LNG carrier Grand Elena, image courtesy Gazprom

By Melissa Akin and Denis Pinchuk

By Melissa Akin and Denis Pinchuk

ST PETERSBURG, Russia, June 21 (Reuters) – Gazprom is ready to take on potential Russian and Australian rivals for Asia’s ballooning liquefied natural gas market, its export chief said after President Vladimir Putin signalled an end to its exclusive right to export LNG.

Putin said Gazprom’s rivals such as Russian company Novatek, which is building an LNG plant on the Arctic Yamal peninsula, would gradually be allowed to export LNG, a move seen by analysts as a first crack in Gazprom’s legally enshrined export monopoly.

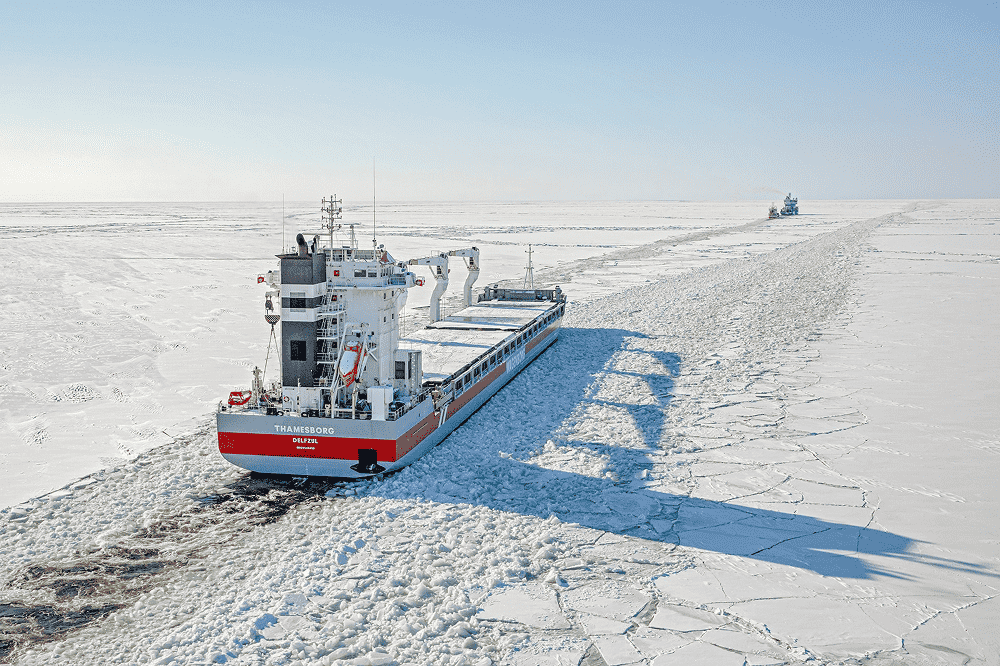

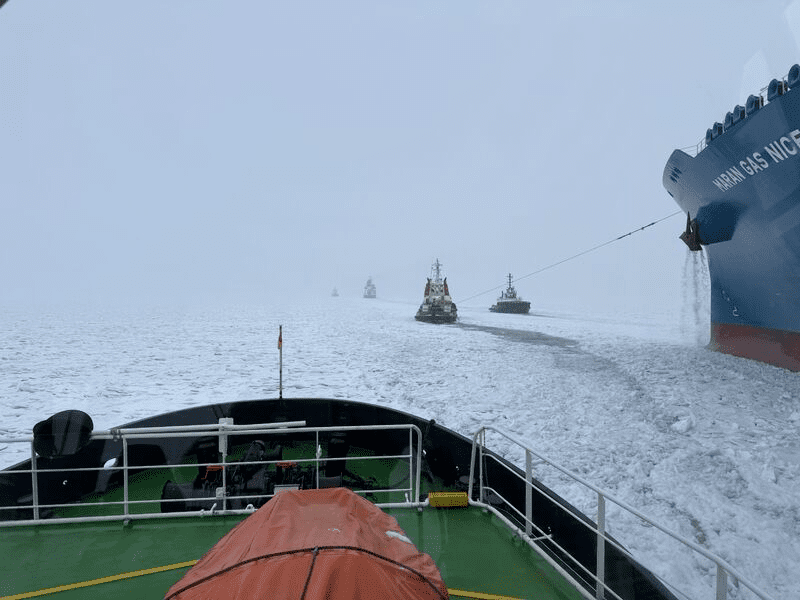

Novatek has said that the rising costs for new Australian LNG capacity have led to Asian interest in its Arctic gas, even though this will have to be liquefied and shipped via the so-called Northern Sea Route accompanied by icebreakers.

By contrast, state-controlled Gazprom has a project to liquefy gas at Vladivostok on the Pacific coast, much closer to Asian markets.

“If production and liquefaction on Yamal is competitive with Australian gas, then the Vladivostok plant or a European plant would be significantly more competitive,” Alexander Medvedev, CEO of Gazprom Export, said in an interview.

“We will earn more money”, he said.

Medvedev said the granting of export rights to rivals would not hurt Gazprom, provided ground rules are established. Putin has said a condition of liberalisation is that non-Gazprom LNG should go only to the growing markets of Asia, not to Europe, where Gazprom earns most of its revenue.

STRANGE THING

“It would be a pretty strange thing for Russian gas to compete with Russian gas, although we are not afraid of competition and compete with other suppliers,” Medvedev said.

“We need to figure out what kind of volumes will end up on the market. If we are talking about Yamal, its target market is southeast Asia,” Medvedev said.

He said exports of gas by pipeline would not be opened up to rivals.

“I don’t think it will even be discussed,” Medvedev said.

Medvedev played down prospects for a deal to deliver pipeline gas to China, adding that Gazprom CEO Alexei Miller’s assurances a deal could be reached as early as September reflected hopes that “thinking makes it so”.

He said price, the main sticking point in 15 years of talks on a pipeline gas deal, remained an issue and that previous reports that an agreement had been reached on prepayment by the Chinese side were incorrect.

“When we agree the price we will agree prepayment,” he said.

He rejected suggestions that Western hub prices could serve as a benchmark for Chinese or other Asian gas deliveries.

Gazprom favours the regional oil-linked benchmark, the Japanese Crude Cocktail (JCC), the basis for deliveries to Asia from Sakhalin-2, Russia’s only functioning LNG plant, which is operated by Gazprom with partners Royal Dutch Shell and Mitsui.

Some analysts say the potential supply from U.S. projects to liquefy natural gas from shale would make U.S. spot pricing a potential benchmark for Asian supplies, but Medvedev rejected the suggestion.

“We don’t see any reason to deviate from the JCC.” (Writing by Melissa Akin; Editing by Anthony Barker)

(c) 2013 Thomson Reuters, Click For Restrictions

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Reuters, published under license.

Join The Club

Join The Club