US Reviewing Five Offshore Wind Farms Under Construction

Five US offshore wind developments are under review, a top Trump administration official said on Wednesday, as the White House targets the renewable energy source.

Discoverer Clear Leader, image (c) R.Almeida/gCaptain

Transocean Ltd. (NYSE: RIG) (SIX: RIGN) announced today that Chairman of the Board and former CEO J. Michael Talbert has announced his intentions to resign from the Board.

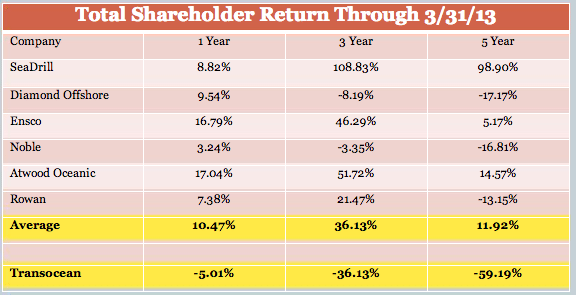

Transocean, as pointed out by shareholder and activist investor Carl Icahn, has lagged far behind their peers in the offshore drilling industry over the past few years. “This underperformance translates into over $30 billion reduction in shareholder value – a number far too large to attribute solely to Macondo,” notes Carl Icahn in a statement to shareholders on 2 May 2013.

Carl Icahn has called on Transocean shareholders not to re-elect Mr. Talbert during the next Annual General Meeting on 17 May. He attributes the company’s poor performance to a number of “distructive transactions” including the 2007 merger between Transocean and GlobalSantaFe which cost shareholders $18 billion and resulting in an accumulation of a large portfolio of old assets including:

In a 2 May filing, Icahn commented that “GSF assets and proceeds from sales may only be worth $7.5 billion. Net Asset Value (NAV) losses from the GSF acquisition for shareholders could be $11 billion or $27.75-30.50 per share, or potentially higher considering that Transocean trades below NAV.”

In addition, Transocean purchased four high spec drilling units from Aker Drilling in 2011 at above NAV. This purchase was made by selling 30 million shares at $40.50, a share value near Transocean’s 5-year low.

Icahn notes this move “destroyed almost $850 million in value.”

Icahn has also challenged Transocean’s strategy of “buy old instead of build new” which comes at a detriment to Transocean’s market “leadership” standpoint.

“By the time the GSF acquisition closed at the end of 2007,” notes Icahn, “Seadrill, Esnco and Noble had 21 ultra deep water units under construction, Transocean had only four, this market share trend has continued into 2013.”

Talbert’s resignation will come no later than the next Annual General Meeting (AGM) in May 2014, that is assuming he is re-elected during the company’s upcoming AGM on 17 May.

“I am honored to have served Transocean,” notes Talbert, “and to have done so as a member of a very knowledgeable and experienced Board of Directors. During my 20 years at Transocean, I have worked diligently to represent the best interests of all of our stakeholders. In this spirit, and after consultations with our shareholders, I have decided to retire from the Board on a timetable that will allow the Board to carefully select a new chairman who will help guide the company in the creation of sustainable, superior value for all shareholders.”

Mr. Talbert, formerly CEO of Transocean from 1994 to 2002, has served on the Board of Directors since 1994.

Steven Newman, CEO of Transocean commented, “Mike’s deep industry and company knowledge, thorough understanding of the value we provide our customers and consistent, strong leadership have played a very important role in making Transocean the company it is today. I want to personally thank him for his mentorship, counsel and guidance, particularly during the difficult period following the Macondo incident, and I look forward to continuing to benefit from his leadership until his retirement.”

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up