The International Union of Marine Insurance (IUMI) has released its 2024 “Stats Report,” providing a detailed analysis of the global marine insurance market.

The report highlights significant growth in marine insurance premiums, which reached a total of US $38.9 billion in 2023—a 5.9% increase over 2022.

This growth was observed across all lines of business, driven by multiple factors including a continued rise in global trade volumes and values, increases in vessel values, and heightened activity in the offshore energy sector due to rising oil prices.

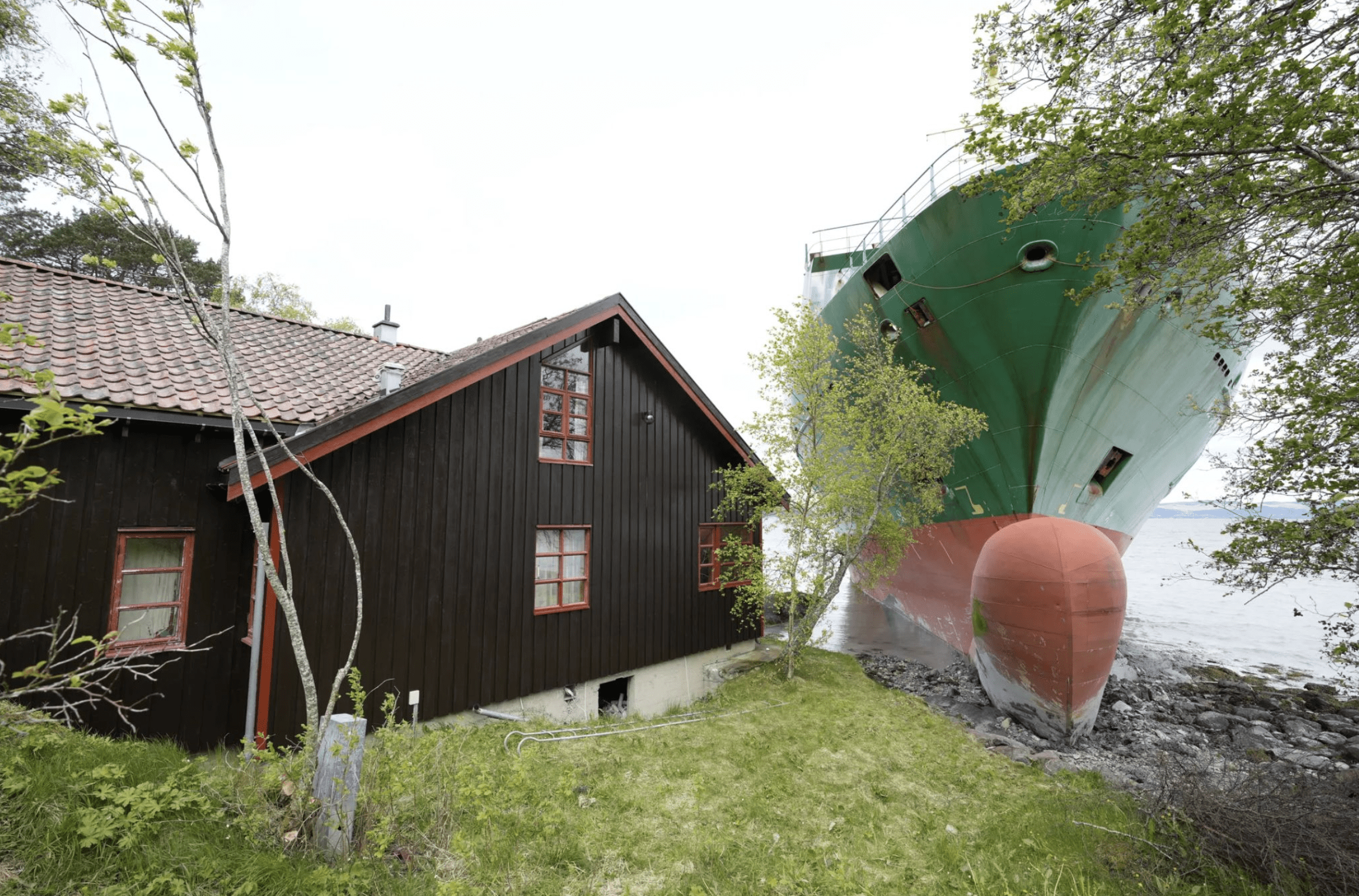

Breaking down the figures, ocean hull premiums saw a substantial 7.6% year-on-year increase, totaling US $9.2 billion. This growth can be attributed to increased maritime activity, a larger number of vessels, rising asset values, and reduced market capacity. While claims remained relatively low, resulting in positive loss ratios across all regions, there was a slight deterioration in 2023 loss ratios, primarily due to the inflationary impact on repair costs. The report also highlights the ongoing concern of fires on large vessels, a issue that continues to plague the industry.

Cargo insurance premiums also experienced significant growth, reaching US $22.1 billion, a 6.2% increase from the previous year. This upward trend in the cargo sector was supported by robust global trade growth. Notably, 2023 loss ratios for cargo insurance started at their lowest point since 2017, indicating a favorable environment for insurers in this segment.

The offshore energy sector maintained its momentum, with premiums growing by 4.6% to reach US $4.6 billion in 2023. This growth reflects the rally in oil prices, which has stimulated increased activity in the sector. Despite the uptick in activity, claims have not yet seen a substantial increase, with loss ratios remaining positive and relatively stable. However, the report notes that 2023 figures started from a higher point than in previous years, and claim costs in this sector typically take several years to fully develop.

IUMI’s Major Claims Database has also seen significant expansion. The database now includes contributions from 28 national insurance associations, with cargo observations totaling 6,400 and representing US $10.9 billion across 12 data fields. Hull data is even more extensive, with 10,300 observations and US $14.6 billion in cumulative losses. This comprehensive database allows for in-depth analysis of losses with respect to severity, frequency, location, and cause.

“Our data relating to 2023 demonstrates positive market development for all lines of marine insurance,” said IUMI Secretary General Lars Lange. “The global premium base continued to grow and this, coupled with a relatively benign claims environment, generated encouraging overall results for underwriters.”

However, Lange also cautioned about potential challenges on the horizon, saying, “Looking ahead, there are a number of headwinds likely to make themselves known this year and beyond. Geopolitical tensions and the continuing attacks in the Red Sea area and the Russia/Ukraine war are significant. Our transition to a cleaner and greener society will also impact heavily as will the continuing – and often tragic – increase in large vessel fires.”

Despite these challenges, the IUMI remains committed to supporting the industry.

“IUMI will continue to keep abreast of the many challenges facing our sector and engage with the relevant agencies to ensure marine underwriters are aware and equipped to continue to provide the insurance services that global trade requires,” Lange added.

Join The Club

Join The Club