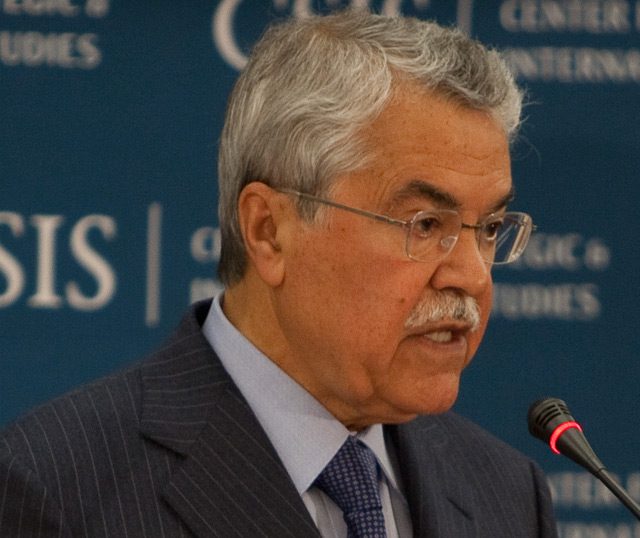

Ali I. Al-Naimi, Minister of Petroleum and Mineral Resources, Kingdom of Saudi Arabia (c) R. Almeida/gCaptain

By Anthony DiPaola

(Bloomberg) — Saudi Arabia and OPEC would find it “difficult, if not impossible” to give up market share by cutting crude production, the country’s oil minister said.

Global oil markets are experiencing “temporary” instability caused mainly by a slowdown in the world economy, Oil Minister Ali Al-Naimi said, according to comments published today by the Saudi Press Agency. He reiterated the country’s intention to maintain output amid plunging prices.

“In a situation like this, it is difficult, if not impossible, that the kingdom or OPEC would carry out any action that may result in a reduction of its share in market and an increase of others’ shares,” Naimi said, according to the state-run news agency. Saudi Arabia, the largest producer in OPEC, will stick to its oil policies, he said.

The Organization of Petroleum Exporting Countries decided Nov. 27 to keep its production target unchanged at 30 million barrels a day, ignoring calls from members including Venezuela to curb output to tackle a supply glut. Crude prices, which had already fallen 30 percent for the year by the November meeting, plunged after the decision, extending the drop to 43 percent.

Brent crude, the international benchmark, rose to the highest level in a week today amid speculation an earlier drop to the lowest in five years was excessive. Futures for February settlement climbed as much as 4.1 percent, or $2.52, to $63.70 a barrel on the ICE Futures Europe exchange in London.

“The oil market is way oversold and due for a rally,” Amrita Sen, chief analyst at London-based consultants Energy Aspects Ltd., said by e-mail. “Given the scale of the price drop, demand growth could surprise significantly to the upside.”

Shale Producers

Increased supply from regions outside OPEC, where oil- production costs are higher, is affecting the market, Naimi said. Saudi Arabia’s crude output has remained stable as production in other regions rose, he said.

OPEC’s decision to maintain output fanned speculation that Saudi Arabia and other members want North American shale drillers and other producers outside the group to be the first to cut production because of falling prices. Saudi Arabia and Iran this month cut the official price levels of their main light crude grades for sale to Asia to the lowest in at least 14 years.

In November, the 12-member group pumped 30.56 million barrels a day of crude, exceeding its output target for a sixth straight month, according to data compiled by Bloomberg. The group’s own forecasts show that world demand for its crude next year will fall to 28.9 million barrels a day, the lowest since 2003.

Saudi Arabia has large enough financial resources to resist the economic impact of the current oil price fluctuations, Naimi said.

The decline in prices won’t last long, Suhail Al-Mazrouei, energy minister in the United Arab Emirates, said today, according to that country’s state-run news agency. OPEC won’t change its output level and isn’t planning an emergency meeting before the next scheduled gathering on June 5, he said.

–With assistance from Grant Smith in London.

Copyright 2014 Bloomberg.

Join The Club

Join The Club