By Ann Koh (Bloomberg) —

Costs for shipping energy are surging as Europe’s scramble for supplies creates a shortage of vessels to carry essential fuels this winter.

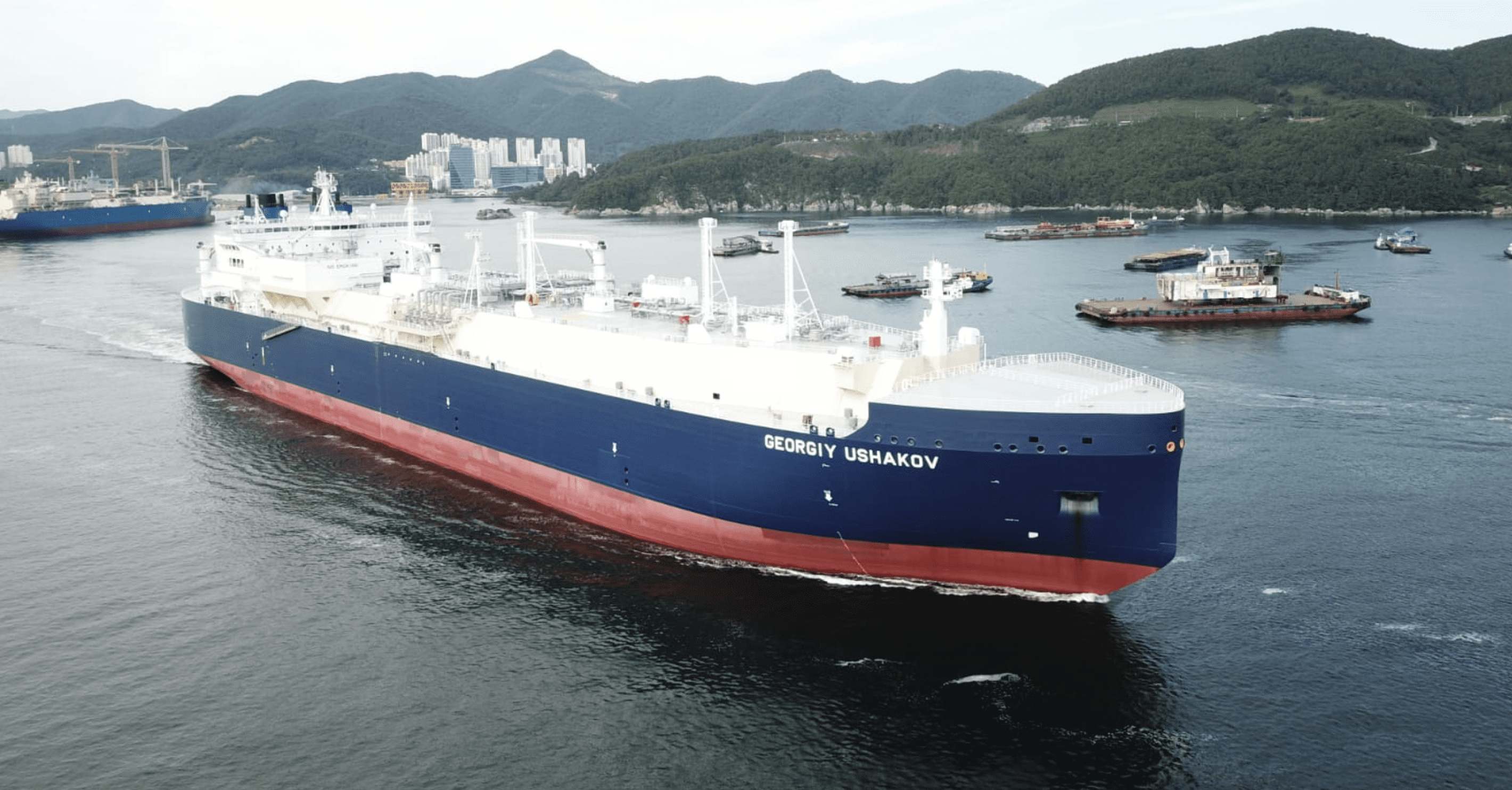

Ships are carrying liquefied natural gas, diesel and crude to Europe from further away than usual to replace Russian energy supplies, as the conflict in Ukraine shows no sign of ending. That’s keeping vessels occupied for longer and delaying their return to service, sparking a rally in global freight rates, said shipping experts.

LNG freight rates are at elevated levels for this time of year and threaten to surpass last year’s winter peak. The cost of shipping a US oil cargo to China is at the highest since 2020, while transporting a cargo of naphtha petrochemical feedstock from the Middle East to Japan costs more than twice as much as it did in March, according to data from the Baltic Exchange.

The ship shortage threatens to impact Asian economies that import oil and gas from the US, as they may find it difficult to get spare cargoes at short notice if the weather turns extremely cold this winter, said traders and shipowners. Even petrochemical feedstock shipments are becoming more expensive to transport, further burdening buyers grappling with sluggish demand for chemicals as the pace of manufacturing slows.

There are very few LNG ships available for hire through the winter, and only for short voyages, said Oystein Kalleklev, chief executive officer of shipowner Flex LNG Management AS. Shipowners have booked out their fleet, and owners are demanding their vessels back so they’ll be available when the Freeport LNG export plant resumes operations, he said.

The Freeport facility in Texas is slated to restart in November after being hit by a fire in June that knocked out a significant portion of US LNG exports.

As companies book vessels for winter earlier than usual, energy majors are refusing to release LNG ships as they typically do at the end of summer. Petroleum tankers obtained at cheaper freight rates are being kept on hire — sometimes burning extra fuel to shuttle between Singapore and Malaysia for the sole purpose of retaining the vessels, according to traders and shipbrokers.

Meanwhile, traders are filling up ships at sea with natural gas and petroleum fuels, tying up more vessels to ensure supplies in the tight market.

“What we’ve seen in shipping this year has been remarkable as a result of the war in Ukraine,” said Peter Sand, chief analyst at Xeneta, a freight market-analytics platform.

–With assistance from Stephen Stapczynski.

© 2022 Bloomberg L.P.

Join The Club

Join The Club