UK Strikes at Heart of Russia’s Arctic Energy Empire

New maritime services ban threatens to sever lifeline for Yamal LNG exports By Paul Morgan (gCaptain) – In the frozen waters above the Arctic Circle, a fleet of specialised ships...

From the perspective of tanker owners, particularly of larger tonnage, it is clear that 2013 will not be remembered fondly. Rates have languished at levels most thought had been consigned to history as tonnage remained abundant in the primary load regions throughout the year. This has been further exacerbated by the altered trading landscape stemming from the US crude oil revolution that unlocked shale reserves at an alarming rate. A global economic malaise has also kept demand improvements limited in both mature and growing economies.

Throughout the year, if VLCC rates started to show even the slightest sign of life, hopes were quickly dashed as charterers played the trading landscape wisely and allowed tonnage to build in their favor. Further pressuring any upward momentum has been the steady competition with the weak Suezmax market. This factor has been amplified by the massive contraction of US imports from West Africa which were around 1.3 million b/d in 1H 2000 and contracted to approximately 600,000 b/d through 1H 2013.

Despite this environment, tanker owners are likely hoping that they will end 2013 on a positive note. If history repeats itself, owners can expect to see a gradual increase in rates through December (Figure 1).

This upward movement can be attributed to charterers securing cargoes ahead of the holidays, which in several countries marks a subsiding of trading activity. Further support stems from a seasonal uptick in production of heating fuels ahead of peak winter demand.

Looking at activity last year, on the route from the Arabian Gulf to the US Gulf, rates climbed by 23% between the start of September and December to WS 29.5. For cargoes moving from the Arabian Gulf to the East, rates climbed by a slightly more impressive 29% to WS 47. In general, rates on these routes increased by roughly 20% during this time period since 2009.

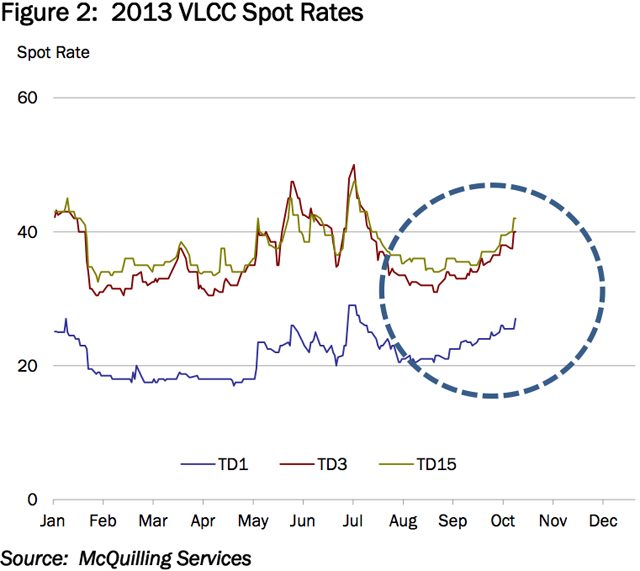

As we enter the final quarter of 2013, VLCC owners might be feeling confident that rates will indeed follow history’s pattern. Since the start of September rates have climbed by about 20% (Figure 2). Although the impact of this is unlikely to be observed on owner’s balance sheets until early 2014, the trend is a welcome change to this year’s weak activity.

Owners are doing their part to drive this momentum by monitoring terminal delays, weather conditions and the timing of voyages. Through this, they hope to nudge history in the right direction lay the foundation for a more prosperous 2014.

This development has been supported by increasing evidence that the global economy could be finding its footing. Employment levels have been increasing in the US as have Purchasing Manager Indices, a gauge of manufacturing activity, in various countries. Maintaining this upward momentum will be contingent on the US government reaching a meaningful agreement to the current budget stand-off and raising the debt ceiling. At the time of writing, it appears that for the time being, an agreement has been reached.

Further support will come from an increase in global refinery throughput rates.

According to the International Energy Agency (IEA) in Q3, global refinery throughputs are estimated to be 77.3 million b/d. This is roughly 1.2 million b/d higher than year ago levels. Although Q4 often represents a seasonal contraction in throughput rates, the IEA still places it at 900,000 b/d higher than 2012 figures.

Accordingly, JBC Energy also projects rising oil demand in most regions (Table 1). The most significant contributions of growth will continue to stem from non-OECD countries. There also remains upward potential for European nations as the region slowly rebalances its financial landscape.

Even as these somewhat favorable market conditions materialize, the availability of tonnage remains a tangible threat to any year-end rebound. In addition, the “invisible tonnage surplus” created by sailing at slower speeds, lurks just below the surface. Owners have attempted to reduce vessel availability in the Arabian Gulf throughout the year, by ballasting to West Africa. However, this move results in boosting competition for cargoes in West Africa, primarily with Suezmax tankers, and an eventual return to the Arabian Gulf in search of higher rates.

This repositioning will seemingly continue to have a limited impact providing only temporary relief as the lasting solution, the permanent removal of larger tonnage, has been slow in 2013.

Year-to-date our data shows that only nine VLCCs have left the trading fleet although market players seem to be moving in the right direction as three demolitions were recorded in September. This, combined with the delivery of 24 vessels, represents a net fleet growth of 15 VLCCs year-to-date.

As 2013 starts drawing to a close, it appears that history is on track to repeat itself and VLCC rates are climbing. Global oil demand is projected to be nearly 1.7 million b/d higher in 2H 2013 and increase by an additional 1 million b/d next year (Table 1).

If this materializes, there will be at least one development from 2013 that owners will not mind being consigned to history.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up