By Justin Fox (Bloomberg Opinion) —

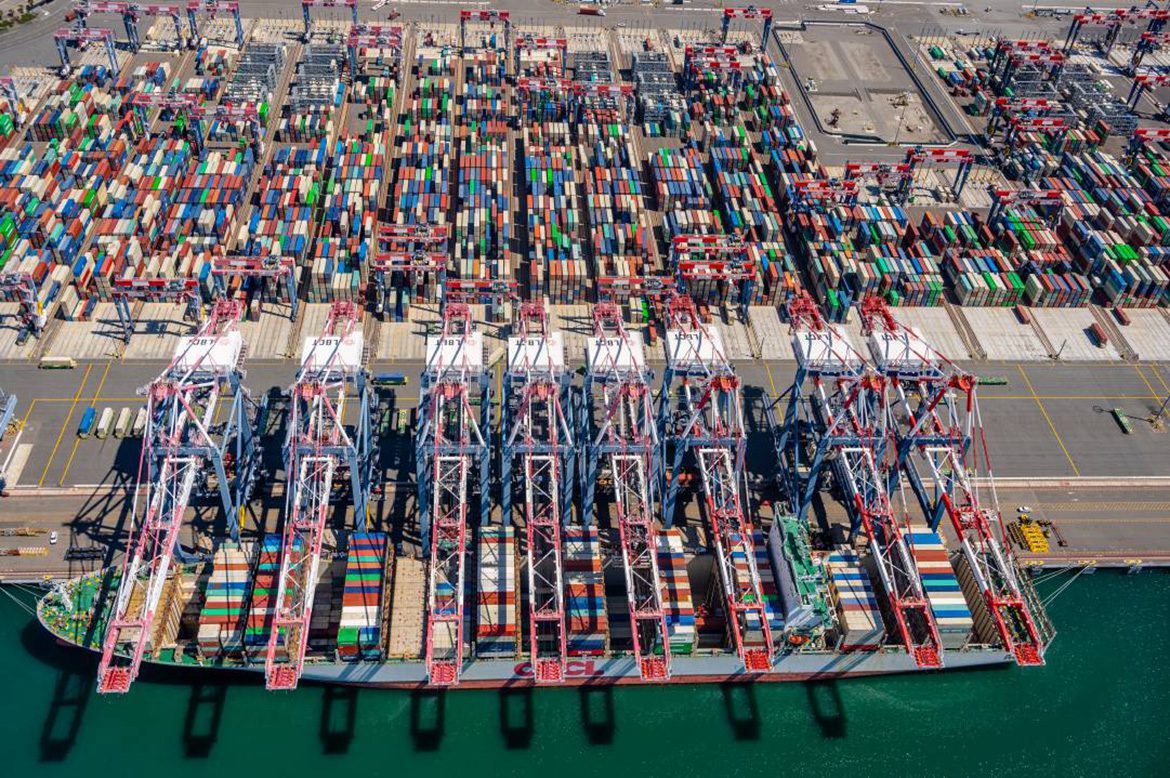

The two busiest ports in the U.S., the neighboring facilities of Los Angeles and Long Beach, have been setting new monthly records for inbound container traffic this summer and fall, with ships from Asia lining up offshore as they wait for berths to open up.

It would be a mistake, though, to read into this a major revival of global trade.

For one thing, a lot of current cargo traffic is just catch-up from the shipping interruptions of the early days of the pandemic. Year-to-date through October, inbound container traffic was still down 1.7% from 2019 at the Port of Los Angeles and up just 2.2% at the Port of Long Beach (which had a pretty weak 2019).

For another, the pandemic-related shift in spending away from in-person services and toward goods, which is driving much of current U.S. demand for imports, won’t go on forever.

Finally, this fall’s offshore traffic jams and high costs — container shipping rates from Asia to Los Angeles are more than twice what they were a year ago — are yet another reminder that supply chains stretching across oceans are subject to risks that were mostly glossed over during the great globalization boom of the 1990s and 2000s.

That last point is a major theme of Marc Levinson’s smart and exceptionally well-timed new book, “Outside the Box: How Globalization Changed from Moving Stuff to Spreading Ideas.” Levinson, an economist who has worked both in journalism and on Wall Street, is author of “The Box,” perhaps the definitive history of, as the 2006 book’s subtitle puts it, “How the Shipping Container Made the World Smaller and the World Economy Bigger.” Now he’s here to declare that the age of ever-expanding global trade the shipping container helped enable ended a little over a decade ago with the global financial crisis and subsequent Great Recession, and it isn’t coming back.

You don’t have to take his word for it, as the change is quite apparent in the World Bank’s measure of trade as a percentage of global gross domestic product. After more than doubling from 1970 to 2008, it has since failed to surpass its 2008 peak.

In a growing global economy, trade can still increase even as its share of GDP stagnates, but since 2018 trade volume has been flat to down as well. “Volume” in this case means not liters or quarts but an index assembled by the CPB Netherlands Bureau for Economic Policy Analysis that measures the value of world trade in constant dollars.

Meanwhile, a forward-looking metric, net foreign direct investment inflows, gives no hint of an incipient trade revival. Corporations have simply stopped shelling out cash to build factories or acquire subsidiaries overseas the way they did before the financial crisis.

There is, to be sure, still a lot more foreign direct investment relative to GDP than back in the 1970s and 1980s. The data don’t point toward a collapse of global trade like that of the 1930s, just a plateau. Meanwhile other forms of globalization have continued apace — until the pandemic, at least. The DHL Global Connectedness Index, which tracks capital, information and people flows as well as trade, is out with an annual update this week that reports globalization held steady in 2019. And while it will drop in 2020, it’s “unlikely to fall below where it stood during the 2008-09 global financial crisis.”

In Levinson’s telling, what we’ve been witnessing is the end of what he calls the Third Globalization (the first started in the 19th century, the second after World War II) of just-in-time global supply chains and the beginning of a fourth, built more around services, software, regionalization and customized manufacturing. Some of this is the result of political backlash to the rise of China and the loss of factory jobs in the West, and some represents technological progress. But a lot of it is simply that just-in-time global supply chains turned out to be less of a bargain than they once appeared to be.

Key to this saga is, of course, the container-shipping industry. Standardized containers transformed global trade by making it possible to get stuff on and off of ships much, much more cheaply and quickly than before. But as container shipping boomed it also benefited from a remarkable willingness of governments to subsidize almost every aspect of it, from the building of ships to the expansion of ports to special tax breaks for shipping companies to lax environmental regulations.

These policies have often perversely favored importers over domestic producers, as subsidies for railroads and truckers are usually smaller. They also brought chronic overcapacity. “With too many ships chasing too little cargo,” writes Levinson, “shipping receipts fell so low that ocean carriers’ receipts from voyages barely covered their fuel bills.”

The reaction of the container-shipping industry, led by Denmark’s A.P. Moeller-Maersk A/S, was to build ever-bigger ships to cut down on per-container fuel costs. But these giant ships — first the “Euromax” vessels that began to ply the oceans in 2006 and then the 20%-bigger “Triple-Es” (for economies of scale, energy efficiency and environmental improvements) that arrived in 2013 — have not really delivered. They are slower, sail less frequently, put new strains on ports and on balance have “made transport less reliable,” concludes Levinson.

One hopes shipping companies will eventually figure out better ways to serve their customers. But theirs is a slow-moving industry subject to all sorts of non-market-driven incentives. It could take a while. In the meantime, the world seems to be moving on to new things.

© 2020 Bloomberg L.P

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club