Nippon Yusen reduced its projected net income to 1 billion yen ($13 million) in the year ending March from an earlier prediction of 20 billion yen, according to a statement today. Mitsui O.S.K. forecast a loss of 24 billion yen, compared with an earlier prediction for a 3 billion yen profit. It also won’t pay a first-half dividend.

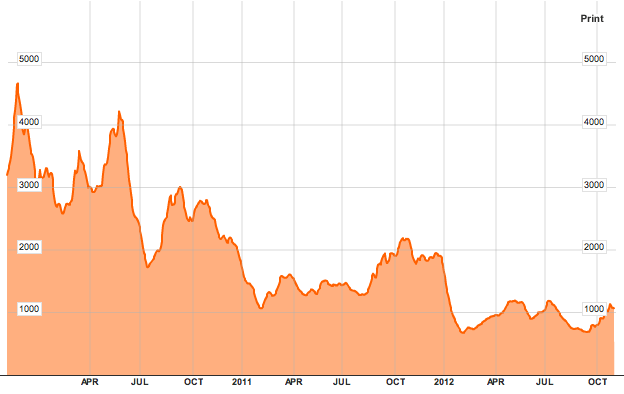

Kawasaki Kisen Kaisha Ltd. similarly cut its profit estimate as slower investment in vessels fails to revive dry-bulk rates amid excess capacity and waning demand. The Baltic Dry Index, a measure of commodity-shipping prices, averaged 45 percent lower in the quarter than a year earlier.

“We don’t expect a meaningful recovery until 2014,” said Janet Lewis, a Hong Kong-based analyst at Macquarie Securities Ltd. Dry bulk is “the main drag” on Japanese shipping lines’ earnings, she said.

K-Line, Japan’s third-largest shipping line, expects net income of 2 billion yen in the year ending March 31, compared with an earlier forecast of 8 billion yen, it said. China Cosco Holdings Co., China’s biggest listed shipping company, yesterday forecast a loss for the current calendar year.

The three Japanese shipping lines, all based in Tokyo, have all slumped more than 20 percent this year on the city’s stock exchange.

In the quarter through September, Nippon Yusen narrowed its net loss to 2.8 billion yen from 4.9 billion yen. Mitsui O.S.K. reported an 8.1 billion loss, down from 8.4 billion yen. K- Line’s loss narrowed to 449 million yen from 14.9 billion yen. A pick-up in container-shipping rates in the period helped boost earnings industrywide.

The Baltic Dry Index averaged 846 points in the three months ended September, compared with 1,534 a year earlier. It traded at 1,043 points, yesterday in London.

– Chris Cooper and Kiyotaka Matsuda, Copyright 2012 Bloomberg.

Join The Club

Join The Club