By Agnieszka Flak and Marina Lopes

By Agnieszka Flak and Marina Lopes

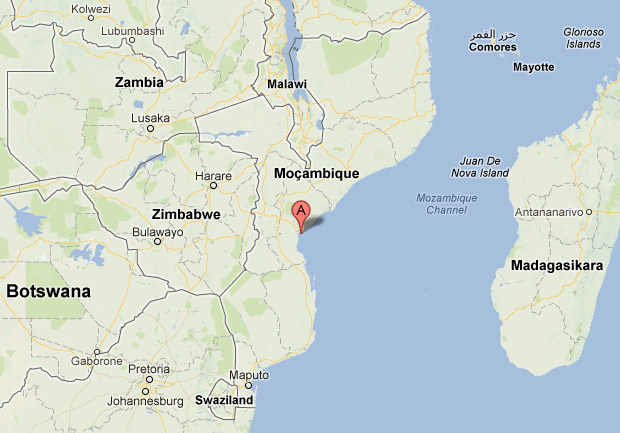

BEIRA, Mozambique – Constant silting and shifting underwater sandbanks at the Mozambican port of Beira require daily dredging, hampering efforts to build the Indian Ocean port into a major minerals export hub, the port’s managing director said.

Beira has long been used as a transhipment port, processing cargo from landlocked Zimbabwe, Malawi and Zambia, but recently also started moving coal found in Mozambique’s northern Tete province, which links with Beira via an old railway.

Infrastructure bottlenecks are a major headache for miners setting up in the former Portuguese colony, home to vast reserves of coking coal, used in steel making.

Brazil’s Vale was forced to curtail its output and export targets last year and Rio Tinto wrote down $3 billion on its Mozambican assets, partially due to infrastructure constraints.

“This is the most difficult channel in this region that requires dredging nearly every day,” Carlos Mesquita, managing director of Cornelder de Mocambique, which handles the port, told Reuters in an interview.

The Pungwe and Buzi rivers come together at the country’s second biggest city and their currents build heavy siltation and sandbanks around the channel, making it difficult for large vessels to pass.

A capital dredging project – normally used to deepen a port – was completed in 2011, but was not sufficient to allow Panamax vessels through and currently only ships of up to 9.5 meters can dock at Beira. This is expected to change when another such operation is performed next year.

Still, the port will need to be dredged every day after that to keep the sand from piling up, Mesquita said.

The port is also constrained by limited capacity on the railway lines linking with Beira, with huge tonnages of cargo currently arriving by trucks along a heavily potholed highway prone to flooding during the rainy summer season.

The majority of coal coming from Tete, including mines set up by Vale and Rio Tinto is sent via the 545 km Sena railway line, whose upgrade has been subject to many delays and which was shut last week following heavy flooding along its tracks.

Mesquita said Vale and Rio Tinto exported a total of 2.43 million tonnes through Beira last year and this was likely to rise only marginally this year despite Vale’s export projections for its mine alone of around 4.9 million tonnes for 2013.

“There are problems on the railway because of heavy rains and this has direct impact on us. This year we should do 2.5 to 3 million tonnes (of coal), that is more realistic,” he said.

NATIONAL VS REGIONAL

Vale and Rio Tinto upgraded an existing coal terminal at the port to handle up to 6 million tonnes per year and state logistics group CFM plans a new 20-million-tonne facility to cater for growing demand from coal exporters setting up in Tete.

Mesquita said the coal exports from Tete are putting his other operations under pressure, especially as neighbouring countries would like to increase their shipments as well, given bottlenecks at the ports in South Africa and Tanzania.

From the region, Beira has traditionally been used to export products such as tobacco, grains and cotton and to import food, fuel and fertiliser, but is increasingly moving minerals as well, including copper, iron ore, manganese and ferrochrome.

“I’m already stuck today. I’ve got ships sitting outside for 5 to 10 days,” he said. “Coal is a national agenda that I can’t stop, but it’s taking away capacity from my traditional cargo.”

Privately held Cornelder, which was commissioned by CFM in 1998 to manage the port, plans to spend at least 300 million euros ($400.51 million) in the next five years to boost productivity and throughput via an additional quay, a new fertiliser terminal, upgrades to roads at port and equipment.

Container traffic was expected to more than double between 2010 and 2015, while general cargo volumes, which include coal, were forecast to rise nearly sevenfold during that same period.

($1 = 0.7490 euros) (Reporting by Agnieszka Flak and Marina Lopes; Editing by Louise Heavens)

(c) 2013 Thomson Reuters, Click For Restrictions

Join The Club

Join The Club