Image (c) Rob Almeida/gCaptain, click for larger

The five-story-tall valve that failed to stop the biggest offshore U.S. oil spill is heading toward a $4.5 billion surge in orders as deep-water oil explorers seek to minimize costs on the world’s most expensive drilling rigs.

Cameron International Corp. and National Oilwell Varco Inc., the two top makers of blow-out preventers, are racing to meet the biggest wave of investment in the 90-year history of the 400-ton fail-safe device that attaches to the well head on the ocean floor. The surge comes as growing demand for deep- water rigs has spurred record rental rates and safety concerns put greater emphasis on time-consuming maintenance.

Blow-out preventers, known as BOPs, are used by oil companies as insurance against explosive blow-outs such as the one that destroyed BP Plc’s Macondo well in the Gulf of Mexico two years ago. Some drillers have begun doubling up on the $45 million machinery to minimize maintenance delays and shorten drilling time for the most modern rigs that can cost more than $600,000 a day.

“If you’re shaving four days off of each well, that may be several hundred thousand dollars a day” in savings, Clay Williams, chief financial officer at Houston-based National Oilwell Varco said in a telephone interview.

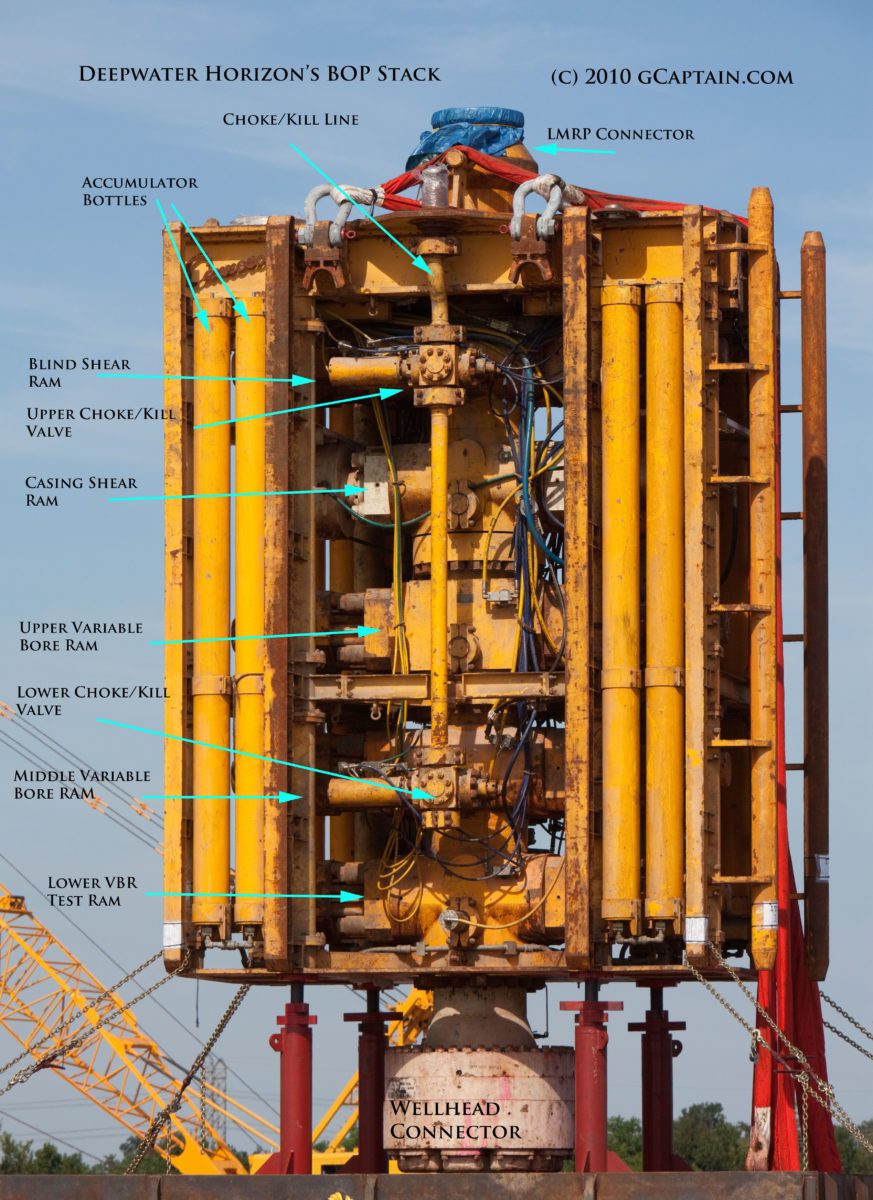

Blow-out preventers monitor pressure levels during drilling, and are designed to pinch off the well in the case of an uncontrolled blast of oil or gas. The device used on BP’s Macondo well in 2010 failed to work after being jammed by drill pipe in an explosion that sunk the rig and forced BP to set aside $38 billion to cover oil spill costs.

Stack of Valves

Equipment makers redesigned and improved the complex stack of valves and gauges as U.S. regulators cracked down on safety guidelines after the disaster. The incident also hammered home the need for more diligent repair and maintenance regimes, which typically mean stopping drilling to haul the BOP to the surface for work that can take several days.

The expanding search for oil is sending explorers into offshore waters where they require the newest rigs engineered to handle greater depths, higher pressures and more extreme temperatures. A total of 88 deep-water rigs are expected to be delivered between 2013 and 2019, the fattest pipeline of orders since the advent of deep-water drilling in the 1970s, according to IHS Petrodata. That compares to 39 rigs ordered from 2003 to 2009.

Device Swap

Each new rig will require a new blowout preventer — most provided by National Oilwell and Cameron and General Electric Co.’s Hydril Pressure Control unit — and as many as half of the new rigs will get a second device. The backup valve can be immediately lowered to replace the one brought up for maintenance, allowing drilling to continue.

“It’s kind of becoming a new standard,” Suzanne Spera, a spokeswoman for driller Rowan Companies Plc, said in a telephone interview. “We felt it was something our customers liked, given the increased demand for safety and decreasing risk tolerance by regulators and operators in general.”

All three of Rowan’s new rigs under construction will feature dual blowout preventers on board the drillships. Doubling up on BOP’s may allow the rig operator to charge a higher premium, she said. Rowan recently announced a three-year lease for one of its new rigs with dual BOPs to producer Repsol SA at a rate of about $624,000 a day, one of the highest rates ever.

Share Performance

Cameron’s shares have gained about 19 percent in the past year, while National Oilwell is up 21 percent in the period. Those beat the 10 percent average increase in a 16-member group of oil and gas services providers. Cameron fell 0.5 percent to $51.70 at 10:07 a.m. in New York. National Oilwell fell 0.2 percent to $76.84.

Other rig contractors, including Seadrill Ltd. and Diamond Offshore Drilling Inc., are putting backup BOPs on more than one of their rigs, while Noble Corp. is designing its new rigs to hold the extra equipment if customers request it. Anadarko Petroleum Corp. recently signed a contract to rent one of Noble’s new rigs with a second BOP onboard.

Manufacturers are about halfway through a roughly two-year surge in orders for the machinery that may amount to as much as $4.5 billion, including about $1.5 billion for double-orders if half of those rigs want spares, according to estimates by James C. West, an analyst at Barclays Capital in New York. Those double orders would mean about 29 cents per share in extra profit for Cameron and 21 cents for National Oilwell Varco, he calculates.

Earnings Gains

“We hope that everyone orders two,” Jack Moore, chief executive officer at Cameron, told analysts and investors on April 26. “I mean, we’d be happy if they ordered three.”

Cameron is expected to boost earnings 54 percent this year to $3.22 a share while National Oilwell is expected to grow net income 26 percent to $5.91 a share, according to average analyst estimates compiled by Bloomberg.

The number of new rigs requesting a second BOP may be closer to 25 to 30 percent, said Brian Uhlmer, an analyst at Global Hunter Securities LLC in Houston.

Lost drilling time for BOP maintenance cuts into rig owners’ operating profits by raising costs and reducing revenues, as producers aren’t always charged during downtime, Uhlmer said.

Transocean’s adjusted pretax operating profit margin dropped to 9.7 percent last year from 22 percent a year earlier as annual operating and maintenance expenses climbed 37 percent in 2011. Noble’s operating margin was almost cut in half to 18.2 percent in the same period.

Limiting Downtime

“Everyone’s trying to limit subsea downtime,” Luke Lemoine, an analyst at Capital One Southcoast in New Orleans said in a telephone interview. “That was the thing that plagued a lot of contractors in 2011.”

Older rigs may be another source of new business for BOP makers. Most of the world’s existing rigs weren’t built to hold a second BOP, which can weigh about 800,000 pounds, National Oilwell Varco’s Williams said. As older deep-water rigs come back to the shipyard for major servicing every five years, some may be upgraded to accommodate a backup BOP. Or an old device may be swapped out for a newer one, he said.

Cameron and National Oilwell Varco also are seeing more requests from rig operators who want to use the original manufacturers to service their equipment. That so-called after- market business could represent $1 billion a year in sales for Cameron alone, Barclays’ West said.

Under Review

Rig operators are still assessing the value of having a backup blowout preventer on each rig, David Williams, chief executive officer at Noble, said July 19 on a conference call with analysts.

“You may or may not be able to fully utilize all the benefits of it all the time,” the Noble CEO said.

National Oilwell had the greatest market share of BOPs sold for deep-water rigs in 2011 with 44 percent, West wrote in a May 10 note to investors. Cameron was second with 31 percent, followed by Hydril with 25 percent.

National Oilwell Varco opened a research and development office in Houston about a year ago dedicated to improving blowout preventers. The facility, with 13 test bays, can research the effects of the safety equipment in harsh environments.

$100 Million Investment

Cameron will invest roughly $100 million this year to improve its after-market business for blowout preventers, which includes recertifying blowout preventers, as required by federal regulators, and continuously servicing them as they get older.

“A lot of stuff has shown up at our door that we have not seen in years, so it is taking us a while to work through it,” Charles Sledge, chief financial officer at Cameron, said Feb. 2. “It certainly is a good business and one that requires a lot of investment on our part.”

– David Wethe, Copyright 2012 Bloomberg

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club