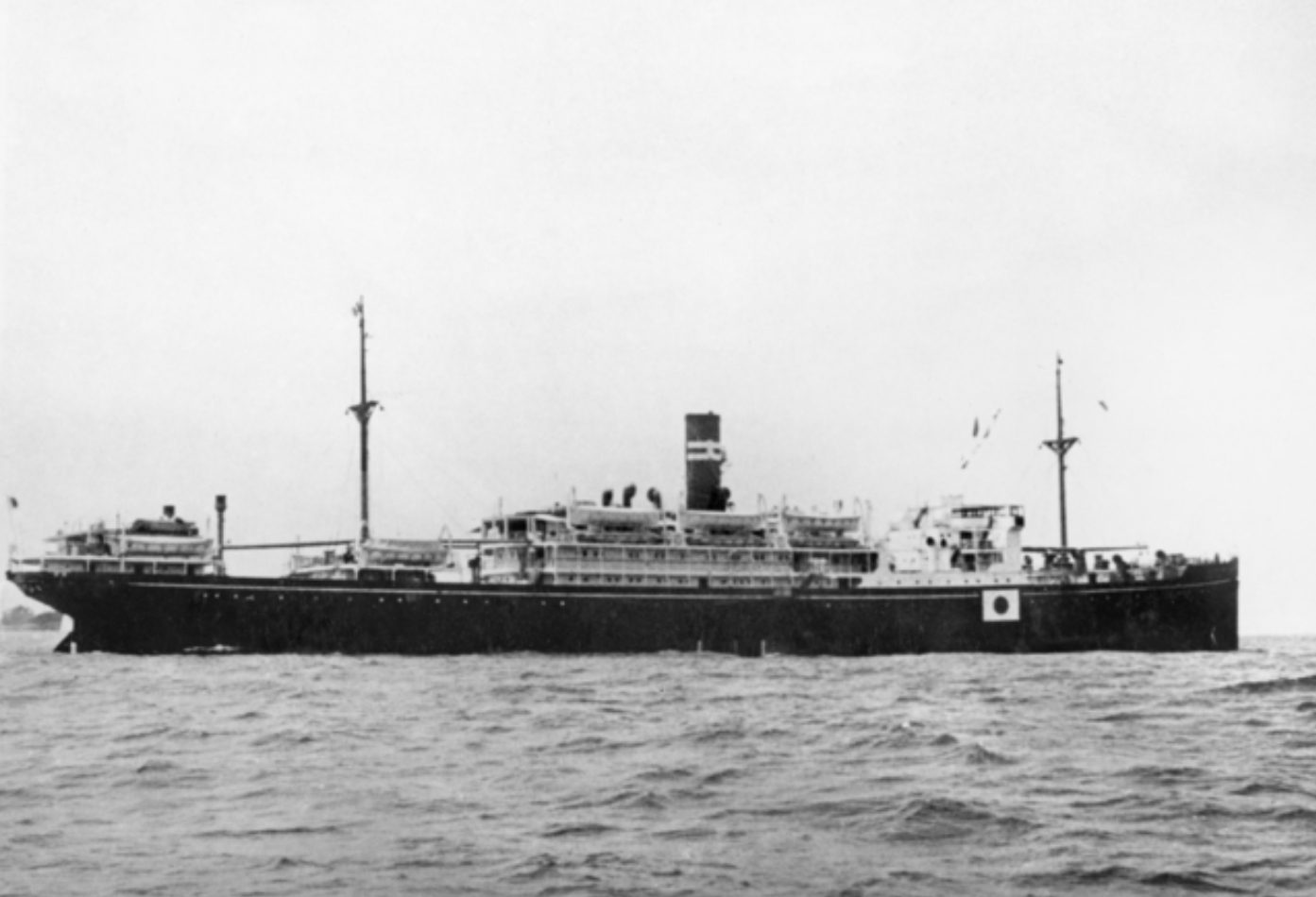

Shell’s Prelude FLNG loads gas from a conventional-sized tanker during systems tests. Photo: Shell Australia

By Stephen Stapczynski (Bloomberg) –Australia started the last in a $200 billion wave of natural gas mega-projects, setting it on course to become world’s top exporter of the fuel.

Royal Dutch Shell Plc said Tuesday its Prelude floating liquefied natural gas terminal offshore northern Australia shipped its first cargo. It’s the eighth Australian plant to start since 2012 by global giants including Chevron Corp. and Exxon Mobil Corp, as well as regional players Woodside Petroleum Ltd. and Malaysia’s Petronas. Their rapid succession has helped the Pacific nation rival Qatar as the world’s biggest seller of the fuel in less than a decade.

“The completion of Prelude marks the end of the Australian greenfield LNG boom,” Daniel Toleman, an analyst at Wood Mackenzie Ltd., said by email. “With Prelude onstream, Australia is on track to export more than 80 million tons per year of LNG, which surpasses Qatar as the largest LNG producer in the world.”

Utilization rates at Australian facilities would need to rise to secure the top seller spot, and even then its dominance may likely be short lived. The U.S. is poised to overtake both Australia and Qatar as the world’s top exporter by 2024, according to the International Energy Agency. Qatar is also planning to soon make final investment decisions on four new trains that will start in mid-2020s, boosting its annual export capacity by 33 million tons as soon as 2024, according to BloombergNEF.

Floating Giant

When fully operational, Prelude will be able to produce 3.6 million tons of LNG annually, as well as 400,000 tons a year of liquefied petroleum gas and 36,000 barrels a day of condensate. Prelude is also the largest floating offshore facility in the world, weighing six times more than the largest aircraft carrier and longer than four soccer fields, according to Shell. The company declined to provide a figure for the project’s total cost, which Wood Mackenzie estimates at $17 billion.

“How fast Prelude delivers its second and third cargo, and ramps up to plateau output will be a key indicator of success,” said Wood Mackenzie’s Toleman. Shell will be keen to ramp up to full production quickly to counteract any reserves impact from the nearby Inpex Corp.-operated Ichthys LNG, which started last year and shares a gas reservoir called Brewster, he said.

Shell’s Prelude partners include Korea Gas Corp. and Taiwan’s Overseas Petroleum & Investment Corp., as well as Inpex. The maiden shipment is being delivered by the Valencia Knutsen vessel to customers in Asia, Shell said.

Despite the end of the building boom, investment in Australia’s gas industry will continue. Developers are now eyeing resources that can fill existing projects, including Scarborough, Barossa, Browse, Arrow and Crux, according to Wood Mackenzie’s Toleman.

“The next investment cycle is already in sight,” he said.

–With assistance from Dan Murtaugh.

© 2019 Bloomberg L.P.

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Bloomberg, published under license.

Join The Club

Join The Club