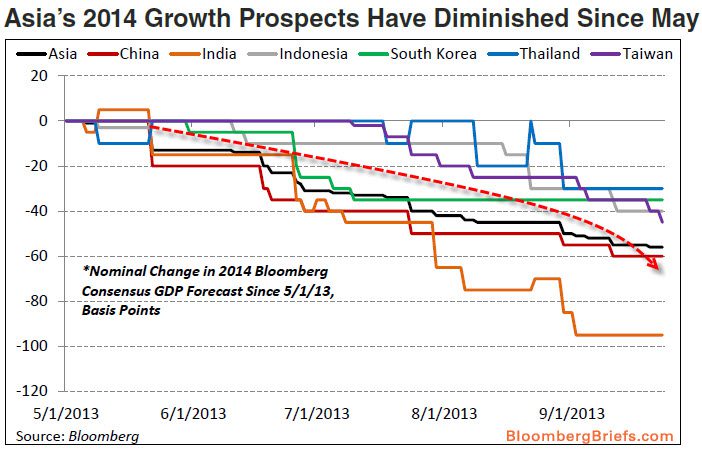

The Bloomberg consensus forecast for Asia’s 2014 GDP growth has slipped steadily during the past four months from 6.9% at the beginning of May 2013 to 6.3% as of September 23rd. For analysts, financiers, private and public equity investors and shipowners, the steady decline in forecasted GDP growth for Asia 2014 is not welcome or consistent with investment strategies currently being pursued in the shipping industry, and particularly in the dry bulk market.

A recovery of the dry bulk market requires expansionary monetary policies across Asia, increased industrial commodity demand, fixed asset investment, particularly residential construction, and an active consumer to support current shipping rates. While we expect consumer demand to remain strong from agricultural products across the region, as consumers continue to demand increased protein and calorie intake, industrial commodity demand is questionable. Should the Bloomberg consensus forecast prove accurate for 2014, the increase in fleet supply will again pressure rates and the financial wherewithal of shipping companies.

While dry bulk rates have improved over the past two months on the back of an expansionary “unofficial economic stimulus” program in China, 2014 forecasted Asian GDP is a harbinger of difficult times ahead and a bad omen for shipping investors, who have been pushing out a recovery year-after-year since 2009.

Jay Goodgal can be reached via email at [email protected]

Join The Club

Join The Club