By Elizabeth Low (Bloomberg) —

The Red Sea shipping crisis is making waves in Singapore as the disruption to global shipping patterns spurs higher fuel sales at one of the world’s busiest ports.

Volumes were 12% higher in January compared with a year ago, according to port authority data. That’s the second month of sharp gains as the confrontation in the region sends vessels scrambling to top up fuel at the Asian hub.

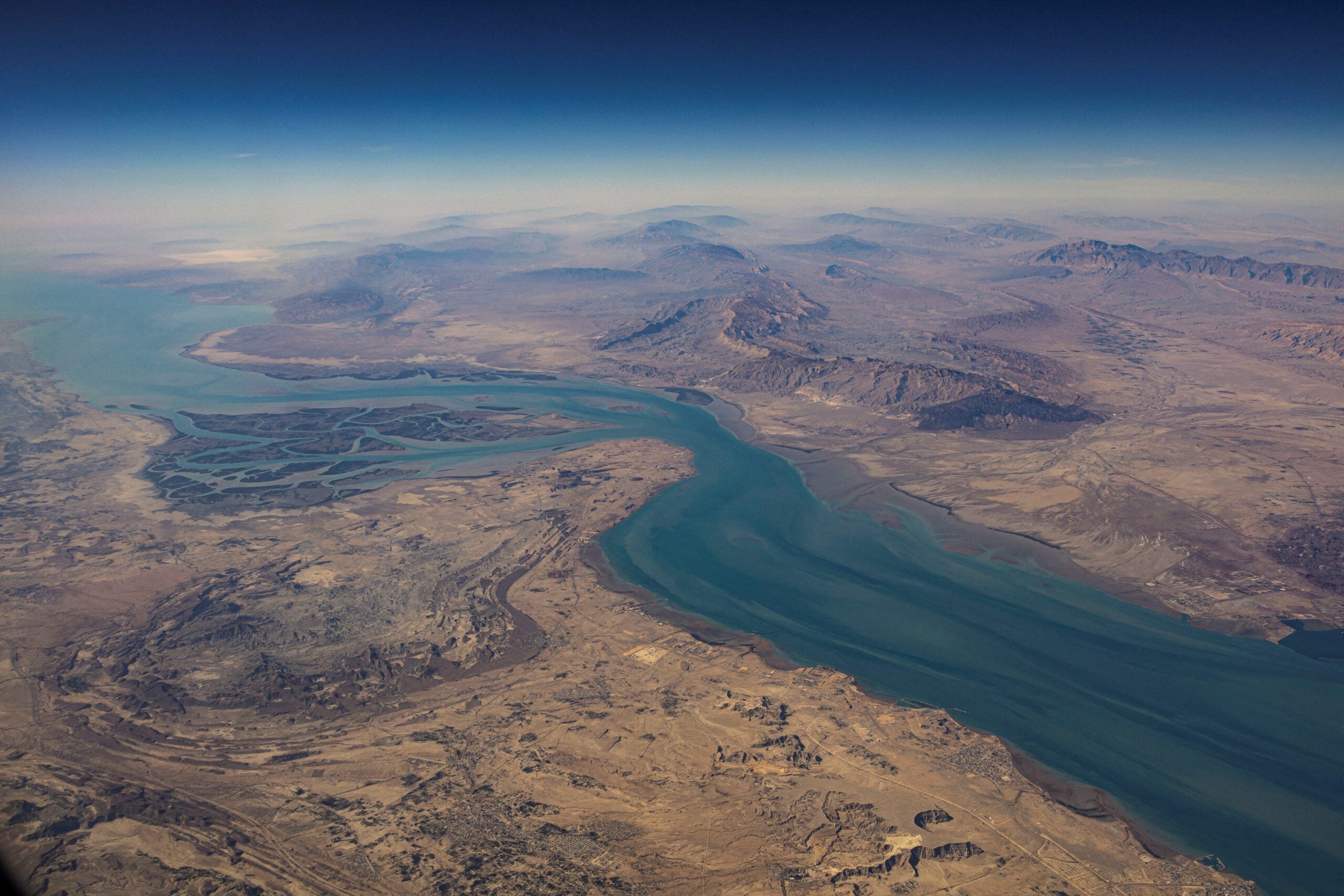

“Demand in Singapore has increased as it’s almost the last stop before heading to the Indian Ocean,” said Simon Neo, executive director of ship-refueling consultancy SDE International Pte. Other ports such as Fujairah in the United Arab Emirates and Sri Lanka may also be options for rerouted vessels, he added.

Global maritime trade has been upended in recent months as Iran-backed Houthi rebels in Yemen target merchant vessels off their coasts to support Hamas against Israel. The attacks have continued despite repeated military strikes by the US, with many shipowners avoiding the area and passage via the Suez Canal, preferring the safer journey around the Cape of Good Hope.

The longer voyages — as well as some vessels opting to boost sailing speeds — have stoked consumption of bunker fuel. That’s driving them to top up their tanks at less traditional refueling ports along the route around Africa, such as Durban and Walvis Bay, as well as at major hubs like Singapore.

“Overall, demand for bunkering should increase due to the longer distances to be covered,” said Fotios Katsoulas, lead analyst for tanker shipping and alternative fuels for S&P Global Commodity Insights. Estimates suggest “this could add up to 5%, if more ships avoid the Red Sea and some of them speed up to minimize the duration of the longer voyages,” he said.

Overall sales of marine fuel in Singapore were 4.9 million tons in January, up about 12%, according to the Maritime & Port Authority. In December, they hit 5.1 million tons, the highest monthly volume in data going back to 1995.

Prices of low-sulfur marine fuel in Singapore – the most commonly used grade – climbed to as much as $671 a ton in January, about 10% above levels at the end of last year, according to data from Clearlynx, a marine fuel procurement and analytics platform. That compares with Brent crude’s 6% gain that month.

© 2024 Bloomberg L.P.

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Bloomberg, published under license.

Join The Club

Join The Club