Ocean carriers raked in a “mind-bending” $59.3 billion profit in the first quarter of the year—the highest quarterly earnings in container shipping history— as the industry continued to benefit from stronger pricing, Blue Alpha Capital founder John McCown said in his latest McCown Container Results Observer report.

Q1 2022 actually marked the sixth consecetive quarter of the highest net income ever for the industry, McCown’s report shows. The industry’s $59.3 net income also marked a 300% improvement from the first quarter of 2021, equivalent to $40.2 billion. Compared to Q4 2021, total profits were up a little over 13%.

“These actual results are diametrically opposed to what anybody could have contemplated at the beginning of the pandemic just over two years ago,” McCown writes.

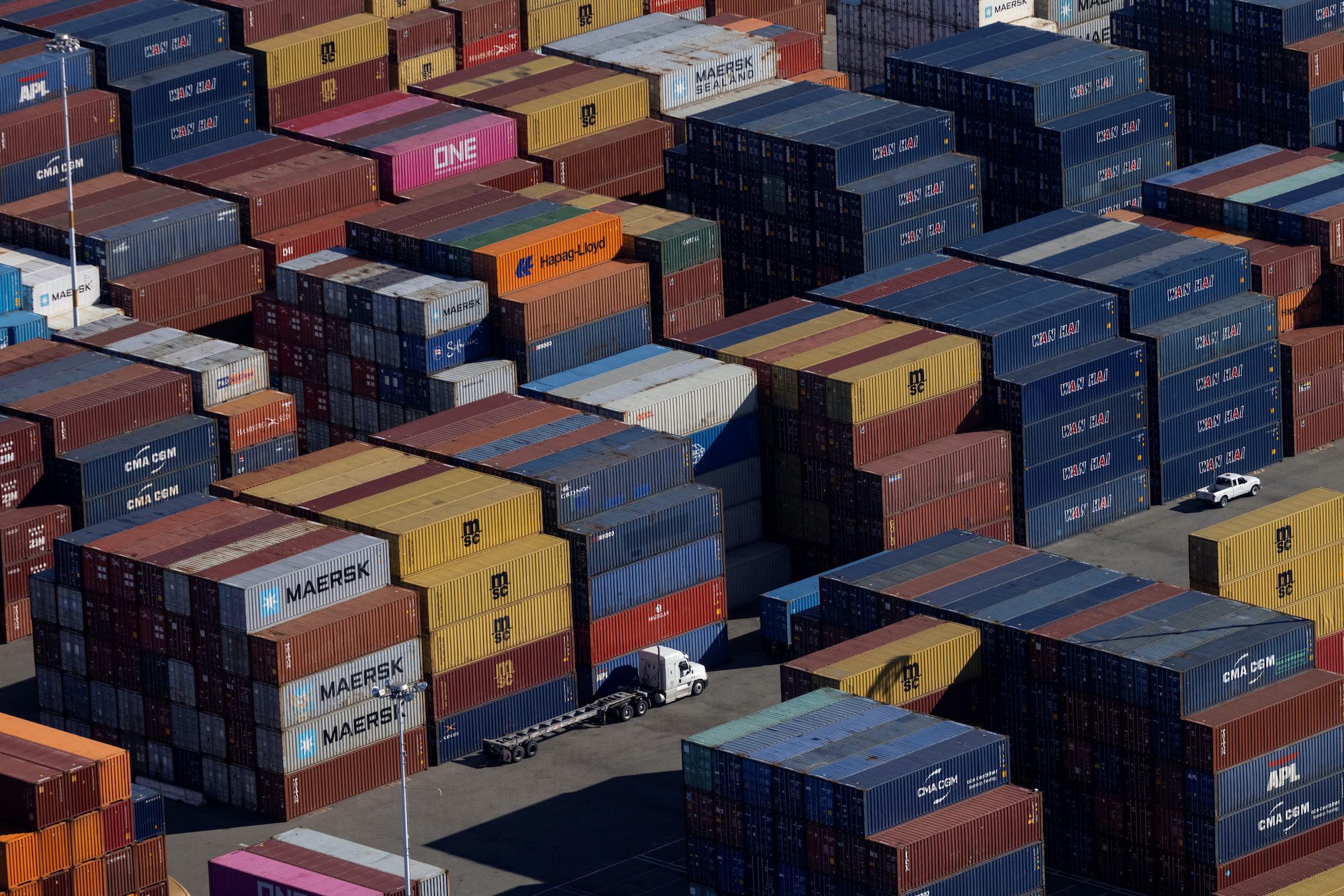

Of the 11 largest ocean carriers, CMA CGM led the pack in terms of profit with a net income $7.5 billion, at least according to McCown’s estimate because the privately-held company has yet to release its first quarter results. Maersk came in second, earning a net income $6.7 billion, which McCown also estimated as the company reports in terms EBITDA.

McCown says the blockbuster results, coming despite an overall 1.1% total decline in volumes compared to Q1 2021, are likely to drive “fundamental change” in future carrier behavior.

“The large majority of container move under contracts that are renewed throughout the year and have a one year or even longer term. This simple fact means that the improved results have a long tail even if supply/demand conditions change materially,” McCown writes.

The report also points that the industry’s strong financial performance has resulted in “unprecedented” new vessels orders, with the total industry orderbook now approaching a record level of almost 30% in terms of TEU capacify. Also, higher profits also make it likely that the ILWU will raise its economic demands in its negotiations with employers at U.S. West Coast ports, which are currently underway.

Due to uncertainty in the industry, McCown has maintained his initial profit forecast of $220.5 billion for the container shipping industry in 2022, noting: “For now, I’m not as confident of further improvement from this later point.” But he adds: “A key tool to watch that the industry has newfound appreciation for is blanking sailings. Look for that to be a key driver of the industry’s performance in 2022 and in the years beyond.”

As an interesting sidenote, according to McCown, the container shipping industry profits in the first quarter of 2022 beat out those of FANG—an acronym for Facebook, Amazon, Netflix and Google—by 103%, expanding the gap from last year’s fourth quarter when liner industry profits beat FANGs by 14%.

Join The Club

Join The Club