By Sanjeev Rana, Deutsche Bank

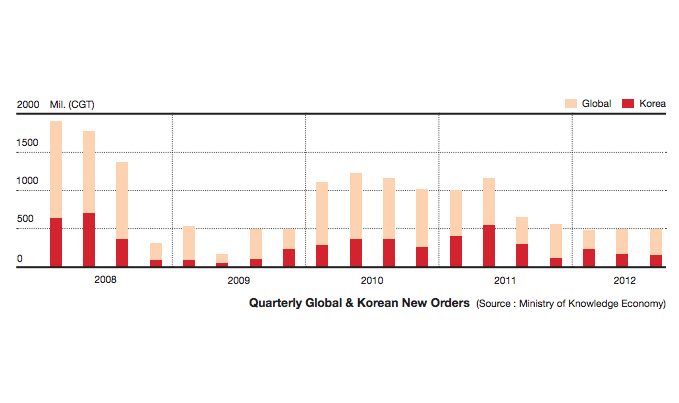

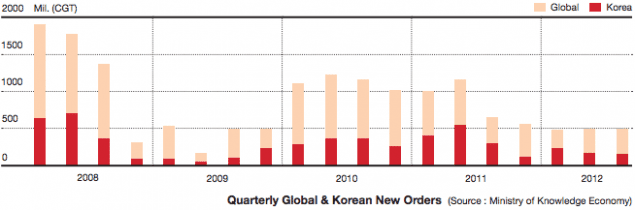

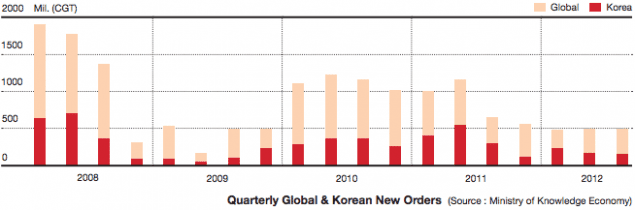

Global Shipbuilding Downturn Continues

Global shipbuilding industry has been going through a downturn for the last four years. The downturn has been felt more in the commercial shipbuilding industry where demand tends to be driven by fixed asset investments and growth in global trade. Global commercial ship orders were down 48% YoY in the first nine months of 2012 and order backlog fell to half of the level in first half of 2008. At this point all lead sector indicators such as freight rates, ship prices, used ship transactions, and used ship prices suggest that commercial shipbuilding demand is unlikely to recover much in 2013 as the sector continues to suffer from oversupply, a weak financing market, and low freight rates. Nevertheless, strength in selective segments such as LNG and offshore should continue to support order flow at big Korean yards although a sustained recovery might take some more time.

Shipowners Still Hesitant to Place Orders

Ship prices have fallen 35-40% from the peak and the Clarkson newbuilding price index (down 8% this year) is now back to levels seen in early 2004. The continued weakness in freight rates, financial markets, declining ship prices, and expectations of further fuel efficiency improvements for “ecoships” have customers waiting on the sidelines as far as placing new orders is concerned. By ship type we expect demand for tankers and bulk carriers to take 1-2 years to show a meaningful recovery whereas containerships and LNG carriers, where demand and supply balance is slightly more favorable, could see modest recovery in 2013.

Big Korean Yards Faring Better Than Small Ones Thanks to Offshore Orders

Despite ongoing problems in commercial shipbuilding, the big three Korean shipyards have done relatively well with Hyundai Heavy, Samsung Heavy, and DSME achieving between 50% and 95% of their 2012 yearly order targets driven by strength in offshore rig and platform orders. Offshore orders accounted for 60% (USD 32.5 billion) of global investment in the shipbuilding sector in the first nine months of this year driven by relatively high oil prices and daily rental rate for rigs. Korean shipyards, with their strong engineering skills and long expertise in building such platforms, were key beneficiaries of offshore orders. In 2013, these shipyards expect orders for offshore production platforms and rigs to support order recovery although there is a chance that some orders/projects might get delayed because of political or technical issues.

Sector Consolidation and Restructuring to Continue

For the small shipyards in Korea, China, and Japan the painful industry restructuring that started in 2010 is expected to continue as shipyards struggle with lack of orders and tight financing. Despite very low ship prices, shipowners expect prices to fall further due to competition among yards as 45% of global shipyards have no orders to work on post-2012. This means finances of small shipyards are likely to deteriorate further and banks might be unwilling to issue refund guarantees to them, starting a negative feedback cycle. According to Clarkson, the number of active yards globally has declined 44% in the last four years, but further consolidation is needed before any meaningful recovery in ship prices can begin. Although this restructuring process is likely to be very painful for the players involved it will also pave the way for the eventual recovery and surviving shipyards are expected to enjoy better operating environment in the later part of this decade.

The writer is an analyst at Deutsche Bank. The views expressed in this article reflect the author’s personal opinion. Republished via HHI’s New Horizons

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club