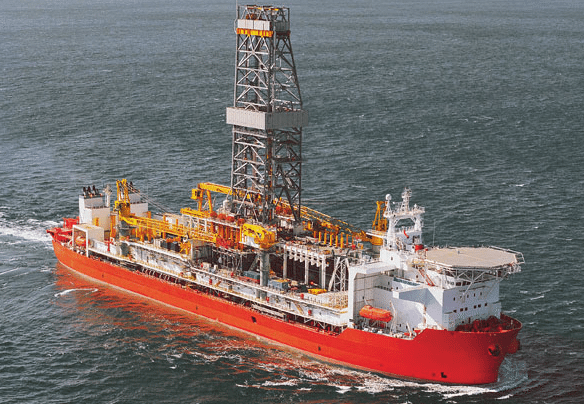

Fred Olsen Energy’s Belford ultra-deepwater drillship. Image: Fred. Olsen Energy ASA

(Bloomberg) — Fred Olsen Energy ASA, a Norwegian offshore drilling company, dropped to a three-week low in Oslo as higher-than-expected cost increases in the fourth-quarter – curbed the company’s earnings prospects.

Shares in the company, based in the Norwegian capital, fell as much as 2.7 percent to 253.5 kroner, the lowest intraday level since Jan. 14, and were down 2.2 percent as of 12:45 p.m. More than 188,000 shares have traded so far today, more than 55 percent more than the three-month average daily volume.

“It looks like we have to increase 2013 operating expenses if the deviation in the fourth quarter was not a one-off,” Pareto Securities AS said in an e-mailed note to clients.

The broker’s estimate for operating expenses this year may be increased by as much as 200 million kroner ($36.4 million), which would cut its earnings per share projection by between 5 percent and 10 percent, said Pareto, which has buy rating and 300 kroner price target on the stock.

Fred Olsen Energy posted fourth-quarter net income of 288.5 million kroner, down from 530.3 million kroner a year earlier, it said in a statement today. That missed the 423.5 million- krone average estimate of 10 analyst estimates compiled by Bloomberg. Sales declined 3 percent to 1.63 billion kroner as operating costs jumped 11 percent.

The driller will pay a dividend of 10 kroner for 2013 as well as an extraordinary dividend of the same amount, it said.

Fred Olsen Energy owns and operates two deepwater drilling rigs, six semi-submersible vessels and one accommodation unit. It also has two rigs under construction, an ultra deepwater drillship due for delivery in the third quarter of 2013, and an ultra deepwater semi-submersible unit scheduled for delivery in the first quarter of 2015.

Shares in Fred Olsen Energy have gained 10 percent during the last 12 months, giving the company a market value of 17 billion kroner.

– Stephen Treloar, Copyright 2013 Bloomberg.

Join The Club

Join The Club