Geopolitics, High Bids, and U.S. Pressure Cloud COSCO’s Global Port Ambitions

COSCO Shipping Ports is facing "challenges" with its international investments amid pressures from the U.S. trade war, its managing director said in Hong Kong on Thursday.

By sunsinger / Shutterstock

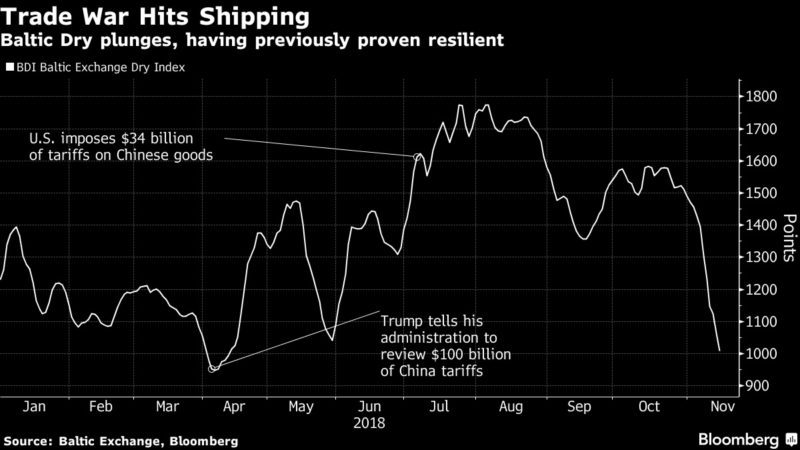

By Prejula Prem and Firat Kayakiran (Bloomberg) — The commodity shipping industry was expected to sail through the trade war unscathed.

Tariffs were being slapped on hundreds of goods and yet shipping rates for dry bulk — the segment that hauls billions of tons of coal, iron ore and crops around the globe — kept rising. No more.

The Baltic Dry Index is within a whisker of crashing through 1,000 points for the first time since April, despite only modest expansion in fleet capacity, the usual culprit when rates collapse. This time, it’s about waning growth in Chinese demand.

“Expect a fragile recovery going into 2019,” said Peter Sand, chief shipping analyst at BIMCO, a 113-year-old shipping association representing vessel owners and operators. “At best, sideways rates improvement is seen.”

The daily rate for a giant Capesize hauling iron ore to China stands at $7,987, from $27,283 in August. Forward freight agreements, used to hedge future costs, have also collapsed.

China buys more than a billion tons of iron ore and coal annually. While imports expanded 1.8 percent this year, growth in 2017 was 5.5 percent. At the same time, the government may restrict imports of coal used in power plants as it seeks to curb pollution. The nation is also buying fewer U.S. agricultural products, hurting smaller ships.

The freight market has also been buffeted by random events. BHP Group, the biggest mining company, was forced earlier this month to derail a runaway train in Western Australia, disrupting iron-ore shipments. That prompted a liquidation of overly optimistic fourth-quarter positions in the Capesize market, Macquarie Wealth Management said.

© 2018 Bloomberg L.P

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up