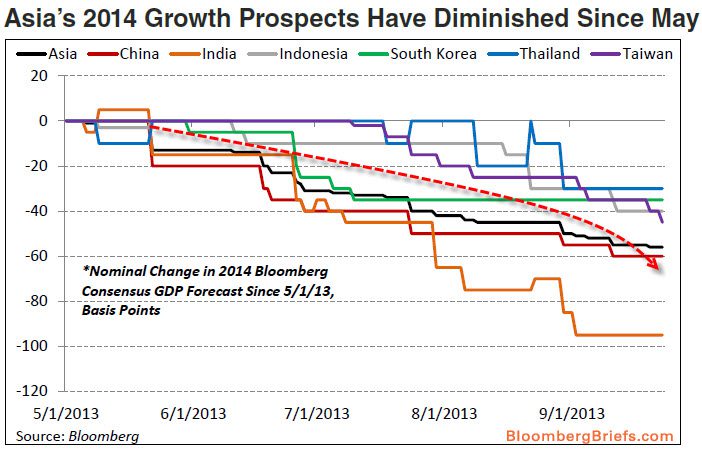

Economic forecasts globally and in particular in Asia have turned negative. The International Monetary Fund (IMF) recently forecast the GDP for China to be 7.6% in 2013, from 7.8% in July, and to 7.3% in 2014, down from 7.7%.

In the IMF’s World Economic Outlook released last month, the IMF comments about the world’s second largest economy:

“The extraordinarily high rates of investment, nearly half of GDP, have resulted in excess capacity and diminishing returns. At the same time demographic trends imply that the labor force will start declining after 2014, with surplus labor becoming exhausted by 2020. Moreover, total factor productivity growth will likely decline as China progresses toward the ranks of high-income countries. As a consequence, without fundamental reform to rebalance the economy toward consumption and stimulate productivity growth through deregulation, growth is likely to slow considerably.”

The recent World Bank forecast expects the Chinese economy only to expand by 7.5% in 2013, down from its April forecast of 8.3% and 2014 GDP growth is estimated at 7.7%, down 0.3 percentage point from its previous forecast.

While an investor might consider the IMF and World Bank numbers high in absolute terms, the GDP estimates for China are coming down and they are inversely correlated with fleet growth. This is not healthy for dry bulk shipping.

And with regards to China, the World Bank said the massive, investment-heavy stimulus program supported by credit expansion, the latest initiated in July/early August was an “Unofficial Economic Stimulus” program has run its course, and policymakers must focus on containing the rapid growth of credit and tighten financial supervision. It added local government debt was a concern, given the complexity and opacity of municipal finances, and said they should be reformed “with clear rules on borrowing, on allowed sources of borrowing, on debt resolution, and on the disclosure of comprehensive financial accounts by local governments”. Furthermore the World Bank believes, “The rapid expansion of shadow banking poses serious challenges, since shadow banking is closely linked to the banking system, is less regulated, and operates with implicit guarantees from banks and local governments”. Controlling credit is not good for expansion of GDP growth and dry bulk shipping.

The most recent Chinese HSBC Purchasing Manager Index (November 22, 2013) estimate missed expectations (50.4 vs.50.8 est.) and dropped the most month-over-month since May 2013. New exports orders dropped to 3-month lows and employment deteriorated, however, manufacturing output rose to its highest in 8 months.

The Chinese economy is being driven purely on liquidity which is not structurally sustainable for long-term demand. The dry bulk markets have, and will continue to be, negatively impacted by increased fleet supply and lower commodity demand, unless additional monetary accommodation is not forthcoming.

Finally, China already has too many “Ghost Cities” as such it doesn’t require additional excess construction expansion. The financial system is currently stressed due to excessive leverage and non-performing debt. After dry bulk rates having soared in mid-August through September, they have retraced and were under pressure in October/November as monetary agrregates contracted / were not injected into the Chinese economy. The People’s Bank of China (“PBOC”) has recently allowed interest rates to rise – a tightening bias has been in effect since October/November and remains in place.

The EU has also revised its GDP forecast to worsening economic conditions. (i.e., 1.1%) and Russia has reduced its GDP forecast.

We are seeing economic forecasts being lowered. This is negative for the Dry Bulk Market in 2014 and 2015. Without additional economic stimulus programs, initiated by central banks, “unofficial” or “official,” shipping markets will remain challenged in 2014 and 2015.

Jay Goodgal can be reached via email at [email protected]

Join The Club

Join The Club