The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has designated Iranian LPG magnate Seyed Asadoollah Emamjomeh and his extensive corporate network for shipping hundreds of millions of dollars worth of Iranian LPG and crude oil to foreign markets.

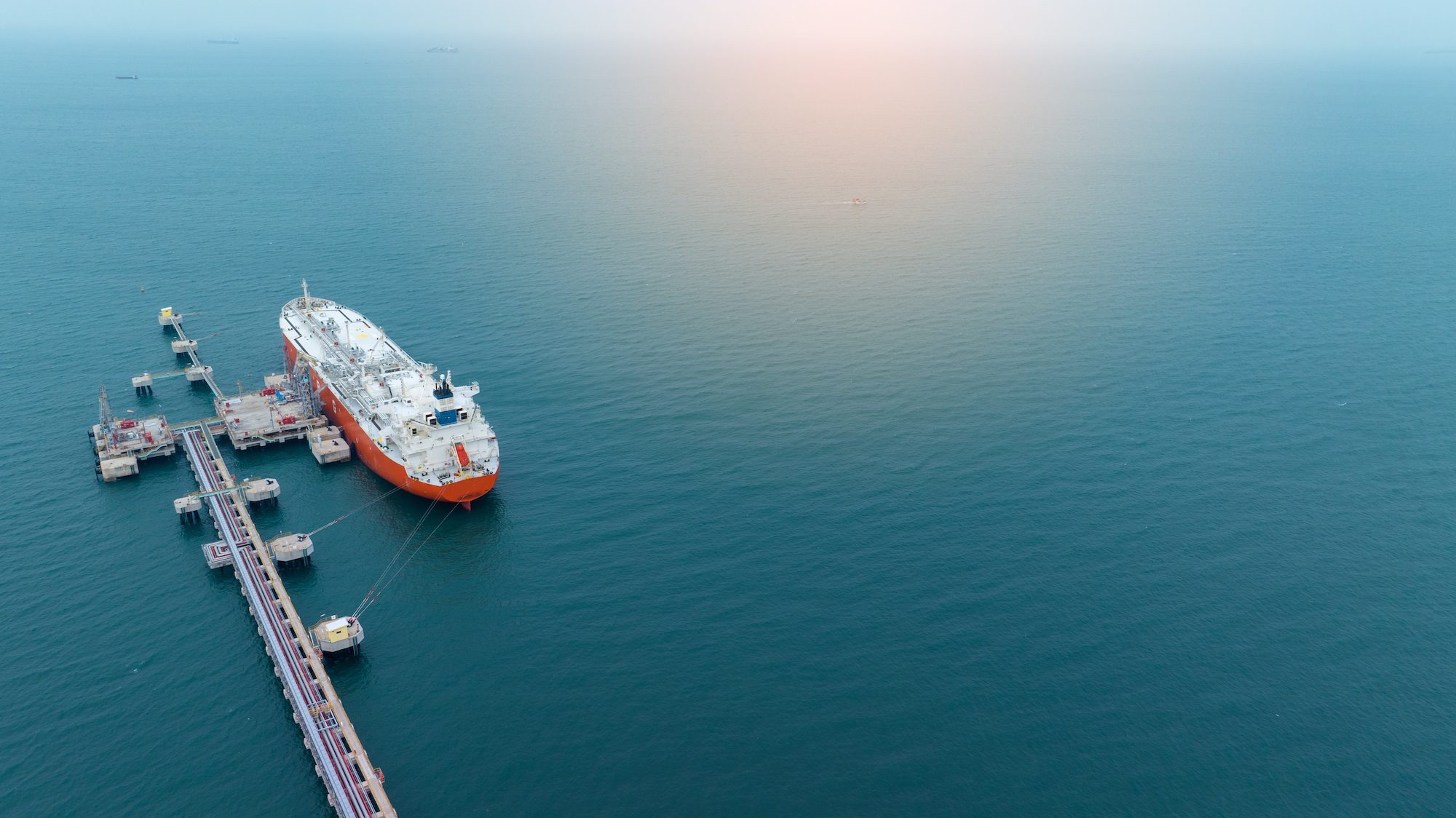

At the center of this enforcement action is the Very Large Gas Carrier TINOS I (IMO 9969821), which attempted to load LPG cargo near Houston, Texas in June 2024 for intended delivery to China. The vessel’s loading attempt was unsuccessful.

The sanctions target a complex network of companies spanning Iran, the United Arab Emirates, and the United Kingdom. The network is operated by Emamjomeh and his son, Meisam Emamjomeh, a British and Iranian national based in the UAE.

Like crude oil, LPG remains a significant revenue source for the Iranian regime, with proceeds funding its nuclear and advanced weapons programs, as well as regional proxy groups and partners including Hezbollah, the Houthis, and Hamas, according to OFAC.

“Emamjomeh and his network sought to export thousands of shipments of LPG—including from the United States—to evade U.S. sanctions and generate revenue for Iran,” Treasury Secretary Scott Bessent said in announcing the sanctions.

The network’s operations include Caspian Petrochemical FZE, which has exported thousands of LPG shipments from Iran to Pakistan. The company has also conducted tens of millions of dollars in business on behalf of Persian Gulf Petrochemical Industry Commercial Co. (PGPICC), an entity previously sanctioned in 2019 for its connections to Iran’s Islamic Revolutionary Guard Corps.

The TINOS I is owned by Pearl Petrochemical FZE, which was transferred from Emamjomeh to his son Meisam in October 2024. Meisam also serves as CEO of UK-based Worldwide LPG Limited while maintaining board positions in several Iran-based companies within the network.

The sanctions designation includes nine additional LPG companies in Iran controlled by Emamjomeh, with one reportedly holding a monopoly on the National Iranian Gas Company’s LPG deliveries.

Under these sanctions, all U.S.-based property and interests of the designated persons are blocked and must be reported to OFAC. The sanctions also prohibit U.S. persons from engaging in transactions involving the designated entities and their assets.

The Treasury Department emphasized that the revenue generated from these LPG operations has been funding Iran’s nuclear and advanced conventional weapons programs, as well as regional proxy groups including Hizballah, the Houthis, and Hamas.

Companies and financial institutions risk exposure to secondary sanctions for engaging in transactions with the designated entities. Violations may result in civil or criminal penalties for both U.S. and foreign persons.

Join The Club

Join The Club