Maersk Contests Transnet’s Pick for South African Port Partner

By Paul Burkhardt (Bloomberg) — A.P. Moller – Maersk A/S is contesting a process held by South Africa’s state logistics firm Transnet SOC Ltd. to find a partner to develop sub-Saharan...

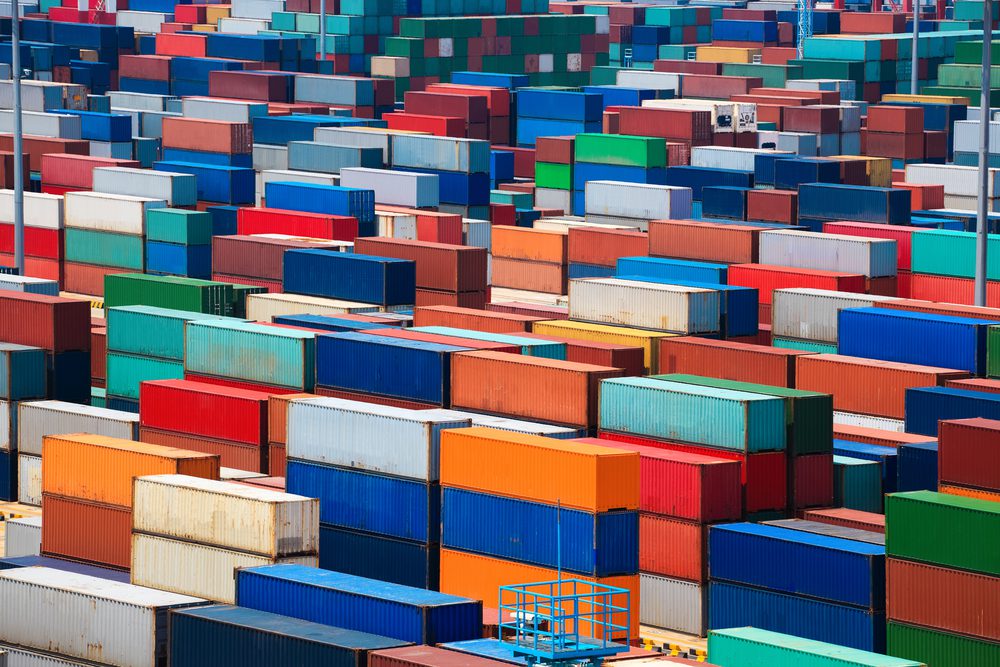

File Photo: chuyuss / Shutterstock

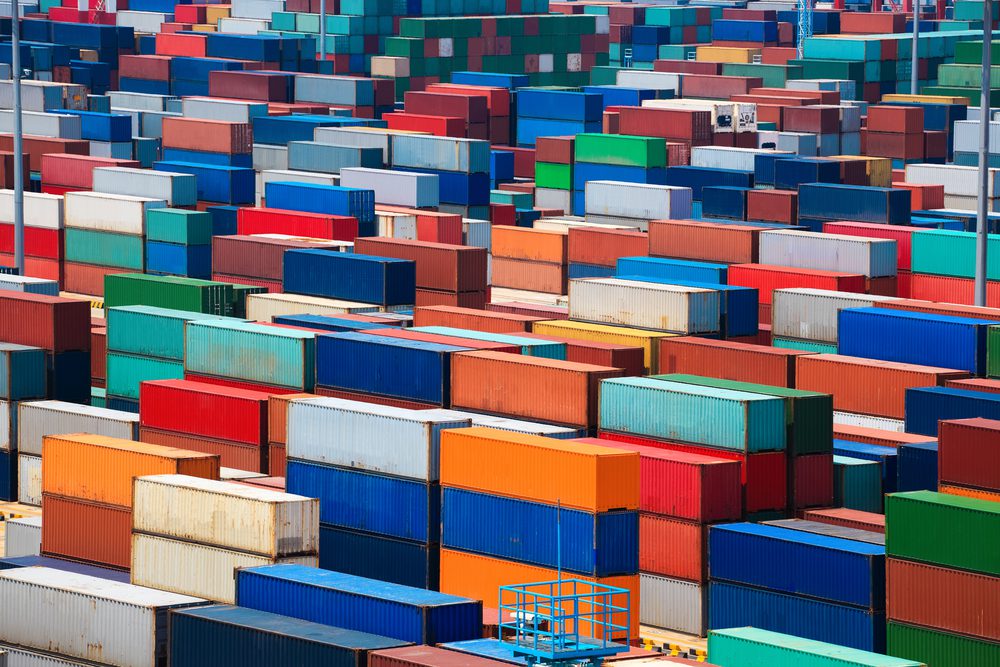

By Kevin Varley (Bloomberg) Global ports are growing more gridlocked as the pandemic era’s supply shocks intensify, threatening to spoil the holiday shopping season, erode corporate profits and drive up consumer prices.

Bloomberg’s Port Congestion Tracker shows a typhoon in Asia spawned another wild week for shipping in a year with multiple challenges — a vessel wedged in the Suez Canal, a dozen major storms, rolling Covid lockdowns disrupting key manufacturring hubs in China and Vietnam, a shortage of truckers and dockworkers, and a resurgence of consumer demand.

As of Friday, at least 107 container ships were waiting off Hong Kong and Shenzhen, the data show. The pileup worsened when the storm brushed past Hong Kong around midweek, shutting down its stock exchange and idling its ports. Globally, RBC Capital Markets reckons 77% of ports are experiencing abnormally long times to turnaround traffic.

The latest congestion won’t be isolated to Asia for long, as delayed ships loaded with merchandise soon start sailing for the U.S. and Europe.

As the Big Crunch of 2021 has repeatedly demonstrated, a bottleneck in one corner of the globe eventually exacerbates a logjam or compounds shortages in another.

Even if shipping strains ease in China, that “could still mean new surges of vessels arriving at congested ports like Los Angeles-Long Beach, shifting the backlog to the destination ports,” said Judah Levine, head of research at Hong Kong-based Freightos.com, an online shipping marketplace.

President Joe Biden last week urged the L.A. port to run a 24/7 operation. In the U.K., containers filled with goods and outbound empties were piling up so high at the key port of Felixstowe that at least one container carrier had reroute cargo through ports in mainland Europe.

That all spells trouble for the world economy. Concern is already mounting that holiday shoppers won’t be able to buy the gifts they want, dealing a blow to retail sales. Companies are worried about their bottom line with executives at Tesla Inc., Target and other S&P 500 companies mentioning “supply chain” a record 3,000 times during presentations as of Tuesday. And a lack of goods and costlier shipping mean further upward pressure on already heady inflation.

“Data on sea and air shipping costs, container throughput and transport utlization point to an ongoing supply shock for the global economy,” Michael Hanson, senior global economist at JPMorgan Chase, told clients in a report on Thursday.

Friday’s queue of ships around Hong Kong and Shenzhen was the largest recorded there since Bloomberg News began tracking the area in April. The current count surpasses highs reached in May when the Shenzhen port of Lantian was gripped by a Covid-19 outbreak.

The fallout from the storm was felt all the way to Singapore, a crossroads for goods transiting from East to West. Waiting container ships off that port reached their highest since July 21, when another storm, Typhoon In-fa slammed into Shanghai, further north of Hong Kong.

Typhoons in Asia have tested an already-strained port infrastructure in U.S. and the effects are rippling to logistics on land like trucking, rail and warehousing.

U.S. ports have some of the highest congestion rates in the world, the data show.

The Port of Savannah, Georgia, on the East Coast had 25 waiting ships versus just six in port late Thursday, leading all major ports with an 81% congestion rate. On the West Coast, the adjacent ports of L.A. and Long Beach had a combined congestion rate of 56% Friday, as ships waiting outnumbered the ships in port.

In Europe, ports in Rotterdam and Antwerp had blockage rates about half that level.

Ports are overwhelmed because they sit at the junctions of global trade where ocean freight gets transferred to some mode of land-based transportation. The supply snags are colliding with a demand surge — peak season for retailers to stock up before holiday shopping kicks off.

Consumer purchases of goods have stayed elevated in advanced economies and labor shortages have stretched trucking, rail and shipping liner capacity to their limits, creating bottlenecks of containers between the factory loading docks and store shelves.

San Francisco-based freight forwarder Flexport developed an indicator to help anticipate when the share of U.S. consumer purchases on goods versus services will return to pre-Covid levels. According to the latest reading released on Friday, there’s no sign yet that it’s easing up, so pressure on supply chains will continue at least to year end, Flexport said.

“Port congestion, equipment shortages and extreme container freight rates are just the symptoms of a deeper problem that includes trucking shortages and limited warehousing space,” said Simon Heaney, senior manager for container research at Drewry in London. “Covid has stressed all links in the chain and these issues take time to resolve as there is no latent capacity that can be turned on like a tap.”

By Kevin Varley and Brendan Murray © 2021 Bloomberg L.P.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,777 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,777 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up