Was The World’s ‘Northern-Most Island’ Erased From Charts?

by Kevin Hamilton (University of Hawaii) In 2021, an expedition off the icy northern Greenland coast spotted what appeared to be a previously uncharted island. It was small and gravelly,...

– By Rojda Akdag, Managing Director, MTS Logistics

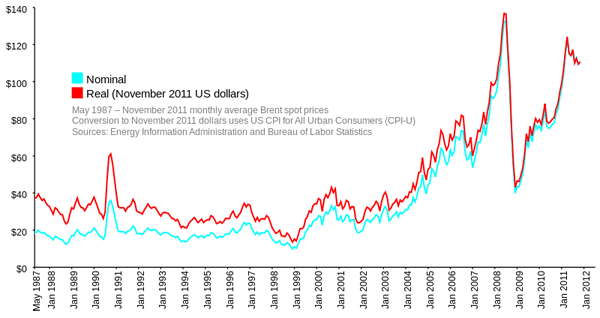

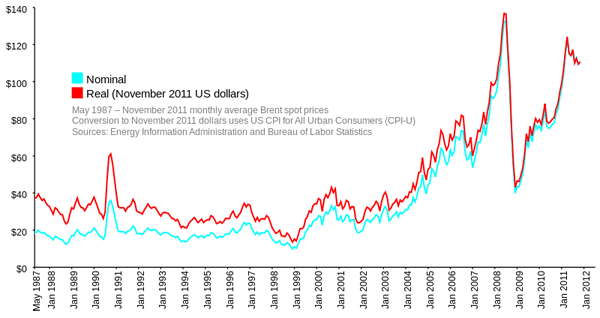

Crude oil prices have many affects on our daily life from gas that we use in our daily commute to commodity products that we frequently buy in our neighborhood market. Not many of us were paying much attention to oil prices until 2004, since the average of crude oil was trading between $22 to $26. In 2004 the big climb started with double digits reaching $50 average in 2005, $71 average in 2010 & above $90 average in 2011. But what happened during this period that drove the prices 2-3 times higher than its trading average? The Iraq war of course has its effects, but it is not the sole reason for this global development.

After researching this issue, I found out that the increased influence of OPEC as the monitor of production capacity, as well as increased interest in oil futures drive the oil prices upward. Currently there are 12 member countries of OPEC, and most members are unsurprisingly from Gulf states and Africa. Again, the addition of oil prices in futures also brought the speculators where the higher prices meant better returns, one recent estimate suggests that speculation in prices is effected at 40% by speculation – in other words if the speculation is banned, the oil prices are estimated to be between $50-$75 per barrel.

In shipping terminology, Bunker is the term that is used relating to oil prices, and Bunker fuel is now a considerable expense to shipping lines. Ship owners started to use fuel surcharges to recoup some of the increased costs that they face so that they pass some of these costs on to the importers.

Other then passing the costs, liners are also implementing other strategies to cover this variable cost, below are some of the trends that I discovered in my research:

1. Designing more efficient vessels

In order to maintain profitability, a large focus is dedicated on the design part. Last year, Maersk line ordered the biggest order in maritime history, with 10 container ships of 18,000 TEU capacity each and when sailing, the ships will save approximately 50% on fuel consumption compared to the current fleet. Each vessel will cost an average of $190,000 million, but Maersk believes the investment will have a very short period of payback time due to cost efficiency on fuel. Another advantage of the new ships is that they will be 100% recyclable when they retire after 25 years of service.

2. Vessel speed

This is an interesting example as many of us do not pay attention to this fact, but liners have huge advantages when they change the vessels’ sailing speed (AKA knots). A good example that I found is that increasing service speed from 23 to 26 knots for an average 13,000 tons vessel is an extra cost to the line of more than $50,000 one day.

3. Vessel Scale

Before the 2008 crisis, as a result of strong growth in container trade routes many shipping lines embarked ambitious growth plans to upgrade their fleet. For the last 4 years, the capacity increase of 6.56 million TEU’s accounts for 70% increase in new space. Another interesting example is in 2007 the number of ships bigger than 7500 TEU’s was 147 vessels, and in 2011 this number increased to 399 ships. The number is even more fascinating when you look at over 10,000 TEU capacity ships; in 2007 the number of ships over this capacity was only 2 and last year this number reached 91. A good example for savings per TEU is for a 5000 TEU vessel, Bunker cost per day is $8.7 whereas for a 12,000 TEU vessel the cost is $5.4 per day – passing savings close to 40%.

4. Outsourcing Fuel Supply

Another trend that I found during my research is that more and more liners are outsourcing their fuel supply to professional companies who focus on this issue alone so that liners can focus more on their core business. These companies develop comprehensive fuel strategies that effectively manage oil prices as well as finding the right type of fuel to meet government regulations.

![]()

![]()

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,931 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,931 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up