via Statoil

By Balazs Koranyi and Michael Shields

By Balazs Koranyi and Michael Shields

OSLO/VIENNA, Aug 19 (Reuters) – Norway’s Statoil sold stakes in North Sea oil fields to Austria’s OMV on Monday, in a $2.65 billion deal giving the former cash to develop new projects and placing the latter on course to meet ambitious output targets.

The deal, which analysts said came at a comfortable premium, gives OMV a foothold in one of Norway’s top new developments and underlines a rebound in North Sea investments driven by new discoveries, high oil prices and better recovery technology.

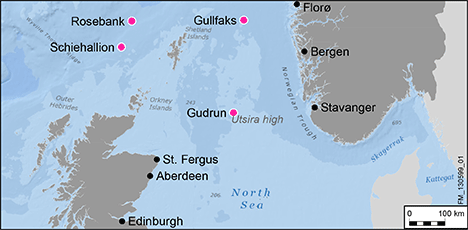

Statoil sold minority stakes in the mature Gullfaks field, the brand new Gudrun development, Chevron’s Rosebank field in the U.K and BP’s Schiehallion field for $2.65 billion but the actual price will be higher to reflect capital expenditure between January 1 and the closing of the deal.

It also agreed optional cooperation in 11 of Statoil’s exploration licences in the Norwegian North Sea, West of Shetland and the Faroe Islands.

“This is a very good price: it’s at two times book value while Statoil itself trades at 1.3 times book value,” said ABG oil sector analyst John Olaisen. “It shows that Europeans are positive about the Norwegian Continental Shelf.”

The cash – in addition to funds earmarked for projects it will no longer own – gives Statoil a sizeable budget to fund new projects, push on with new exploration and appease investors worried about soaring capital expenditure.

Statoil has been short of cash in recent years as it spends heavily on the development of new discoveries in places like Brazil, Norway and Tanzania – arguing that funding the development risk there will ultimately offer a higher yield.

As a result Statoil’s capital expenditure jumped to $19 billion this year from $13.7 billion in 2010 and its net cash flow is expected to stay negative until 2015. The company’s free cash flow is expected to match its capital expenditure this year, forcing it to raise money, in part through divestments, to fund dividends.

“The idea is to use the proceeds to reinvest in high-return projects,” Statoil Chief Executive Helge Lund said. “It will increase our financial flexibility in the sense it releases $7 billion in future capital expenditure from these assets.”

Shares in Statoil rose 0.6 percent on Monday while shares in OMV were down 2.6 percent.

“NICE PRICE”

“This is a very nice price,” said Trond Omdal, an oil sector analyst with Arctic Securities in Oslo. Using the industry standard of an 8 or 9 percent discount rate and basing his calculation on the weighted cost of capital, he calculated that the deal brought a 41 percent or 50 percent premium.

For OMV, in the process of exiting lower-margin downstream operations to focus on more lucrative upstream business, the deal gives that effort, cheered by analysts, a major push.

UBS analysts said the deal was “transformational” for OMV and also highlighted how willing the industry was to pay a premium to access strategic resources in Norway – a stable and secure free market in the context of an industry increasingly pushed to more hostile investment climates.

Although OMV produced only a fraction of its total output from the Middle East and Caspian region in 2012 – 10 million barrels out of a total 111 million – CEO Gerhard Roiss said on Monday the reduction of its exposure to the region was “an important dimension.. when you see what is happening today.” OMV has assets in Yemen and in Libya, where it suffered a major production outage during that country’s conflict.

OMV said it would finance the deal in part from its cash flow and the proceeds from divesting petrol stations in the Balkans, its lubricants business and a stockholding unit, as well as from existing credit lines. It said it would need no capital hike or fresh loans for the transaction and forecast the new assets would contribute more than $500 million a year to operating profit from 2014, assuming stable oil prices. OMV has not given an operating profit target for 2014. Operating profit in 2012 was 3.1 billion euros.

The deal lifts OMV’s proven and probable reserves by about 320 million barrels of oil equivalents, or about 19 percent, and will boost production by about 40,000 barrels in 2014 and almost 60,000 barrels in 2016.

That is enough to put it well on course to meet its 2016 target of lifting production to around 400,000 barrels a day from 297,000 barrels in the second quarter.

(c) 2013 Thomson Reuters

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Reuters, published under license.

Join The Club

Join The Club