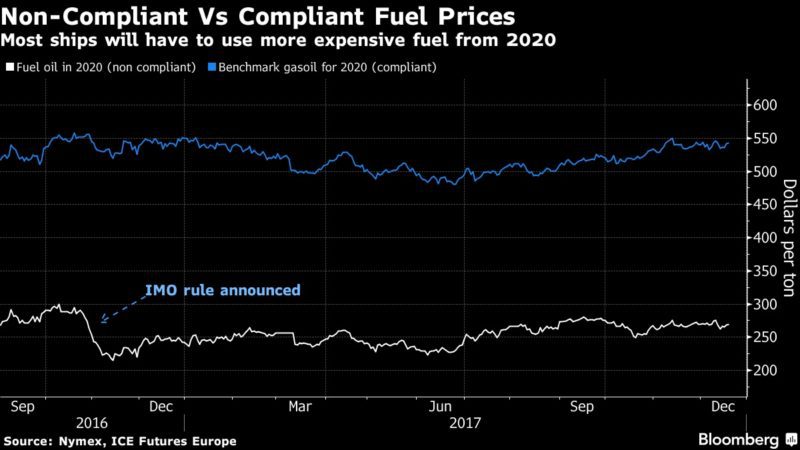

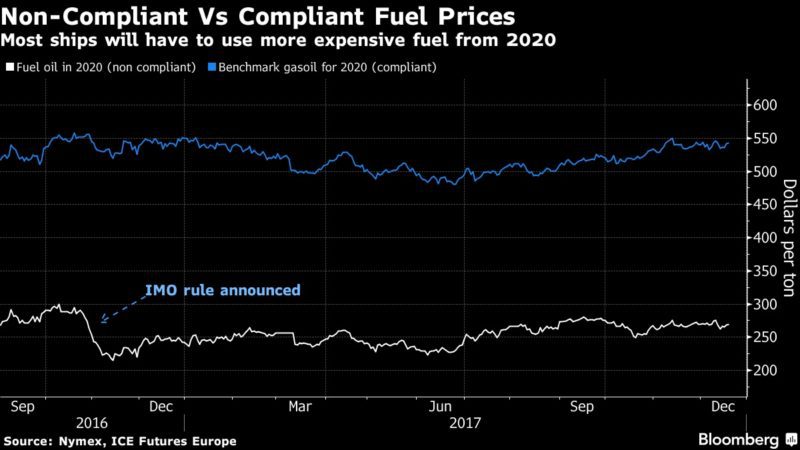

Last year, the IMO determined that enough fuel would be available for ships to adjust to the changes by 2020 and agreed to implement the rules by that date. While vessels can switch to lower-sulfur fuel, it would increase demand, and hence the cost of that product. Shippers may even have to pay as much as $60 billion a year on higher-quality fuel to comply, industry consultant Wood Mackenzie Ltd. predicted earlier this year.

“The cost of moving things will increase as the vessels will be using more expensive fuels, and there will be fewer of them,” Alan Gelder, Wood Mackenzie’s vice-president of refining, chemicals and oil markets, said in a phone interview.

Seaborne Trade

Not everyone in the industry foresees turmoil.

“World trade is probably not being affected directly to any degree, simply because there is little alternative to seaborne trade,” said Lars Robert Pedersen, deputy secretary general of the Baltic International Maritime Council, a Denmark-based owners’ group.

Some trade to remote locations may be affected by higher fuel prices, and there may be indirect effects on commerce if vessels are curbed by large-scale non-compliance with the rules or because compliant fuels aren’t available, Pedersen said.

Still, owners will likely pass along additional costs to consumers or run their vessels more efficiently instead of scrapping them, according to Faig Abbasov, an aviation and shipping officer at Transport & Environment, a Brussels-based group advocating for environmental standards.

“The high costs of fuel did not constrain world trade in any way” a decade ago, before the 2008 financial crisis, Abbasov said. “Why would it do it now?”

Upgrades, New Ships

Fuel oil prices in Rotterdam exceeded $700 a metric ton in mid-2008 and again reached that level in March 2012, data compiled by Bloomberg show. Since then, they’ve declined to about $340 a ton.

Less than a third of the world’s merchant fleet are eligible to be fitted with scrubbers or technologies to meet the sulfur cap by 2020, according to Marinakis. The company’s $1.1 billion modernization plan includes upgrades and new ships, allowing the vessels to be scrubber-ready and also to meet separate rules regarding water-ballast treatment.

“The scrubber is a mature technology onshore, but it’s considered relatively untested in shipping and shipowners are still reluctant to embrace it,” Marinakis said.

© 2017 Bloomberg L.P

Join The Club

Join The Club