Madison Maersk at Maasvlakte II in Rotterdam. Photo: APM Terminals

By Chris Bryant

(Bloomberg Gadfly) — It’s hard to think of two more challenged industries than oil and shipping. AP Moller-Maersk A/S’s misfortune is to be heavily involved in both.

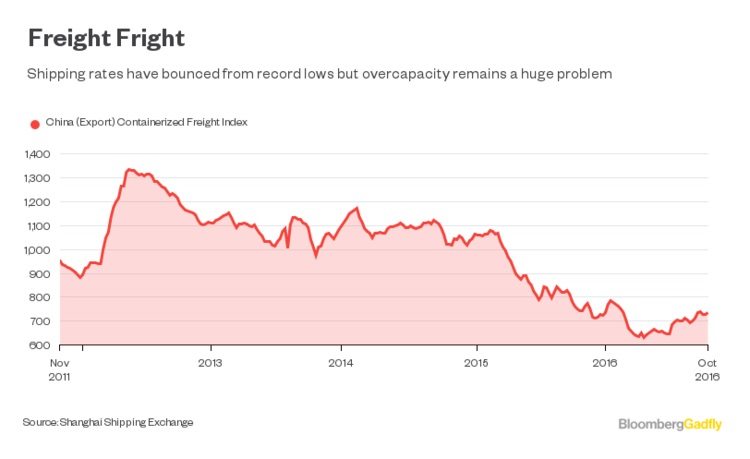

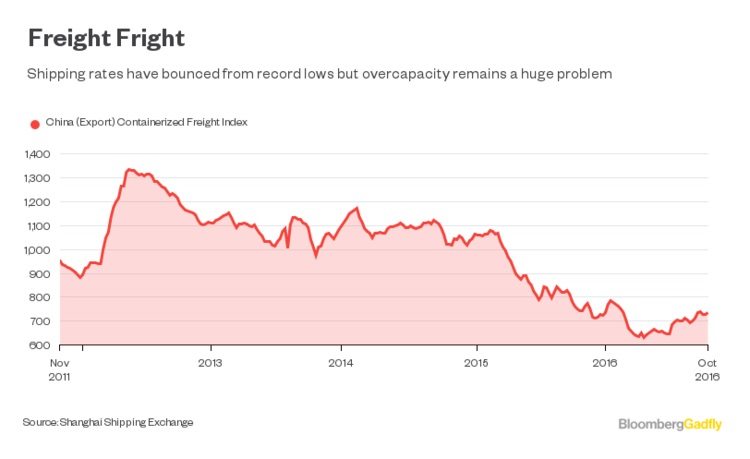

Investors were starting to hope the worst was over. Oil prices and container rates have risen lately, and consolidation in container shipping is finally underway. But on Wednesday that optimism was punctured when the Danish conglomerate warned Maersk Line would make a full-year loss, sending the shares tumbling by 9 percent.

A reality check was arguably overdue. Under new CEO Soren Skou, Maersk is separating its energy and transport activities so it can focus on the latter. While his plan could unlock more cost-savings and remove a conglomerate discount, it won’t fix the huge overcapacity problem in shipping.

A reality check was arguably overdue. Under new CEO Soren Skou, Maersk is separating its energy and transport activities so it can focus on the latter. While his plan could unlock more cost-savings and remove a conglomerate discount, it won’t fix the huge overcapacity problem in shipping.

In the wake of Hanjin Shipping Co Ltd’s insolvency, Maersk has increased its market share — its volumes increased 11 percent in the third quarter, compared to demand growth in the wider industry of about 1.5 percent. But investors should ponder whether winning a bigger slice of an unprofitable business is really such a good thing.

Maersk Line is cash flow positive but loss-making — though others are losing more. Its game-plan therefore seems to be this: cut costs, push for growth and pressure more financially straitened competitors into giving up. The trouble is, with oil prices creeping higher, Maersk Line risks losing something that was propping up its earnings: cheap fuel. Its fuel bill rose compared to the second quarter, which explains why better freight rates didn’t lead to a return to profit.

So while Maersk is in no danger of a Hanjin-like death spiral, it’s still taking on water. Maersk Line’s losses this year total about $229 million so far. In the long term, consolidation should — in theory — lead to more of a recovery in freight rates but it’s going to be a slow, grinding process.

The shipping industry’s capacity increases again exceeded demand growth in the third quarter, suggesting it still hasn’t learned. While vessel scrapping rates are up, new vessels are still being delivered and the industry order book is equivalent to about 16 percent of the current fleet.

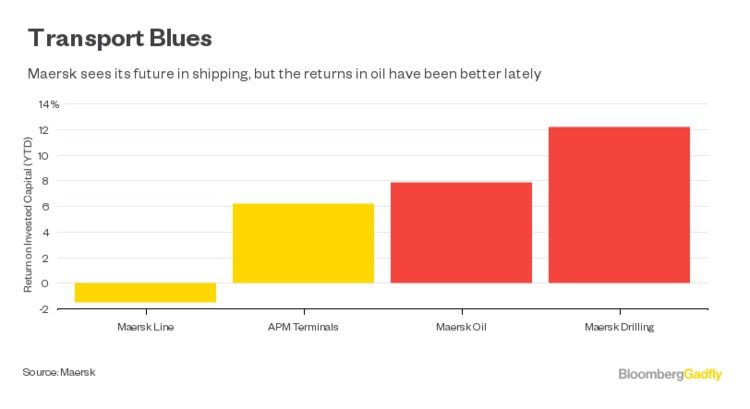

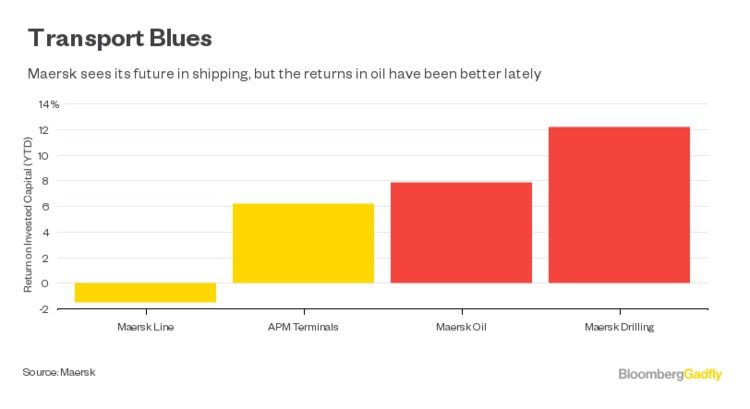

Awkwardly for Skou, Maersk’s energy assets did much better than the transport businesses.

That’s handy, of course. Finding a home for oil assets via joint-ventures, mergers or a listing will be that much easier if they’re making money. But it says something when even oil offers better returns than transporting goods by sea.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners. Or gCaptain.

© 2016 Bloomberg L.P

Join The Club

Join The Club

A reality check was arguably overdue. Under new CEO Soren Skou, Maersk is

A reality check was arguably overdue. Under new CEO Soren Skou, Maersk is