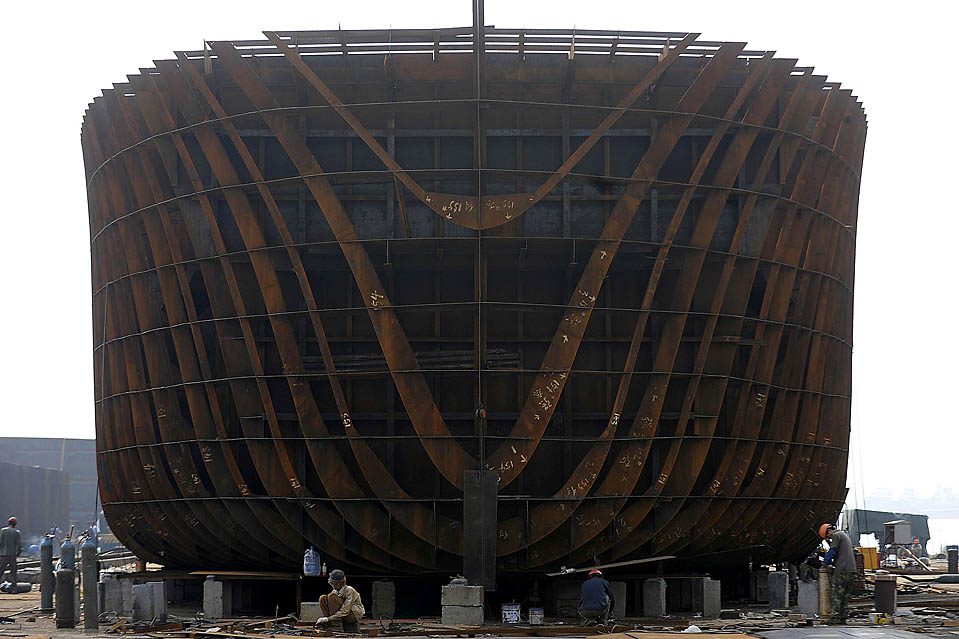

Employees work at a shipbuilding factory in Wuwei county, Anhui province, July 2, 2009. REUTERS/Jianan Yu

Aug. 12 (Bloomberg) — China grew into the world’s leading shipbuilder over the last decade as hundreds of private yards opened to compete with state-run companies. Now, the government is poised to regain control as the industry heads for consolidation.

The number of shipyards in China has swollen to 1,647, contributing to a global capacity glut. To stabilize the industry, one third to a half of the yards will probably have to disappear through acquisitions and closings, according to executives and analysts.

State-run companies are at an advantage because they have easier access to credit to pay workers, buy raw materials and provide financing for clients. China State Shipbuilding Corp., China Shipbuilding Industry Corp. and other government-backed companies won three-quarters of all orders in the first half of this year. Though state companies may buy some private yards, many will likely have to close since their capacity isn’t needed.

“It’s a lost cause for most of the private shipyards,” said Park Moo Hyun, an analyst at E*Trade Securities Korea in Seoul. “The government and even the banks seem to have given up on trying to save some of the troubled private shipyards. What innovations can they come up with when they can’t pay to keep their workers?”

Three-Year Plan

China’s State Council announced Aug. 4 a three-year plan for the industry that included control of capacity. Ship owners ordering China-made vessels, engines and some main parts should get better access to funds from financial institutions and some key companies will be allowed to issue corporate bonds, according to the State Council statement.

Last month, China Rongsheng Heavy Industries Group Holdings Ltd., the country’s biggest private shipyard, sought financial assistance after failing to win a single vessel order this year.

“China has realized it’s better to have a few big yards under its control and help them become more competitive than have too many,” said Park at E*Trade Securities. “The government is looking for quality now, not quantity.”

More than half of China’s yards will have to be wound down to cut capacity, according to Ren Yuanlin, chairman of Yangzijiang Shipbuilding Holdings Ltd., the country’s second- largest private vessel maker. Of the remainder, only 20 percent will be profitable, he said. China Association of the National Shipbuilding Industry said last month a third of the nation’s yards face the danger of closure in about five years after failing to win orders.

Idled Workers

“It’s very difficult to conduct mergers and acquisitions in the shipbuilding industry in the current market,” said Sarah Wang, an analyst at Masterlink Securities Corp. in Shanghai. “Big companies can’t win new orders. How would they be willing to do acquisitions?”

The State Council stepped in with its plan a month after Rongsheng said it had a first-half loss and sought government support. Some idled contract workers surrounded the entrance of its main factory in Jiangsu province, the company said July 3.

“Compared with shutting down of companies, mergers and acquisitions will less likely cause social unrest,” said Xu Minle, an analyst at Bank of China International Ltd.

Consolidation may help the government achieve a target that the nation’s top-ten yards should account for 70 percent of the total output by 2015. China also aims to have more than 50 brands of different types of ships in that period, according to a five-year plan released last year.

“Less Hope”

In comparison to that goal, the nation’s top-ten builders accounted for 48 percent of the total output in 2011, according to the latest available data from the industry group. Chinese yards had an order book of 218 million deadweight tons in 2008, overtaking South Korea as the world’s largest shipbuilding nation, according to Clarkson Plc.

“The Chinese government wants to support its big state- owned shipyards because they are strategically important,” said Kim Hong Gyun, an analyst at Dongbu Securities Co. in Seoul. “That means less hope for private yards.”

Global ship orders reached a peak in 2007, helped by China’s demand for raw materials. To support the yards, the government also provided low-cost financing for new vessels.

Yards in China won orders to make vessels with a capacity to carry 27.8 million deadweight tons, or 47 percent of global contracts, in the seven months through July, according to Clarkson, the world’s largest shipbroker. State-backed builders won almost three-quarters of those deals, helping the nation gain a 7.8 million-ton lead over South Korea.

China Vs South Korea

Chinese shipyards and related companies employed about 671,564 people in the country in 2012, down from 681,339 in the previous year, according to data provider Beijing Compass-info Consulting Co. Most of the builders are based in Yangtze River Delta, Pearl River Delta and northeastern China. South Korea has 138,248 people working at 65 shipyards, according to its Ministry of Trade, Industry & Energy.

China’s government hasn’t had much success in its efforts to encourage mergers and acquisitions in the steel industry, Wang at Masterlink said. Benxi Iron & Steel Group, owned by a provincial government, and Anshan Iron & Steel Group, controlled by the central government, failed in their bid to merge in 2010, at least five years after authorities initiated the process.

Shipbuilders should be confident as “the potential in the domestic market remains relatively large,” the State Council said. The government also pledged to study securitization of shipbuilders’ loans and authorities will encourage development of offshore engineering equipment such as drilling platforms and large LNG ships.

“Shutting down yards is a hard landing, while mergers and acquisitions is a soft landing,” said Li Yanqing, president of Shipbuilding Information Center of China.

– Jasmine Wang and Kyunghee Park, Copyright 2013 Bloomberg.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club