Major Cocaine Bust: UK Border Force Seizes Record Shipment at London Gateway

In one of the UK’s largest drug seizures of the past decade, UK Border Force officers have seized cocaine with an estimated street value of £96 million (USD 130 million)...

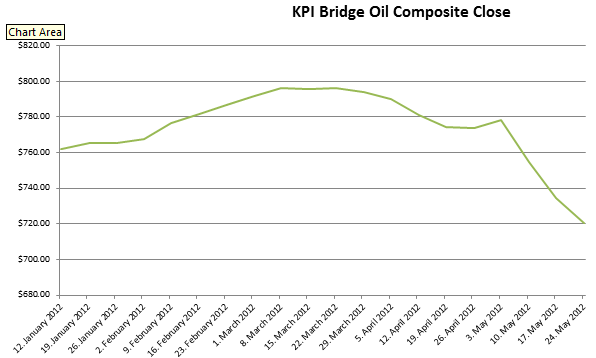

Stabilized-volatility would be the most accurate description of the oil markets this past week. Overall crude prices closed down only about $1 bbl this week; but we have seen them down several dollars at different stages throughout the week and during each trading day. While the KPI Bridge Oil Composite continues to go down, fuel oil and gas oil prices are just getting in line with the overall market trend of the last several weeks. It would not be unreasonable to expect bunker prices to stabilize next week barring any major change in the crude markets.

It is amazing to see how volatile operational costs have become for ship-owner’s and charterer’s. In this month alone, we have seen the KPI Bridge Oil Composite go down over $57 MT. For a vessel burning 20 MT per day that represents decrease of $1140 to daily operating costs. With changes like this, a spot charter can go from a winner to a loser quickly, and visa-verse.

With a short week next week, we should all prepare for a lot more volatility. Offices in the United States will be closes on Monday 28 May in observance of Memorial Day.

About the KPI Bridge Oil Composite

![]() The KPI Bridge Oil Composite is a calculated fuel number based on 14 ports strategically positioned worldwide. It is calculated on a weekly basis blending 90% fuel oil prices with 10% distillate prices. The idea behind the number is that it would represent actual fuel costs on a global basis and what vessels would consume on average. This number will not fluctuate as quickly as daily prices and can easily be hedged or used for voyage calculations.

The KPI Bridge Oil Composite is a calculated fuel number based on 14 ports strategically positioned worldwide. It is calculated on a weekly basis blending 90% fuel oil prices with 10% distillate prices. The idea behind the number is that it would represent actual fuel costs on a global basis and what vessels would consume on average. This number will not fluctuate as quickly as daily prices and can easily be hedged or used for voyage calculations.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up