By Will Wade and Jennifer A Dlouhy (Bloomberg) —

When President Joe Biden in 2021 laid out a target of deploying 30 gigawatts of offshore wind capacity during the next nine years, the plan was deemed bold and ambitious. Best of all, many saw it as within reach.

Two years later, the industry has another word for it: impossible.

After a cascading series of setbacks, from sobering cost revisions to billions in possible impairment charges, the US offshore wind industry’s 2030 generation goal now looks further away than ever.

BloombergNEF, which even early on had been dubious about the goal, has slowly been paring back its outlook. In June, the forecast was for 23.1 gigawatts in 2030. But then, the industry suffered another blow last week after New York forcefully rejected developers’ pleas for higher rates, raising serious questions about some of their projects. That prompted Atin Jain, senior wind analyst at BNEF, to slash his estimate by 29% on Wednesday. The researcher now expects total US capacity to reach just 16.4 gigawatts by the end of the decade — a little more than half of Biden’s target.

“The 30-gigawatt target is a pipe dream,” Jain said.

The big picture shows further unsettling in an industry viewed as key to meeting US climate commitments, including the country’s Paris Agreement pledge to at least halve greenhouse gas emissions from 2005 levels by the end of the decade. Offshore wind farms have the potential to supply vast amounts of power to big cities along US coasts, where more than 40% of the country’s population resides.

In an industry where weather puns run rampant, developers have called America’s challenging environment for offshore wind a “storm of inflation” battered by “headwinds.” Although the more than a dozen sites planned off the coast of the Eastern US made financial sense when they were first modeled years ago, costs for every component of the multi-billion-dollar projects have skyrocketed, from the raw materials that go into the towering structures to the corporate credit that finances them. Just two years ago, companies were making plans — and signing massive power purchase agreements — based on a projected cost of $77 per megawatt hour, BNEF calculates. Today, it’s jumped 48% to $114.

The White House isn’t deterred. Spokesperson Angelo Fernández Hernández said the administration “is using every legally available tool to advance American offshore wind opportunities and achieve the goal of 30 GW by 2030,” including approving major offshore wind projects and leveraging federal infrastructure investments to nurture a new domestic supply chain. Investments in the US offshore wind industry have increased by $7.7 billion since enactment of the Inflation Reduction Act last year, with more progress to come in collaboration with states, developers and other stakeholders, he said.

Still, as the price of construction climbs, developers are rapidly backpedaling on their plans or asking to re-negotiate their deals. Equinor ASA, BP Plc, Orsted A/S and Eversource Energy were the most recent developers to hear “no.” The companies had asked New York state to let them raise their rates, a request that the New York Public Service Commission unanimously denied on Oct. 12, leaving the developers at a loss for how best to move forward.

“These projects must be financially sustainable to proceed,” Molly Morris, president of Equinor Renewables Americas, said following the ruling, referring to its Empire and Beacon wind farms being developed with BP. David Hardy, chief executive officer for the Americas at Orsted, said the viability of the Sunrise project it’s co-developing with Eversource east of Long Island was “extremely challenged” due to the state’s decision.

In total, developers building about 9 gigawatts of capacity for five East Coast states have sought to renegotiate deals. That’s in addition to the more than 3 gigawatts of power contracts that have been outright canceled in recent months — at great cost. In July, Avangrid Inc. agreed to pay around $48 million in fines to get out of its deal to supply power to three utilities from its Commonwealth project off the coast of Massachusetts. The next month, a Shell Plc unit and its joint-venture partners agreed to pay more than $60 million to exit their own deals. In October, Avangrid agreed to pay $16 million to terminate contracts for its Park City project near Connecticut. Companies may participate in a new round of auctions, though whether the developers can square their costs with households’ needs remains to be seen.

Companies have also taken massive write-downs. Eversource reported a $331 million after-tax impairment charge in the second quarter for its offshore wind operations, while Orsted announced a potential $2.3 billion charge on its US portfolio.

Six governors have implored Biden to “utilize every federal tool available” to keep offshore wind projects competitive, warning that without interventions from the US government, “offshore wind deployment in the US is at serious risk of stalling.”

States aren’t the only ones under pressure to renegotiate power purchase agreements that were inked before a runup in costs.

Developers have also been asking for the maximum tax policy support possible under last year’s sweeping climate law. The Inflation Reduction Act expanded tax credits so offshore wind power projects generally can claim a base rate of 30% and, in some cases, get bonus incentives for using US-sourced materials and building in so-called energy communities, such as former coal towns. Now, some offshore wind developers see those bonus credits — worth as much as 20% — as key to survival. Without more help, Orsted has threatened to “walk away” from some of its US offshore wind projects.

Biden’s 30-gigawatt target “was once an ambitious goal,” said Timothy Fox, an analyst at ClearView Energy Partners. “Now, it’s a not-going-to-happen goal.”

Still, Biden’s goal was always a non-binding target primarily meant to signal the administration’s enthusiastic support for a nascent offshore wind industry that depends on permit approvals, lease sales and other actions in the nation’s capital. In that sense, “it may have served its purpose,” Fox said, adding that the point was to send “an indication that you have friends in this administration, you have people who support your industry and what you’re trying to develop.”

And, even if Biden were to win a second term, the 2030 target would fall beyond his time in office.

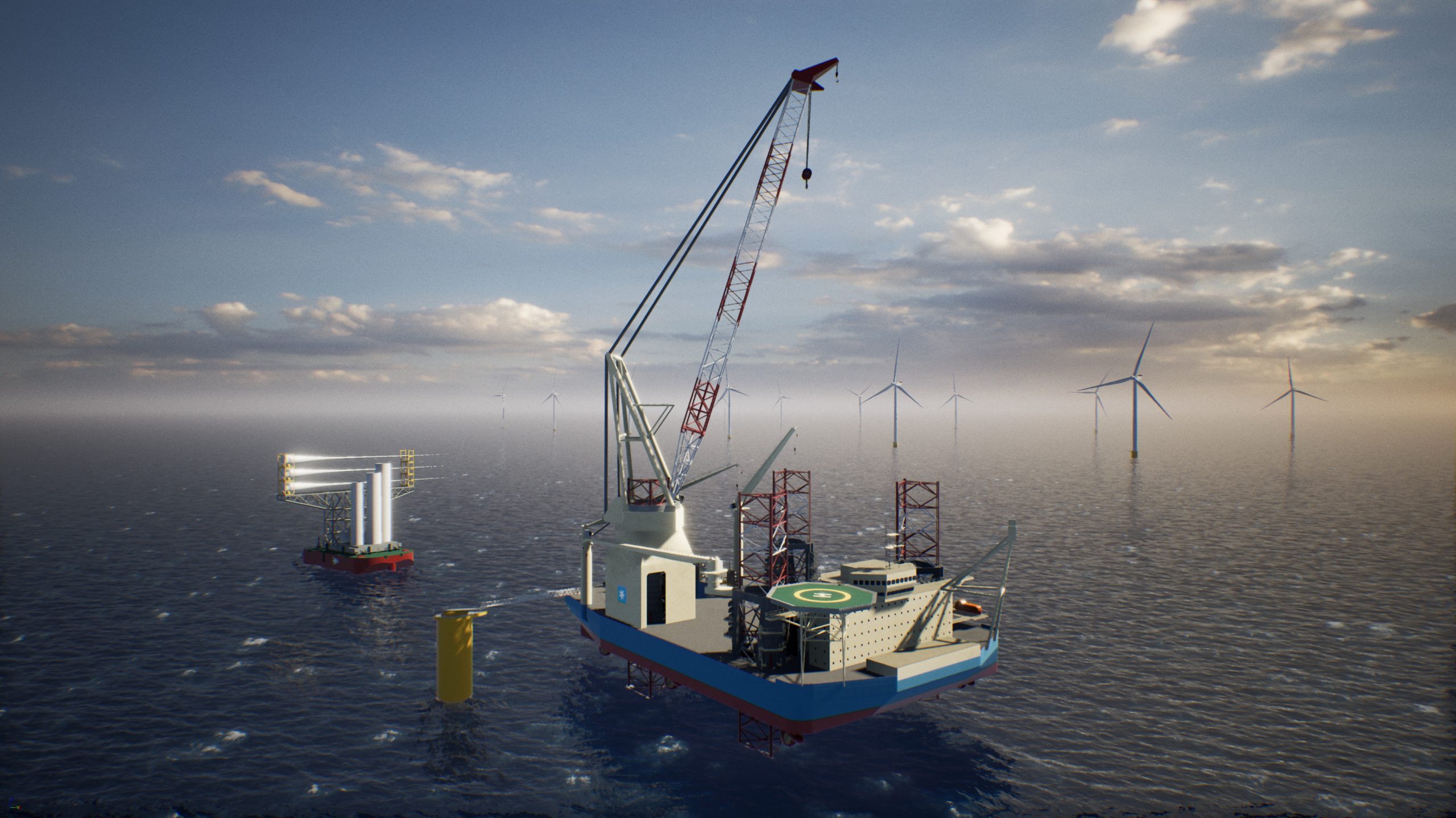

There are two offshore projects already under construction in the US, which were able to line up supply deals before inflation drove up costs. Two others have been operational for years: Dominion Energy Inc.’s pilot off the coast of Virginia and Orsted’s five-turbine project near Block Island, Rhode Island. Together, those four projects would get the US to less than 5% of its 2030 goal.

It’s unclear when the others might come online, though most agree they probably still will. Wind farms that may have once been on track to deliver power by the end of the decade are now more likely to connect to the grid in the early 2030s, BNEF’s Jain said.

“It’s not that it’s not going to happen. It’s just not going to happen as fast as they initially anticipated,” said Fox of ClearView Energy. “Offshore wind has a lot of growth potential in the United States; it’s just likely to be on a trajectory that is flatter than what was initially anticipated.”

© 2023 Bloomberg L.P.

Join The Club

Join The Club