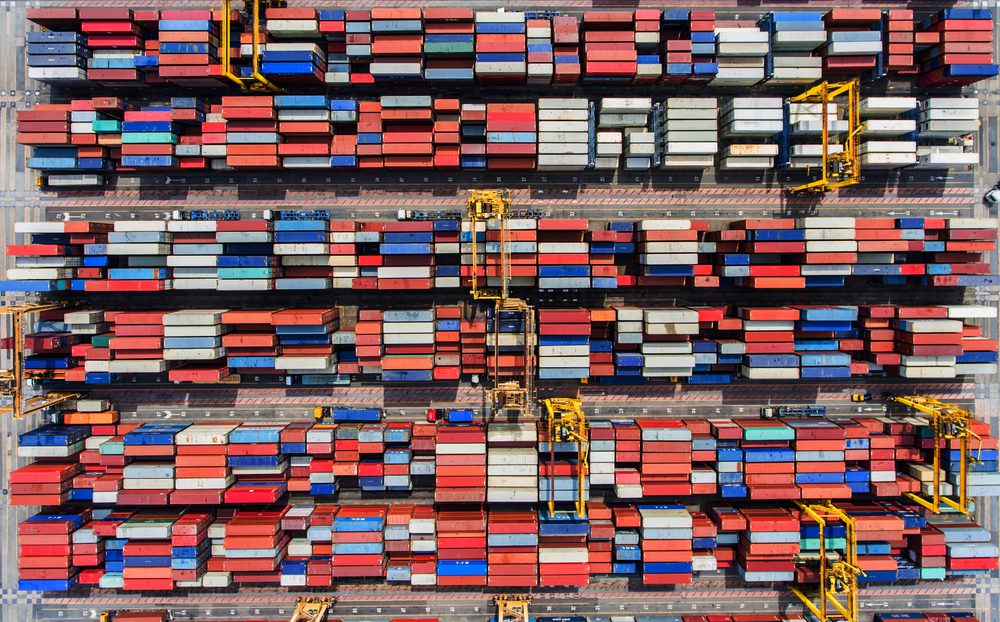

Photo: MAGNIFIER / Shutterstock.com

By Gavin van Marle (The Loadstar) – Predictions that the current crop of disruptive digital start-ups will revolutionize container shipping has been disputed by a leading liner analyst.

Alphaliner this week suggested that, despite the considerable hype and hundreds of millions of dollars raised by freight and logistics start-ups in Silicon Valley and elsewhere, evidence suggests that the container shipping industry is peculiarly resistant to being radically transformed.

“Since the first generation of shipping portals was launched in 2000, the container shipping market has not seen any transformative change in the way business is conducted,” it said.

“The three main multi-carrier shipping platforms, INTTRA, GT Nexus and CargoSmart, provide only basic software service solutions to handle cargo bookings, shipping instructions, track and trace and exception management and reporting.”

It added that attempts by carriers to create freight e-commerce platforms and marketplaces had “flopped”, while the partnership between Chinese e-commerce platform Alibaba with a number of carriers since last year “have generated very little volumes, despite the initial fanfare”. And a logistics cooperation with China Shipping was launched in 2014, but was “silent within its first year”.

Alphaliner further argued that the award of an NVOCC license to Amazon to book freight on the China-US transpacific route triggered “a stream of speculations on how Amazon could potentially revolutionize the shipping industry”.

But, it said: “More than a year after Amazon’s entry, its actual shipping volumes remain very small and the company has failed to produce any disruptive breakthroughs in the shipping market.”

However, investors and tech analysts alike have put their money behind a slew of projects, while bankers have eagerly arranged huge loans for would-be acquirers to consolidate their position in the sector.

Alphaliner calculates that since 2010 container shipping-related start-ups have raised over $500m from investors, including an increasingly familiar line-up of names – Flexport, Freightos, Haven, iContainers. Xeneta, NYSHEX, Clearmetal, Kontainers, Traxens and Cargobase among them – “while transactions involving shipping-related technology buy-outs have exceeded $1bn, led by Infor’s acquisition of GT Nexus in 2015, which valued the company at $675m”.

However, it also argued that none of these start-ups, while much better funded than tech companies from the previous two decades, were able properly to meet the challenges that the face the industry as a whole.

“Each of these new initiatives addresses specific challenges in the supply chain, but overall they remain fragmented and lack the ability to integrate all relevant processes.

“Even within their individual focus markets, actual demand appears to be overstated, and the industry’s poor track record of embracing change could undo most of the promised benefits these new digital initiatives are supposed to deliver.”

Alphaliner added: “There is a need to avoid the hype that some of these new technology providers for container shipping are trying to advance and examine more closely the practical challenges they will inevitably face.”

The future of container shipping has become hotly debated at industry events and in publications such as The Loadstar, and insiders say what the Alphaliner analysis fails to appreciate is that “the history of social and commercial revolutions rarely take place as a result of one specific initiative or incident, but more often due to a ‘paradigm shift’ as described by philosopher Thomas Kuhn“.

And if container shipping were to change in this way, it is the glaring inefficiencies inherent in the industry that will force that change, even if it is in incremental steps, because there are simply so many cost savings that could be achieved by automating a host of processes, it has been argued.

But Alphaliner countered: “About half of all bookings for container shipments continue to be made manually, while up to a third of shipping invoices are reported to contain errors, despite the introduction of e-commerce capabilities by shipping lines more than 15 years ago.”

Indeed, a white paper by SWG, which has created a freight audit platform for shippers and forwarders, finds that just 17% of invoices issued in the freight industry are correct, with the remaining 83% of inaccurate invoices resulting in the overcharging of freight costs by 2-6%.

SWG founder Steve Walker said: “I really do think that away from the headlines there is a lot of work going on to improve the industry through introducing automated processes – but it is also the case that anyone who thinks they have split the freight atom is clearly misguided.”

The Loadstar is fast becoming known at the highest levels of logistics and supply chain management as one of the best sources of influential analysis and commentary.

Check them out at TheLoadstar.co.uk, or find them on Facebook and Twitter.

Join The Club

Join The Club