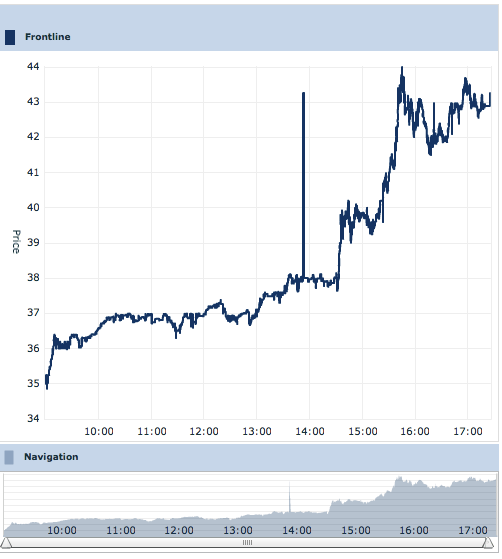

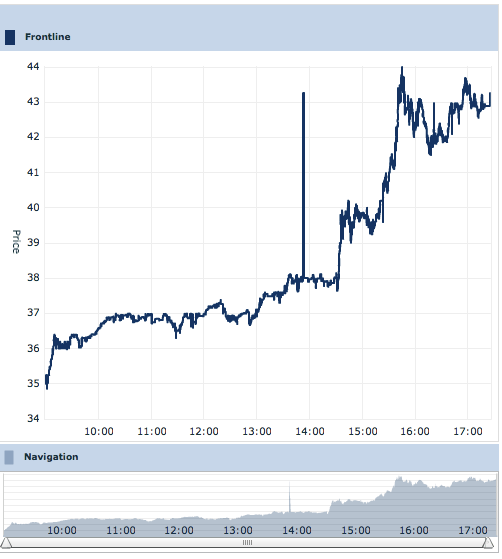

It was quite a day for shareholders of Frontline Tankers. Their stock shot up nearly 29% on news of increased VLCC and Suezmax tanker day rates.

In a note dated 15 March by Wells Fargo Securities Senior Analyst, Michael Webber, VLCC and Suezmax spot day rates have jumped 87% and 82% respectively ($32,500/day and $37,700/day) from previous levels.

Microsupply/demand disruptions (and potentially elevated longhaul Chinese imports (West Africa) stemming from Iranian supply concerns) have driven VLCC and Suezmax rates to profitable levels, with the timing coming against the grain in terms of seasonality (and the general theme of tanker overcapacity).

According to our channels, the physical tanker market is still seeing upward pressure in the Atlantic Basic intraday, with relatively thin supply (VLCCs, Suezmaxes), which could continue putting some near term upward pressure on day rates and potentially tanker stocks. The Mediterranean market is also firming to a degree, which could keep some Suezmax vessels from ballasting to the Atlantic, which could keep tonnage (vessel supply) relatively constrained, potentially adding some modest length (days most likely) to the recent rally in rates.

In his statement, Mr. Webber makes a point by saying that Wells Fargo does not, however, feel this upward momentum is the start of an industry-wide recovery. In addition, much of the profit gained by Frontline Tankers’ upswing will be handed over to Ship Finance International (SFL), as part of Frontline’s December 2011 restructuring agreement.

Overseas Shipholding Group (NYSE:OSG) was up 8.39% at the bell on Friday.

Join The Club

Join The Club