Photo: Shutterstock.com / bob63

By John Kemp LONDON, Aug 2 (Reuters) – World trade is growing again which will give a big boost to middle distillates such as diesel used in the high-power engines that move almost all freight.

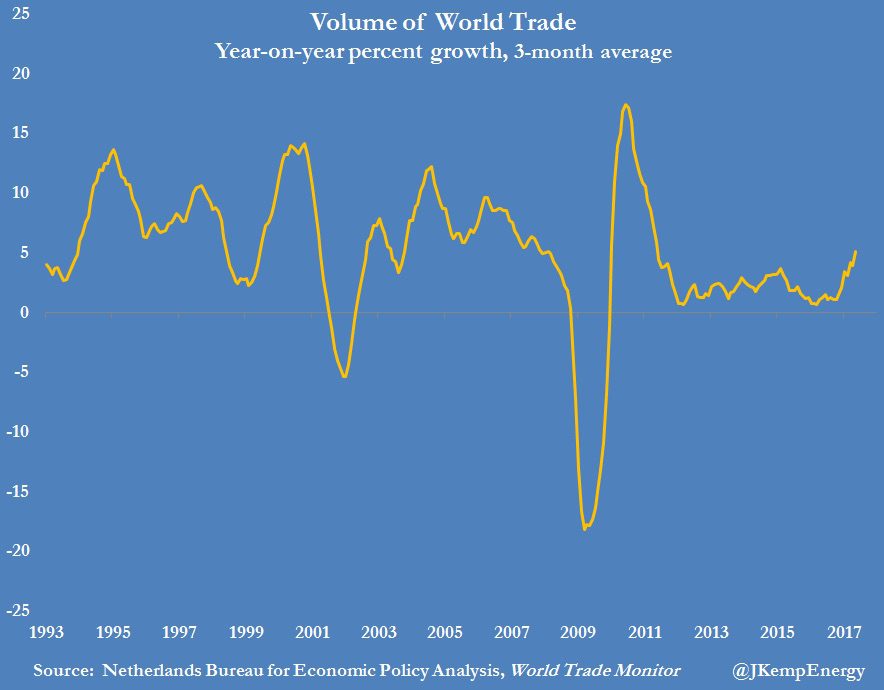

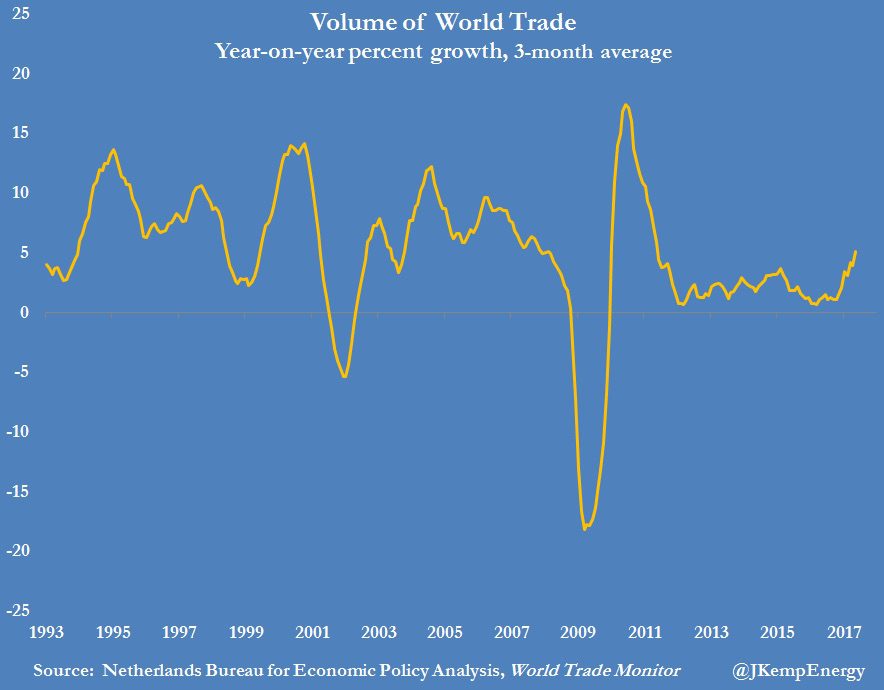

World trade volumes grew by 5 percent in the three months to May compared with the same period a year earlier, according to the Netherlands Bureau for Economic Policy Analysis (CPB).

Trade growth came close to a standstill in the first quarter of 2016 but has been accelerating gradually since then especially from the fourth quarter onwards (“World Trade Monitor”, CPB, May 2017).

Volumes are now rising at the fastest rate for six years though growth is still comparatively slow in historical terms.

Growth has accelerated in all regions, with the exception of Africa and the Middle East, where economic activity is still depressed owing to low oil prices.

Trade is closely linked to the commodity cycle. Commodities are among the largest traded items by volume while commodity production dominates the economies of most developing countries.

Slumping commodity prices between the middle of 2014 and early 2016 hit consumer spending and business investment in most developing countries hard.

The result was a sharp slowdown in trade as household incomes fell and new oil, gas and mining projects were postponed or cancelled (“Commodity slump stalls global trade growth”, Reuters, Oct 2016).

But the stabilisation and increase in commodity prices, including oil, is now helping support faster trade growth in 2017.

MIDDLE OF THE BARREL

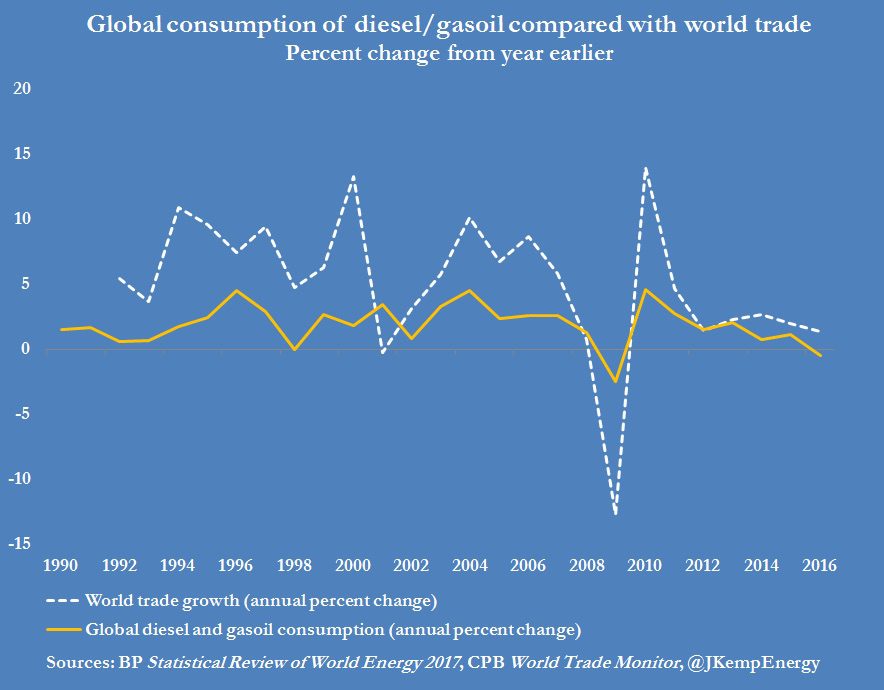

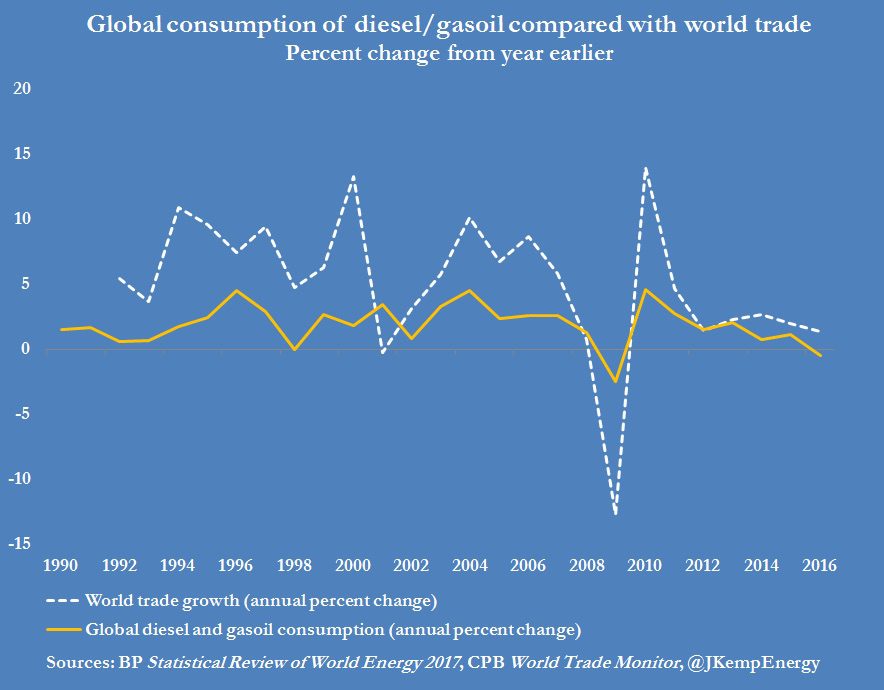

Trade is in turn a key driver of demand for middle distillates (including jet fuel, road diesel and marine gasoil) as well as the heavy fuel oil used in ocean shipping.

Mid distillates account for around 35 million barrels per day of global oil consumption, most of which is used to transport freight (“Statistical Review of World Energy”, BP, 2017).

Worldwide distillate consumption fell by 0.5 percent in 2016, the first annual decline since the global financial in 2009 and only the third since 1990.

Consumption was hit by a combination of the trade slowdown and back-to-back mild winters in much of the northern hemisphere in 2015/16 and 2016/17.

Distillate demand grew more slowly than oil consumption as a whole, which was up 1.6 percent in 2016, and much slower than gasoline, up 2.4 percent.

But as freight movements pick up, distillate is set to receive a big boost in 2017 and 2018, with growth likely to exceed gasoline.

(Editing by David Evans)

(c) Copyright Thomson Reuters 2017.

Join The Club

Join The Club