By Priscila Azevedo Rocha (Bloomberg) —

The crisis engulfing Europe’s wind industry is proving to be a wake-up call: things have to change radically to make progress on what’s a key part of the climate transition.

A flood of negative headlines have dominated recently, the fallout from soaring raw-material prices, higher borrowing costs and long-running supply-chain issues. As those ripped through the industry, causing project failures, multi-billion dollar writedowns and disastrous wind farm auctions, it all looked increasingly bleak.

Then, Vestas Wind Systems A/S shifted the narrative, announcing a big increase in orders and boosting its outlook. At the same time, the reality that getting projects off the ground will cost more and needs more support appears to be getting through. Governments in Europe are already reacting, giving some hope that this is the nadir.

Last week, the UK took direct action to help with funding, bumping up the support price for new offshore wind farms. The European Union says “immediate action” is needed and plans to speed up permits for wind projects, and Germany will make it easier for green energy firms to get on the grid. That’s all intended to keep investment flowing and, more broadly, keep countries on the road to their net-zero targets.

“We need to recognize this is where we are right now and we need to find ways to get that investment into the market,” Alana Kuhne, head of new markets Europe at Orsted A/S, said at a conference. “Policy makers have started to recognize this challenge.”

Shares in Vestas, the world’s biggest wind turbine maker, have rebounded about 30% from their low in early October. JPMorgan Chase & Co. upgraded the stock to “neutral” from “underweight” last week. A further boost for the sector came from Octopus Energy announcing on Friday it will launch a £3 billion ($3.7 billion) fund to invest in offshore wind by 2030.

Orsted, which has been at the center of the wind crisis, has also moved off its lows in recent weeks after suffering a sharp selloff.

Cost Squeeze

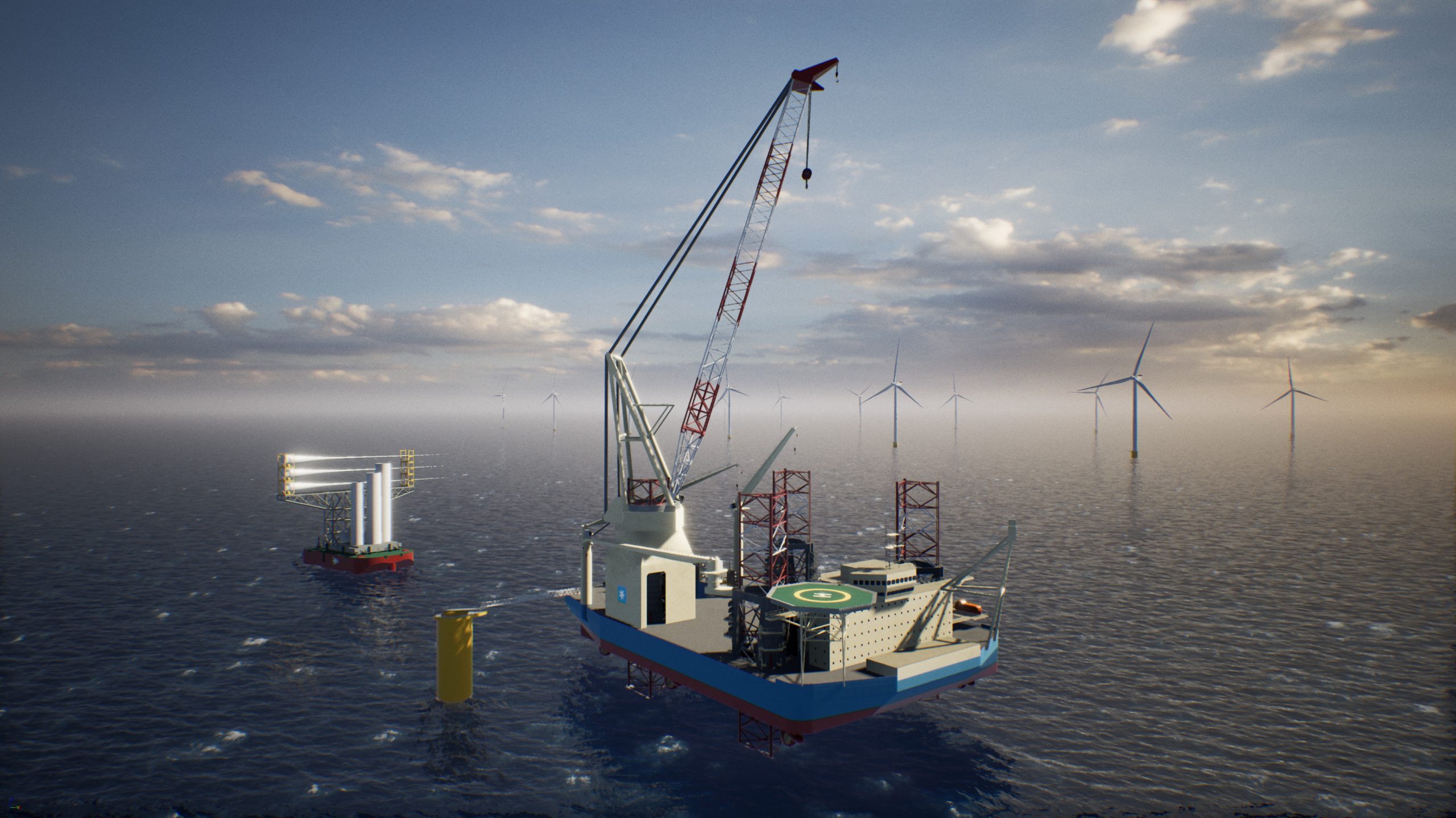

Offshore wind is extremely capital intensive, and the squeeze on costs has made it difficult for developers and suppliers to secure financing for projects at profitable margins. Many locked in contracts years ago to deliver power at specific prices, but after inflation drove up costs, those deals were no longer viable.

“Offshore projects are walking on very thin ice,” said Xabier Viteri Solaun, director of Iberdrola SA’s renewables business. “Reaching a final investment decision is much harder today.”

Raising prices paid for wind power is one solution, but that will ultimately mean higher bills for consumers, who are still reeling from the energy price and inflation shock of 2022.

So far, the nascent revival for offshore is centered on Europe. Wind energy is particularly important in the region, both economically and in terms of energy security. Equipment makers are huge employers, and wind accounts for more than 30% of electricity generation at times.

Companies are still working through issues in the US, where developers including Orsted and BP Plc have taken more than $5 billion in writedowns on offshore wind projects.

Some companies, including Avangrid Inc., say they plan to bid for new contracts, though they will need to seek higher prices. But the risk is that will make projects uncompetitive . That’s what happened in July, when Orsted and its partner Eversource Energy failed to win a contract to supply power to Rhode Island because their offering was too expensive.

Meanwhile, the European Commission has acknowledged the troubling situation and published an action plan late last month. It estimates the EU needs more than 500 gigawatts of wind power by 2030 to meet renewable targets, up from 204 GW in 2022, something that won’t happen “without a healthy, sustainable and competitive wind supply chain.”

“Both interest rates and inflation seem to have reached a plateau, which provides some certainty in costs, favoring investment,” said Carla Ribeiro, head of offshore wind advisory for UK and Ireland at consultancy Ramboll. “However, the recovery is likely to be slow” and “investor confidence needs to be re-established.”

On top of the industry-wide problems, there have also been company-specific issues. Siemens Energy AG has had to seek government help as it deals with faults in turbines made by a Spanish business it bought.

And in a world of higher-for-longer interest rates and raw material prices, securing financing for offshore wind is still a challenge.

Government guarantees can drive some capital into projects, but for offshore wind projects in particular, money is only one part of the equation. Companies need to have their access to the grid in place, the contracts with all the suppliers signed and there is a specific order that things need to happen. If one gets delayed, the project as a whole faces delays and cancellations.

The UK will announce an overhaul of how it prioritizes connections to the country’s power grid this week, Bloomberg has reported. That’s part of a broader plan to get clean energy into homes and businesses.

In Poland, where Vestas said it secured a big order in the third quarter, projects are keeping to schedule because the government chose to link its support price to inflation which is helping to cover the rising costs.

“Although there are tough market conditions at the moment, it’s clear that offshore wind is going to be in the backbone of our future energy systems,” said Adam Morrison, UK country manager at Ocean Winds, a joint venture of EDP Renewables and Engie. “Offshore is very suited to doing a lot of the heavy lifting of large scale power generation.”

© 2023 Bloomberg L.P.

Join The Club

Join The Club