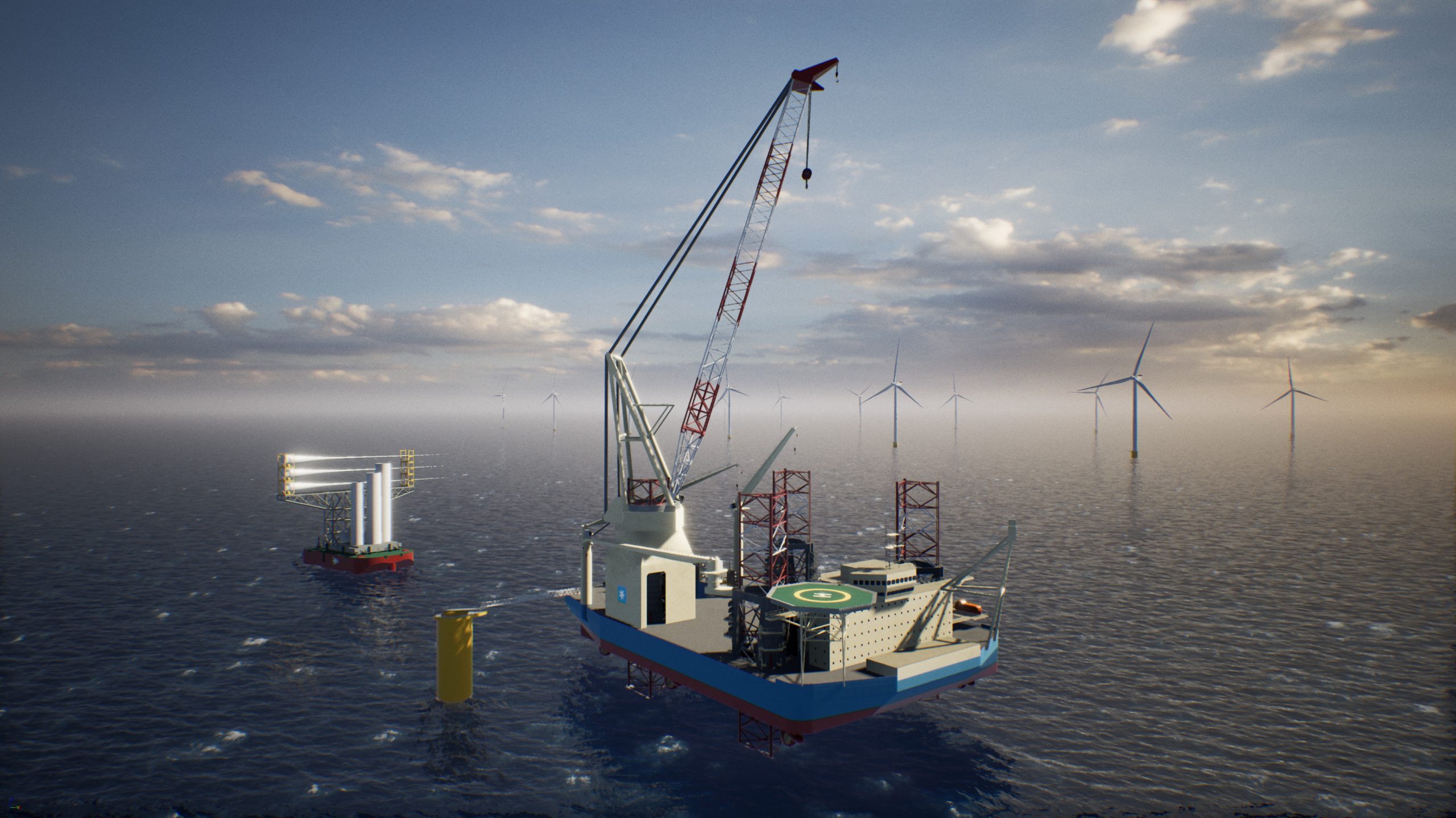

Seadrill’s West Intrepid jack-up. Photo (c) Seadrill

Leading offshore drilling company Seadrill announced Tuesday that it has secured drilling contracts with Mexico’s PEMEX for the operation of five jack-up rigs in the Gulf of Mexico.

Each contract is for a firm term of approximately 6 years and total revenue potential from the five contracts exceeds US$1.8 billion.

The finalized contracts include the jack-up drilling units West Oberon, West Intrepid, West Defender and West Courageous and a fifth contract for the recently acquired jack-up drilling unit, Prospector 3 (renamed West Titania), which is expected to close in the second quarter of 2014, Seadrill says.

To execute the contracts and develop additional business in the region, Seadrill will establish a 50/50 joint venture with an investment fund controlled by the Finnish private investment firm, Fintech Advisory Inc. The new JV, named SeaMex Ltd., will own and manage the jack-up drilling units working for Pemex, as well as to develop and pursue further opportunities in Mexico and other Latin American countries. The deal with Fintech is expected to generate about US$488 million in a gain recordable in the first half of 2014, Seadrill notes.

Commenting on the new joint venture, Per Wullf, Seadrill CEO, said:

“This opportunity to expand our relationship with Pemex was partly developed on the back of Seadrill’s successful operations with our ultra-deepwater semi-submersible West Pegasus in Mexico.

“The long term nature of these contracts and the establishment of SeaMex, will create economies of scale in the region. Seadrill sees recent developments in Mexico such as new petroleum legislation, Pemex’ expansion plans and recent large deepwater discoveries as supportive to the great opportunity to expand business within the country.

“By using the Joint Venture to build up a strong local independent organization with close proximity to our customer, strong focus on education, and a high degree of local content, we expect to be able to create an efficient, high quality, and more cost effective organization. Over time, this will position Seadrill better than a centrally driven organization in what we see as a very attractive market. At the same time, a strong focus on localization benefits the Mexican labor market, the Mexican society, and our clients.”

Join The Club

Join The Club