French shipping giant CMA CGM has posted impressive third-quarter results for 2024, reporting $15.8 billion in revenue—a notable 38.5% increase from Q3 2023—driven by strong demand in shipping combined with disruption on major trade routes.

The group’s EBITDA hit $5 billion with a margin of 31.4%, up 14 points from the same time last year.

“Our Group has delivered solid performances in the third quarter, with dynamic maritime activity and ongoing transformation within our logistics division,” said CEO Rodolphe Saadé. “We have adapted our offerings, invested in terminals, and made significant advances in artificial intelligence to enhance service quality.”

The strong performance was driven by several key factors, notably a strong peak shipping season fueled by demand for inventory restocking and anticipation of potential port strikes in the U.S. This uptick, coupled with slower inflation, saw global trade volumes rebound sharply from last year’s levels. During the third-quarter, CMA CGM moved 6 million TEUs, up 5.5% year-over-year.

Revenue from maritime shipping operations amounted $10.9 billion for the quarter, a 43.4% increase from the third quarter of 2023. EBITDA reached $4.4 billion, with an EBITDA margin of 40.2%. The average revenue per TEU stood at $1,798.

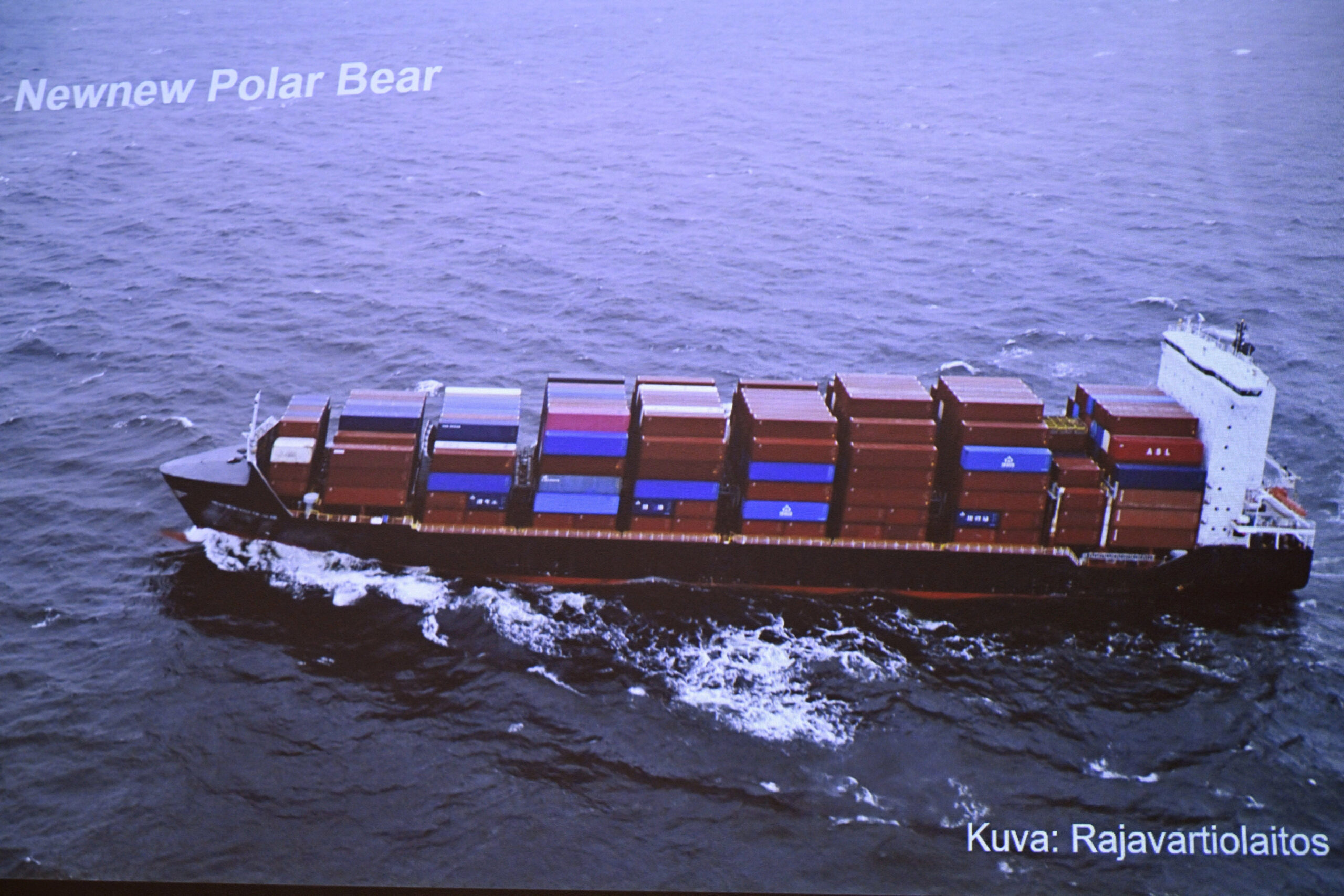

Red Sea Rerouting Adds Pressure

Ongoing geopolitical tensions continued to reroute vessels via the Cape of Good Hope, extending transit times and tightening available shipping capacity. CMA CGM responded by reallocating resources to keep goods flowing, despite the logistical strains these disruptions caused.

Strategic Investments in Logistics and AI Partnerships

CMA CGM solidified its logistics footprint with strategic acquisitions, including a 48% stake in Brazil’s Santos Brasil terminal operator and a joint venture between CEVA Logistics and Almajdouie Logistics in Saudi Arabia. Furthermore, CMA CGM’s acquisition of Bolloré Logistics has bolstered its logistics presence across South America and the Middle East.

As part of its decarbonization strategy, CMA CGM is also set to introduce 131 new vessels powered by low-carbon fuels by 2028, including twelve that entered service in the third quarter. Through a partnership with SUEZ, CMA CGM aims to produce up to 100,000 tons of biomethane annually by 2030. Additionally, a new partnership with Google is bringing artificial intelligence to the heart of CMA CGM’s operations, enhancing decision-making across maritime, logistics, and media functions.

Looking ahead, CMA CGM anticipates a challenging 2025, with macroeconomic trends, regulatory changes, and geopolitical issues potentially impacting maritime shipping and logistics.

“At the same time, new container shipping capacity will come into service. This may disrupt the balance between supply and demand and continue to hamper freight rates, in line with the recent trend,” CMA CGM said.

“The CMA CGM Group remains focused on cost control and operational discipline and will continue to invest in its industrial capabilities and terminals.”

Join The Club

Join The Club