The Port of Vancouver has reported unprecedented trade volumes in the first half of 2025, moving more than 85 million metric tonnes (MMT) of cargo between January and June. This represents a 13% increase compared to the same period last year, highlighting the port’s growing importance as a gateway for Canadian exports seeking markets beyond traditional U.S. trade routes.

Port of Vancouver terminals handled nearly 20% more international trade than the previous year, with particularly strong performance in exports of Canadian crude, canola oil, grain, potash, and coal to global markets. This surge comes at a time when geopolitical tensions have disrupted traditional trade patterns worldwide.

“Canadians and their businesses depend on the Port of Vancouver to buy and sell the products they manufacture, farm, mine and stock their shelves with,” said Peter Xotta, President and CEO of the Vancouver Fraser Port Authority. “As Canadians navigate a moment in time like no other, I want to acknowledge the port community and our supply chain partners for rising to the occasion and moving record trade volumes so far this year.”

Already Canada’s largest and most diversified port, Vancouver connects the country with more than 170 global economies and handles as much cargo as Canada’s next five largest ports combined. Over 80% of trade through the Port of Vancouver involves countries other than the United States, positioning it as a critical asset as Canadian businesses seek to diversify their export markets.

Crude oil exports saw the most dramatic increase, surging 365% to almost 12 MMT following the completion of Trans Mountain’s expanded pipeline and terminal that came into operation in May 2024. Approximately 60% of these volumes went to China, while markets including the U.S., South Korea, Singapore, and Japan all surpassed their full-year 2024 volumes in just the first half of 2025.

Canadian agricultural exports also showed particular strength. Canola oil exports increased 72% to 0.7 MMT in the first six months of 2025, with the port successfully connecting producers with new overseas markets to offset lower demand from traditional buyers like the U.S. and China. Export destinations expanded from just four countries in 2024 to twelve in the first half of 2025, including new and returning markets in Belgium, Malaysia, and Mexico.

Grain exports grew by 8% to reach their second-highest half-year volumes on record, with wheat up 16% and canola seed up 12%. The port saw increased shipments of canola seed to Japan, while new markets including Mexico, Netherlands, France, Bangladesh, and Bulgaria helped counterbalance the impact of Chinese tariffs.

Fertilizer exports were similarly strong, with potash up 26% to reach its second-highest half-year result on record, while sulphur exports increased by 5%. Coal exports saw a slight decrease of 2%.

“We’re using new tech and tools to facilitate thousands of ship movements a year—allowing us to improve visibility in how goods are moving through the port, better coordinate with supply chain partners and add capacity,” said Xotta.

The port’s Active Vessel Traffic Management Program has been crucial in smoothly integrating Trans Mountain’s expanded volumes while also enabling CN to increase rail service to the busy North Shore trade area by 10%.

Containerized trade through the port remained strong despite global uncertainties, with 1.88 million twenty-foot equivalent units (TEUs) moved by mid-2025, representing 6% growth driven largely by Canadian trade. This was the second-highest volume of containers moved at mid-year, just behind the 2021 record of 1.94 million TEUs.

“Containerized trade—like the Canadian economy—has shown remarkable strength and resilience so far this year in the face of U.S. tariffs and global uncertainty,” said Xotta.

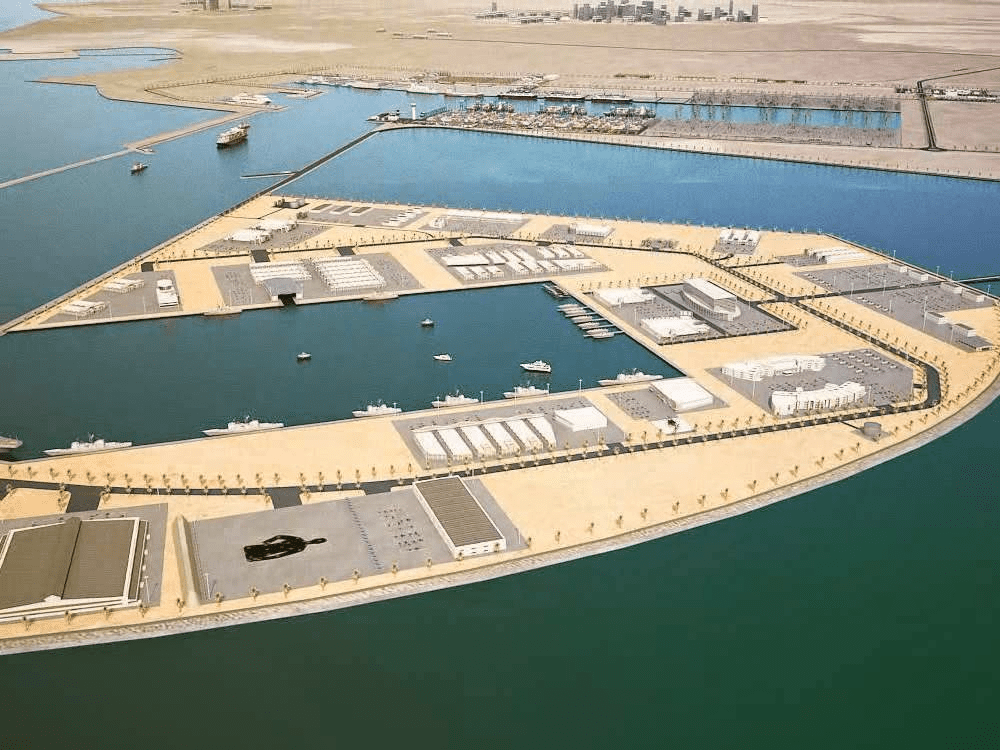

To accommodate future growth, the port is advancing toward a final investment decision on the Roberts Bank Terminal 2 project, which would unlock an additional $100 billion a year in West Coast trade capacity.

While bulk and container cargo saw increases, some sectors experienced slight declines. The port’s cruise sector recorded just over 130 cruise ship calls and 500,000 passenger visits between March and June—down from 2024’s record-breaking year but still strong. According to a 2024 Economic Impact Study, each cruise ship visit to Canada Place injects approximately $3 million into the local economy.

Auto volumes also eased by 3% to 241,000 units, though this still represents the third-highest volume for the port. Nearly 100% of Canada’s Asian-manufactured vehicle imports arrive via the Port of Vancouver. The recently completed optimization of the Annacis Auto Terminal has increased its capacity by one-third.

The port authority continues to work with industry and government on numerous infrastructure investments to boost reliability and capacity. In addition to Roberts Bank Terminal 2, projects include dredging near Second Narrows to improve shipping efficiency in Burrard Inlet, construction of the Holdom overpass in Burnaby to enhance rail service, and expansion of the Active Vessel Traffic Management system to the Fraser River and Roberts Bank trade areas.

Other significant recent developments include DP World Fraser Surrey’s new facility capable of exporting approximately 1 MMT of canola oil annually, upgrades to Westshore terminal to export 4.5 MMT of potash annually, and the Centerm Expansion Project which boosted capacity at DP World Vancouver terminal by more than 60% to 1.5 million TEU.

The Port of Vancouver’s performance in the first half of 2025 demonstrates its growing strategic importance to Canada’s economy as the nation diversifies its trade relationships beyond North America amid shifting global trade patterns.

Join The Club

Join The Club