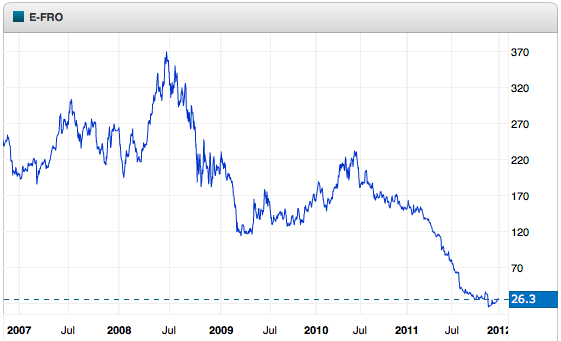

The world’s largest tanker owner, Frontline Ltd., has just announced the completion of major corporate restructuring following a sustained weak global tanker market that crushed their stock price since its peak of NOK 362.50 in 2008. The following is their press release:

Frontline Ltd. (“Frontline” or the “Company”) is pleased to announce that the restructuring of Frontline has been successfully completed. The major part of the restructuring consists of the following elements:

Frontline Ltd. (“Frontline” or the “Company”) is pleased to announce that the restructuring of Frontline has been successfully completed. The major part of the restructuring consists of the following elements:

Frontline has completed the sale of five VLCC newbuilding contracts, six modern VLCCs including one time charter agreement and four modern Suezmax tankers to Frontline 2012 Ltd. at fair market value of $1,121 million. In addition, Frontline 2012 has assumed $666 million in bank debt attached to the vessels and newbuilding contracts and $325.5 million in remaining newbuilding commitments. Further, Frontline will receive payment for working capital related to the assets sold. The estimated book value of the assets sold, including the remaining newbuilding commitments, at December 31, 2011 is $1,428 million. The assets have been sold at fair market values assessed by three independent appraisals. The right to subscribe to shares in Frontline 2012 has thereby no instant economical value, and no subscription rights have thereby been given to Frontlines shareholders.

On December 16, 2011, Frontline 2012 completed a private placement of 100,000,000 new ordinary shares of $2.00 par value at a subscription price of $2.85, raising $285 million in gross proceeds, subject to certain closing conditions. These conditions have now been fulfilled and Frontline 2012 was registered on the NOTC list in Oslo December 30, 2011. Frontline Ltd. was allocated 8,771,000 shares at a subscription price of $2.85, representing approximately 8.8 percent of the share capital of Frontline 2012. Frontline 2012 has used the proceeds from the private placement to acquire the assets from Frontline, prepay bank debt with installments for 2012 and capitalize Frontline 2012.

Frontline has obtained the required consents from lenders whose loans are transferred to Frontline 2012 and has further obtained agreements with its major counterparts whereby the gross charter payment commitment under existing chartering arrangements is reduced by approximately $320 million in the period 2012-2015. Frontline will compensate the counterparties with 100 percent of any difference between the renegotiated rates and the actual market rate up to the original contract rates. Some of the counterparties will receive some additional compensation for earnings achieved above original contract rates.

As a consequence of the restructuring, Frontline’s sailing fleet, excluding the non recourse subsidiary ITCL, is reduced from 50 units to 40 units. The newbuilding commitments are reduced from $437.9 million to $112.4 million, which relates to two Suezmax tanker newbuiding contracts, and bank debt is reduced from $679 million to zero, following a prepayment of $13 million associated with a vessel which is not part of the transaction with Frontline 2012. The cash proceeds for Frontline following the completion of the transaction is approximately $70 million.

The Board of Frontline wants to thank all the parties involved, including counter parties and financiers who greatly have contributed to the solution. Without the flexibility on terms and timing shown by them, a successful restructuring would have been impossible.

Following the restructuring, Frontline should have significant strength to honor its obligations and meet the challenges created by a very weak tanker market. Through the sale of a limited number of the Company’s assets, Frontline has avoided a heavy dilutive new equity offering and will thereby keep significant upside for the existing Frontline equity holders if the market recovers in the years to come.

Join The Club

Join The Club

Frontline Ltd. (“Frontline” or the “Company”) is pleased to announce that the restructuring of Frontline has been successfully completed. The major part of the restructuring consists of the following elements:

Frontline Ltd. (“Frontline” or the “Company”) is pleased to announce that the restructuring of Frontline has been successfully completed. The major part of the restructuring consists of the following elements: