By Fabiana Batista (Bloomberg) —

Sugar refineries waiting for sky-high shipping rates to ease before locking in purchases may find that supplies tighten by year-end as mills in top producer Brazil send more cane to make ethanol, according to BP Bunge Bioenergia.

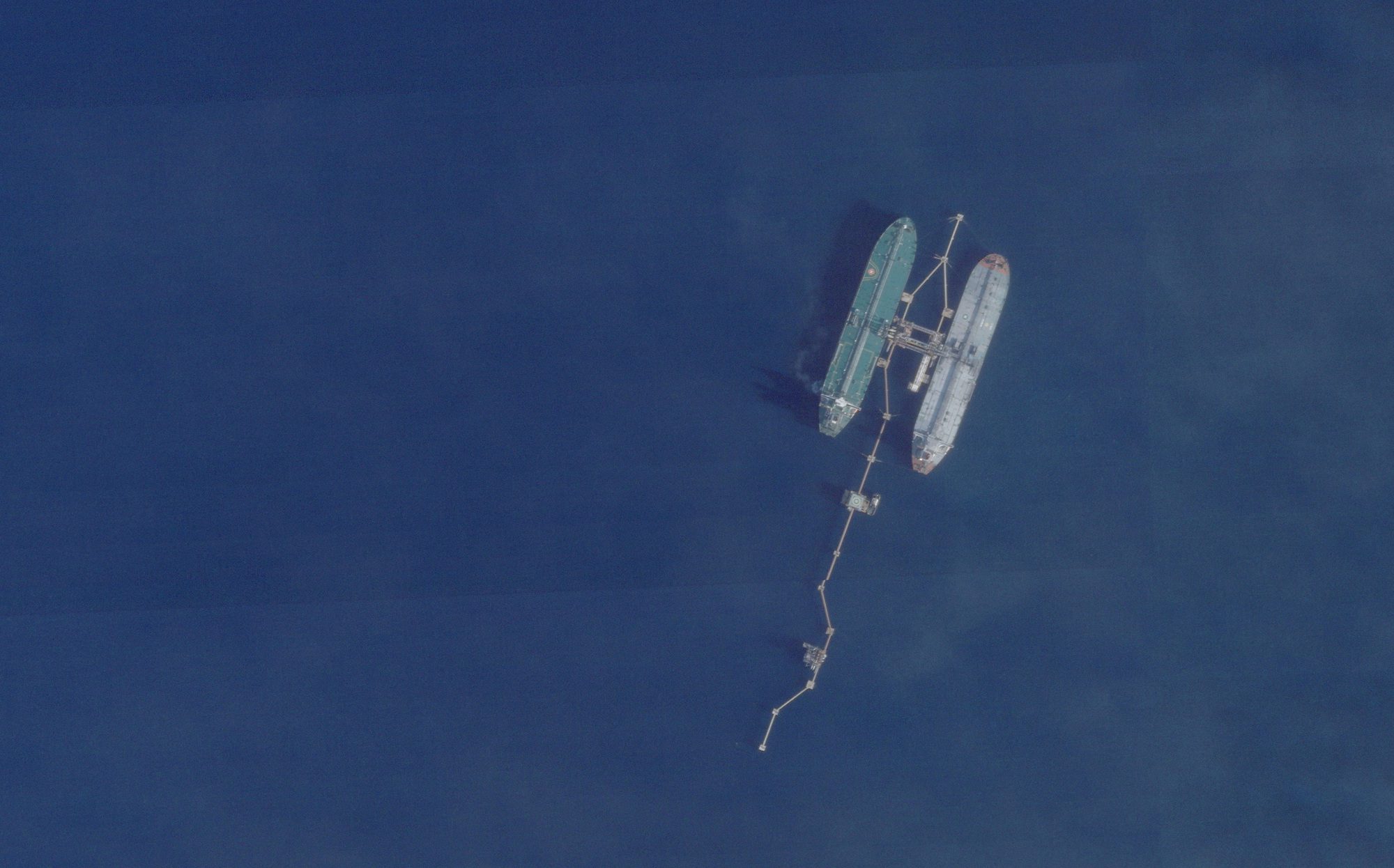

The priciest sea freight in at least a decade is squeezing the global sweetener trade as refineries hold off on buying raw sugar that they process. The slowdown is reflected in 60% less volume to be loaded at Brazil’s ports than last year.

Some millers in the South American nation have taken advantage of high ethanol prices by diverting more cane for the biofuel, meaning less sugar supplies may be available when demand returns, said Ricardo Carvalho, commercial director at the BP Plc-Bunge Ltd. joint venture.

“We are very optimistic,” he said in an interview. “From the fourth quarter, the world will have no leftover sugar.”

As global economies rebound, demand for the transportation of goods has surged. Sea freight rates have jumped more than 200% this year, although contracts for months ahead suggest prices will ease, Carvalho said. Refineries around the globe are probably running down inventories to defend margins as the jump in transport costs coincides with slightly lower-than-expected consumption, he said.

Raw sugar futures have jumped more than 50% in the past year after drought dimmed Brazilian crop prospects, fueling a global sugar deficit. Even as the price for Brazilian millers in local currency is near record levels amid real weakness, the ethanol market has rebounded, prompting some millers located further from ports to shift more toward the biofuel.

“This sugar has been converted into ethanol and consumed internally,” Carvalho said. “We may see less sugar content available ahead when refinery demand returns.”

BP Bunge Bioenergia sees Brazil’s Center-South sugar output falling to 34 million tons in the current season, versus the maximum of 35.5 million tons millers would produce if they channeled all capacity into making the sweetener. The company sees sugar-cane availability in the region of 545 million to 550 million tons this season.

© 2021 Bloomberg L.P.

Join The Club

Join The Club